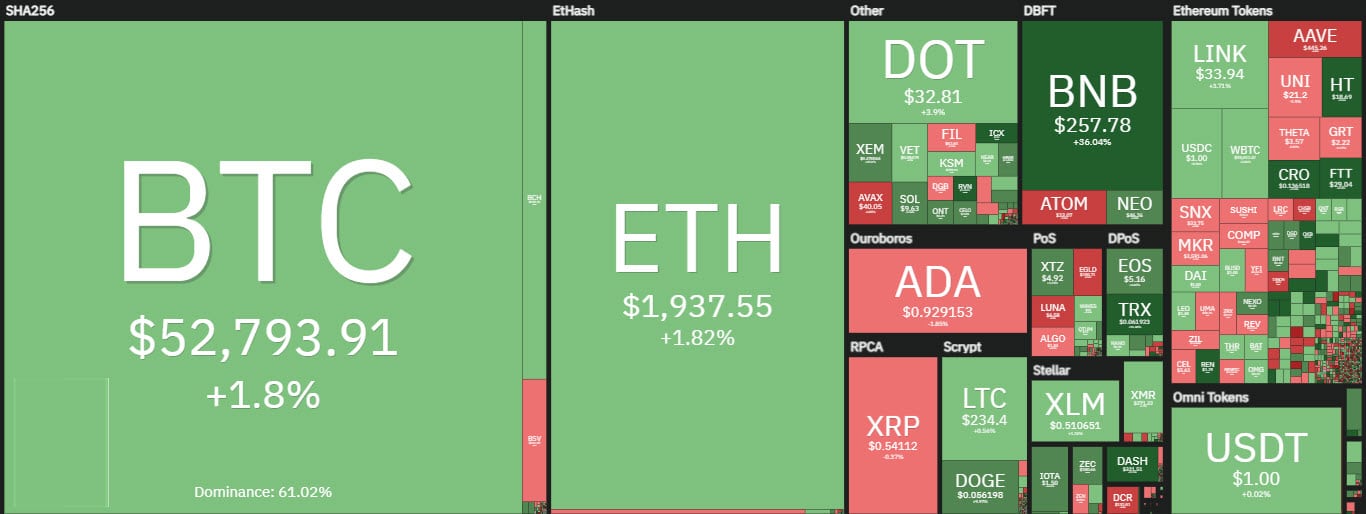

Bitcoin and most of the major big names are moving into double-digit gains this week too.

For the queen of cryptocurrencies, Bitcoin, it is the fourth consecutive week of gains, an event that has occurred twice since September, but unlike previous weeks it is the highest appreciation in value ever with a gain of over $23,000 since the lows of late January.

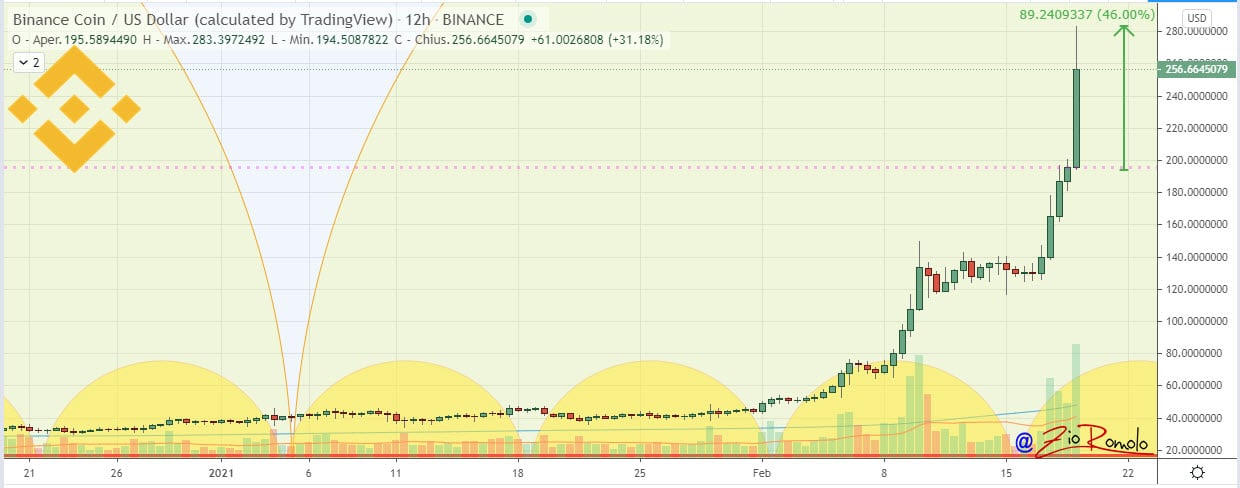

Binance Coin (BNB) shines

It is not just Bitcoin that has been shining in recent hours as the moment of glory is being enjoyed by both Binance Coin (BNB) and Polkadot (DOT). Both are recording new all-time highs.

For Binance Coin, the price has risen by more than 50% in the last 24 hours to fly above $290 for the first time. The capitalization of Binance grows dramatically above $42 billion, taking the third position in the ranking of the largest capitalized also surpassing the stablecoin Tether.

The total market cap is at an all-time high, rising to over $1.615 trillion with Bitcoin just short of the trillion mark despite losing some of its market share and falling back to 60%, its lowest level since last October. This is due to an altcoin season that continues to post exceptional numbers. Taking away Bitcoin’s capitalization from the total of $1.6 trillion, total altcoin capitalization exceeds $635 billion for the first time, over $100 billion from its previous peak in January 2018.

Volumes in recent hours fall below $630 billion. In the last few hours both Bitcoin and Ethereum trade a countervalue of just over $8 billion, both surpassed for daily trades by the Binance token which in the last 24 hours records the highest trades ever, since its launch in 2017, at over $8.5 billion.

Among the best of the day opening the weekend, another effervescent reality emerges: PancakeSwap (CAKE), among the best risers of the day along with Binance Coin and DODO token. Pancake and DODO are up more than 50%.

The week is coming to a very positive end for privacy coins, which are bucking the trend of previous weeks. Dash in particular is up 100% from last Friday’s levels, doubling in value to $340, its highest level in three years.

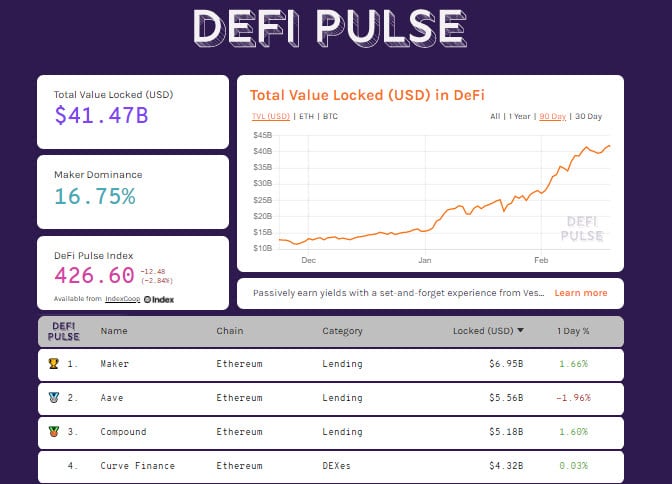

The value of collateral locked in decentralized finance projects rises and is for the first time within a hair’s breadth of $42bn, with Maker setting a new record for value locked at $7bn. It is followed by Aave and Compound, both above $5bn. These records come despite a decrease in locked tokens on DeFi projects compared to the highs seen in recent days.

Bitcoin (BTC) gains touch $53,000

For the first time in its history, Bitcoin is set to end the weekly quotations above $50,000, a rise that has characterized the trend since the end of January and that is currently not suffering from any pause.

Any downward movement would only begin to cause concern at prices below $46,000, levels that coincide with the Tesla effect that was triggered on Monday, February 8th. At $53,000, the price of Bitcoin is increasingly in uncharted territory and until recently considered impossible.

Ethereum (ETH) towards $2,000

Ethereum, despite remaining somewhat in the shadow of Bitcoin’s rise, has in the last few hours reached new all-time highs on its way to the psychological threshold of $2,000.

For Ethereum, the upward trend has now been confirmed and continues to find confirmation in the short term.

At the end of the week, in case of reversals, it will be opportune to monitor the $1,850, while in the medium term the dynamic support in the $1,600 area remains valid, a level more than 15% distant from current quotations.