After yesterday’s day that closed with a daily decline of -3.5% for Bitcoin, the worst since the beginning of February, today there is a change of course with a return of strength and a rise that allows the recovery of most of the losses suffered yesterday.

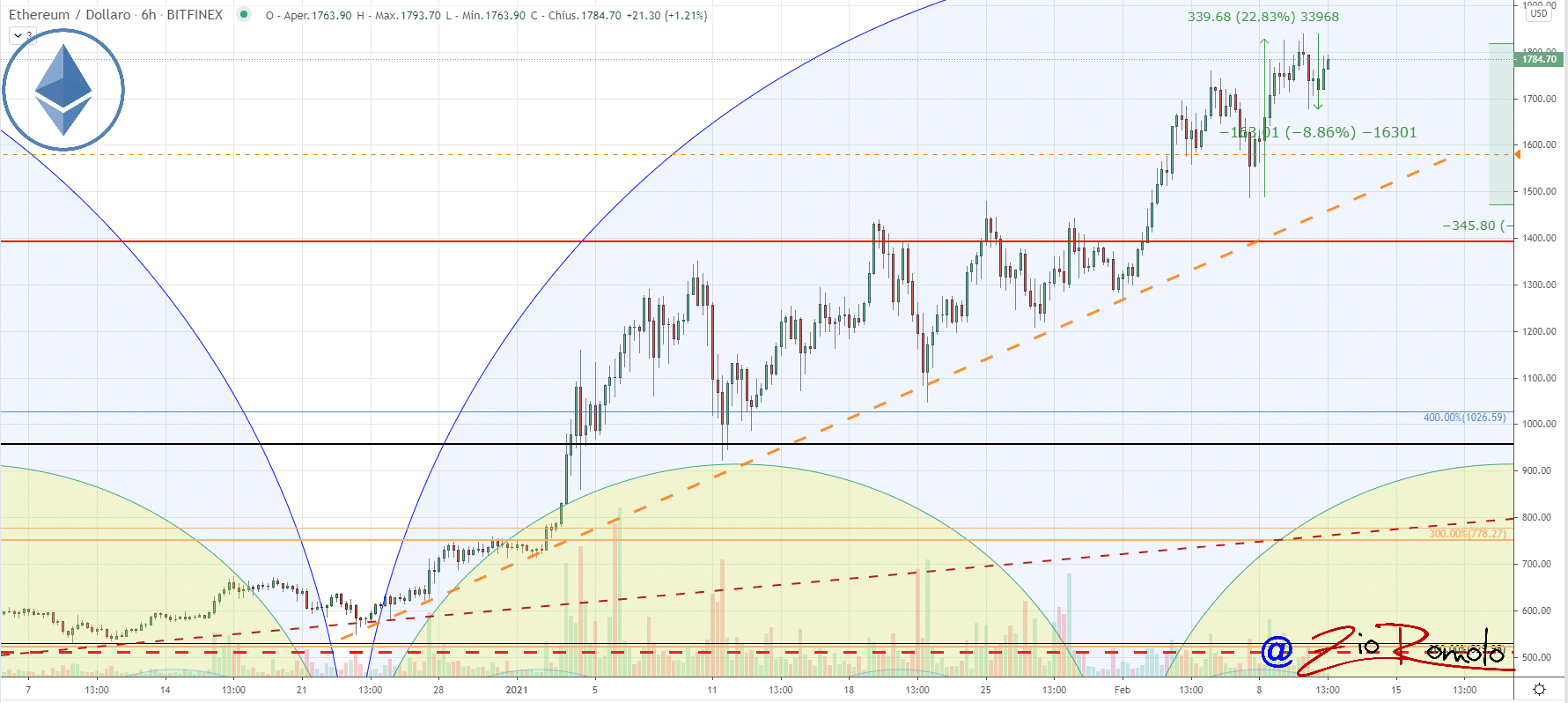

Yesterday also saw new all-time highs for Ethereum, which climbed to just short of $1,840.

Among the best rises of the day is Iota (MIOTA), which with a 50% climb from yesterday’s values is back above $1.20, the highest peak since June 2018. It is a movement that allows Iota to climb back to 25th position in the ranking of the largest capitalized coins with about $3 billion in total capitalization.

Other rises include Icon (ICX), up 40%. This is followed by Enjin Coin (ENJ) and Basic Attention Token (BAT), both up over 30%.

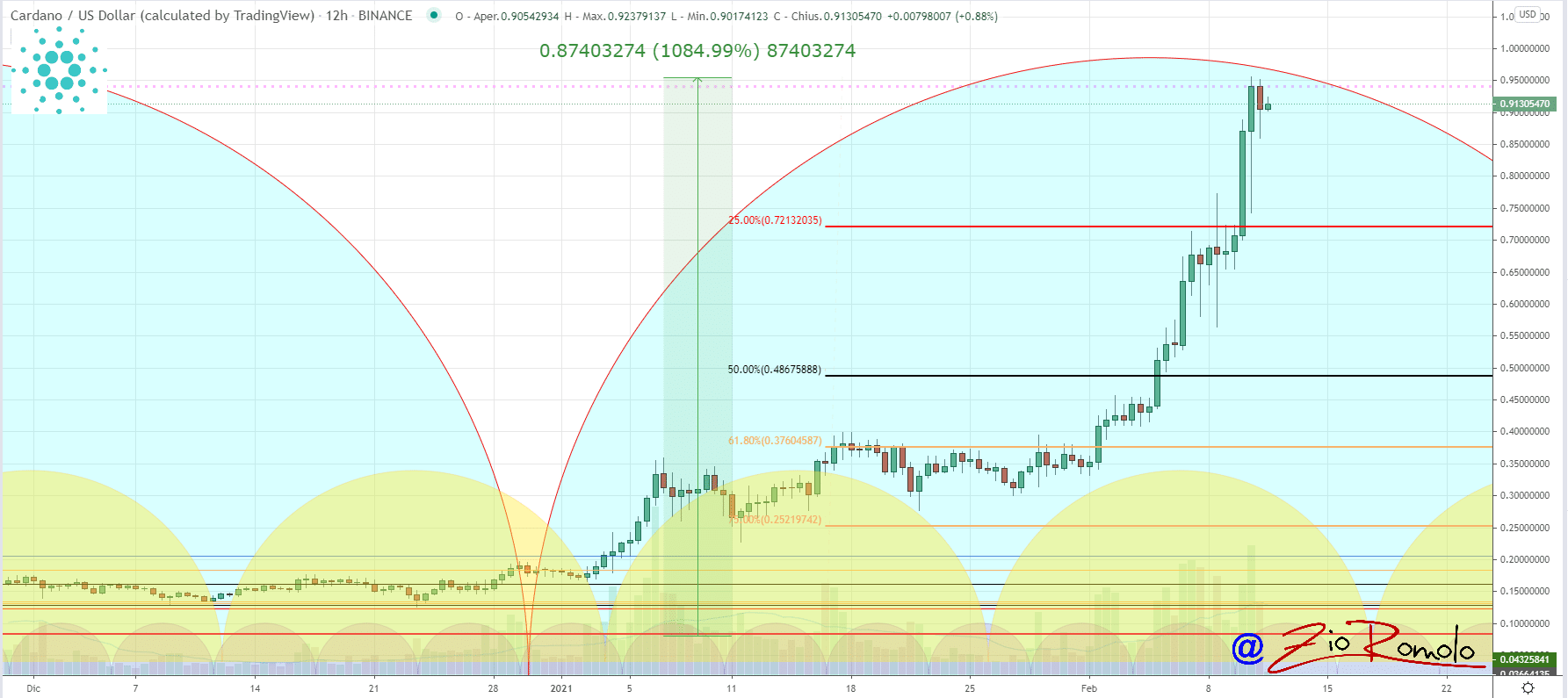

Among the big names, the rise of Cardano (ADA) continues, which yesterday touched the one-dollar mark, the highest level since January 2018. For Cardano, it is a rise that adds to the gains of the past few days and thus sees the performance rise over 400% since the beginning of the year.

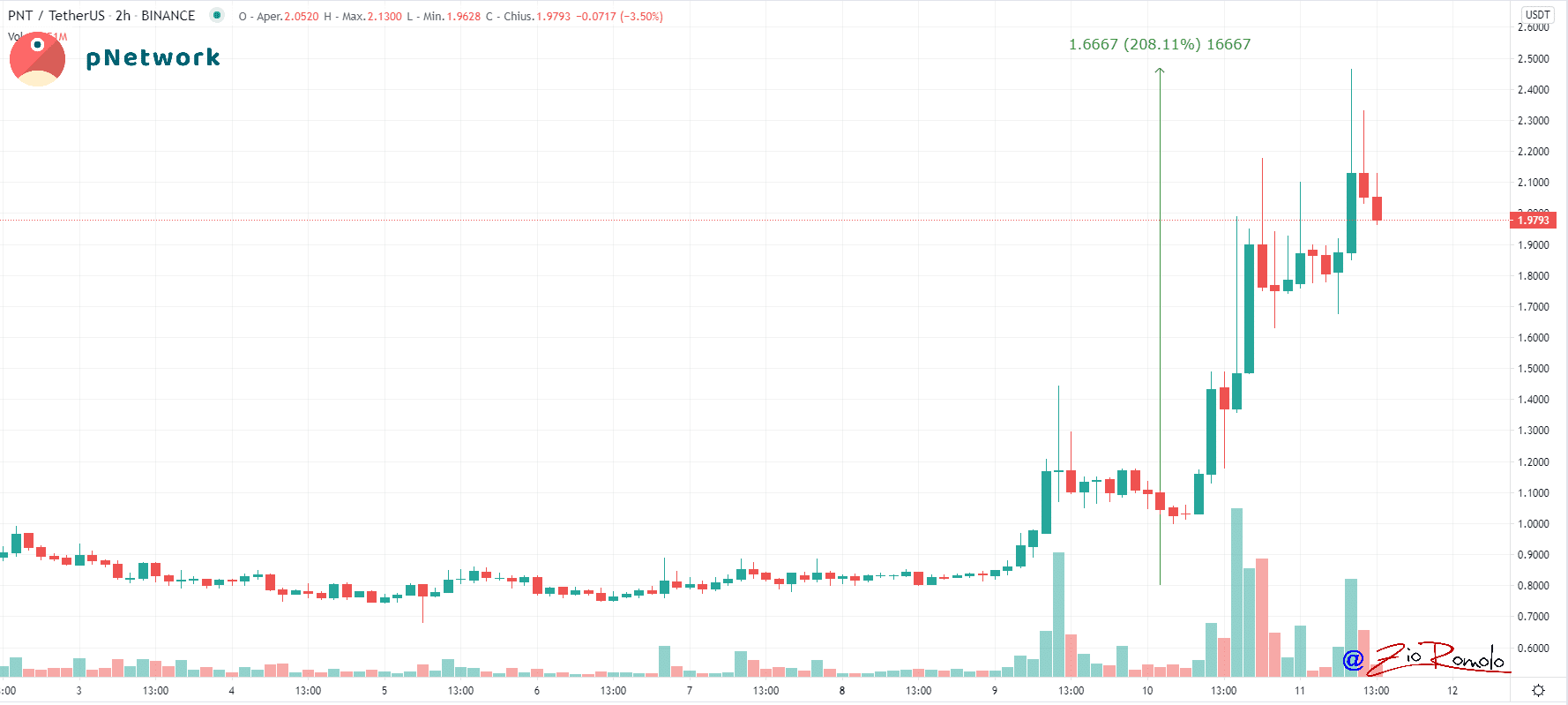

Going beyond the top 100 capitalized, it is necessary to highlight the strong rise that is characterizing the token of pNetwork (PNT, formerly EDO), which in 48 hours sees its value triple, from 80 cents to over $2.4. For PNT, it’s the highest price spike since May 2018 on all exchanges.

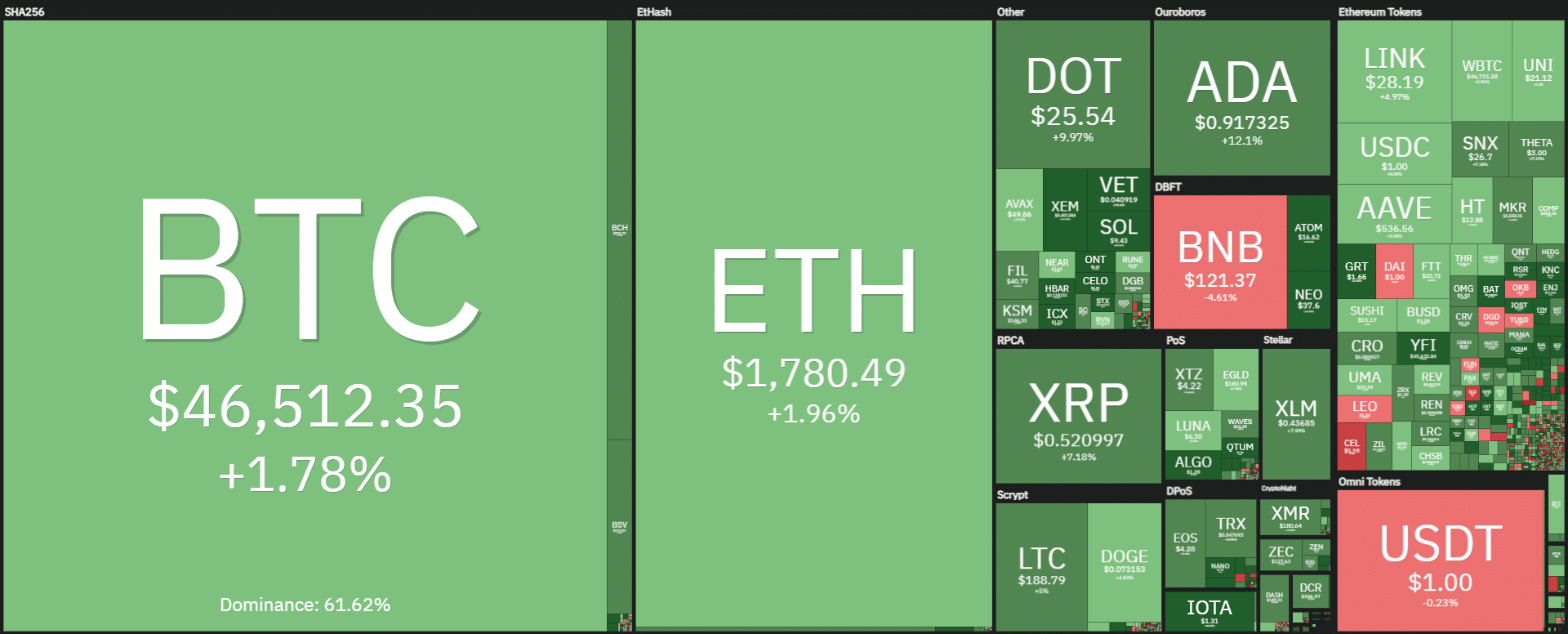

The total market cap drops below $1.4 trillion. If you take away Bitcoin’s capitalization, the market cap rises to $550 billion in these hours, one step away from the all-time record set in the first days of January 2018.

Bitcoin’s dominance remains above 61%, with Ethereum gravitating around 14.5% and the third-largest by capitalization, Cardano flying above 1.7% which in percentage terms is the highest level since May 2018.

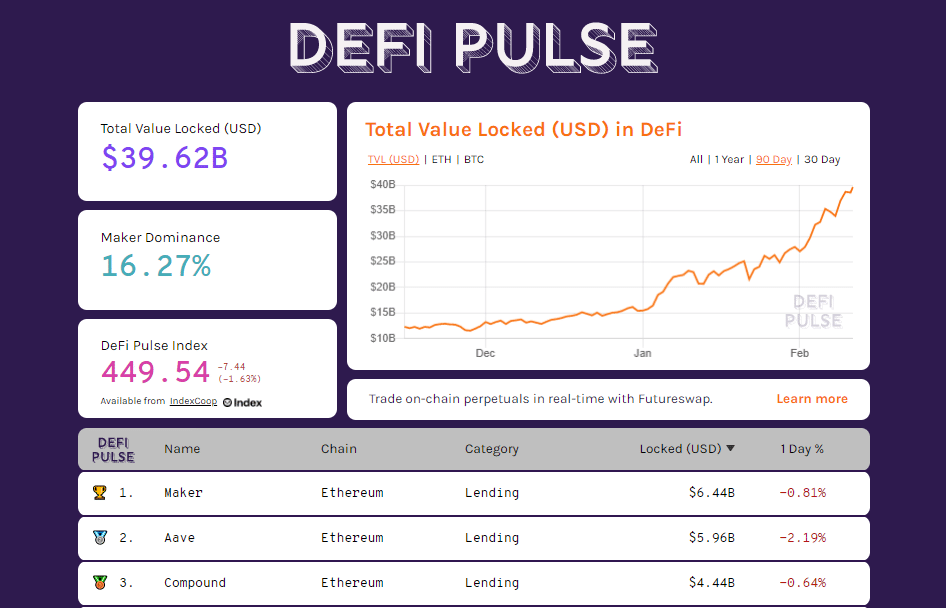

DeFi climbs one step closer to the psychological wall of $40 billion. Maker consolidates industry leadership with $6.4 billion followed by Aave and Compound.

Summary

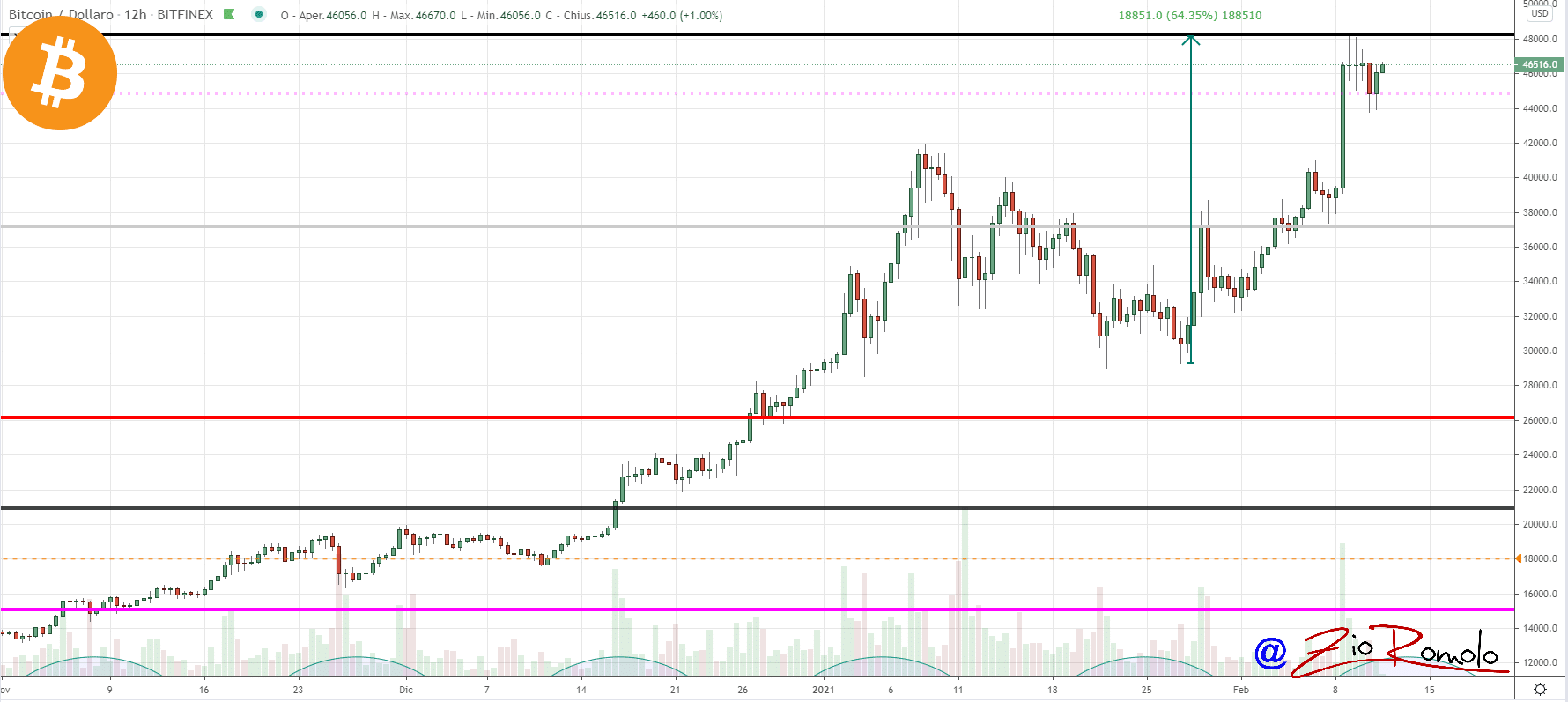

Bitcoin (BTC), rising and recovering the $46,500 mark.

Bitcoin, after yesterday’s weakness with prices that have returned below $44,000, in these hours recovers $46,500.

Both in the short and medium-term Bitcoin confirms the bullish trend. The monthly cycle started on January 27th confirms the strength of the annual upper cycle. At the moment the first bearish signal would be realized with prices below $41,000, a level that coincides with the bullish trendline that joins the lows from the end of January.

Ethereum (ETH)

Despite the volatility of yesterday’s day that recorded prices down more than 8% from the all-time highs marked on the same day, Ethereum remains above the levels of collapse risk.

The bullish structure of Ethereum, confirmed by the rises of recent weeks, keeps prices within a safe limbo while allowing wide swings like the one of yesterday.