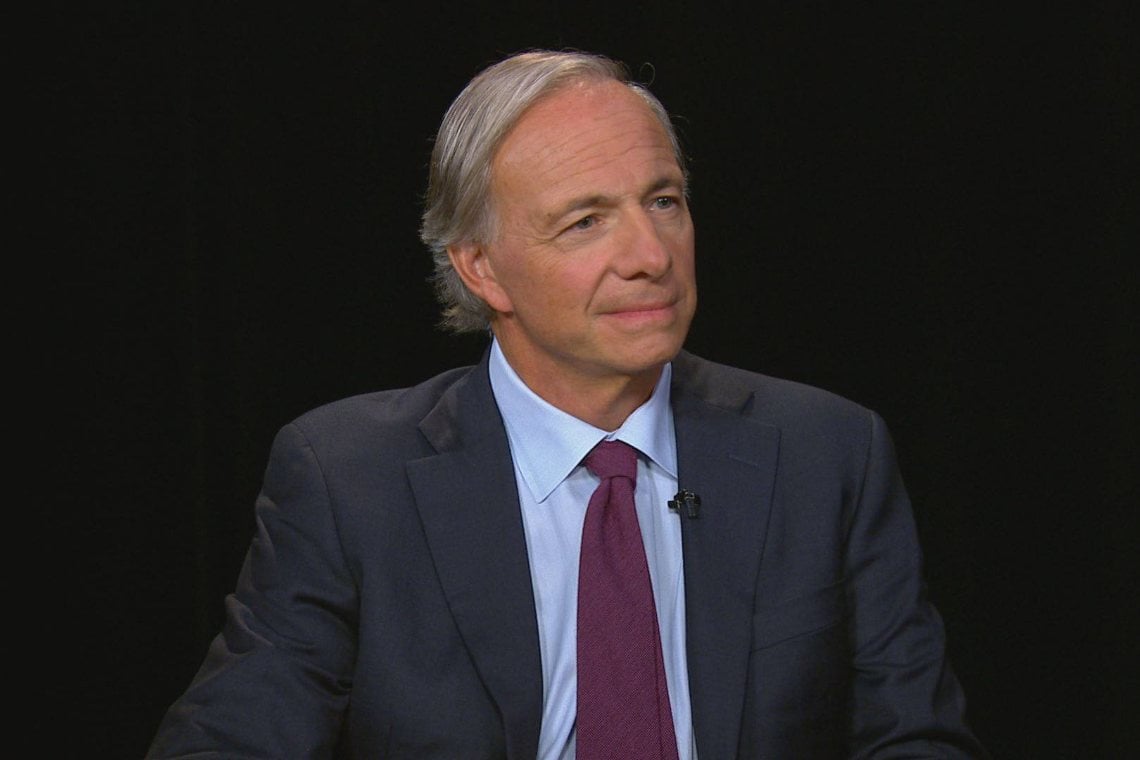

According to Ray Dalio, the economics of investing in bonds, and in most financial assets, has become stupid.

He put it bluntly in a recent post on LinkedIn in which he outlines a “new paradigm”.

He writes:

“I believe a well-diversified portfolio of non-debt and non-dollar assets along with a short cash position is preferable to a traditional stock/bond mix that is heavily skewed to US dollars. I also believe that assets in the mature developed reserve currency countries will underperform the Asian (including Chinese) emerging countries’ markets”.

For one thing, Dalio, who is the founder of the world’s largest hedge fund (Bridgewater Associates), points out that bond markets now offer ridiculously low yields, and real yields on reserve-currency sovereign bonds are actually negative.

Real cash yields are even worse, although not as bad as during some periods in the past.

So he says that these yields, which are extremely low or even non-existent, are not meeting the needs of the holders of these assets.

Ray Dalio advises against bonds

In other words, it is as if he is advising against investing in bonds, or advising those who hold them to get rid of them.

The fact that he has decided to make these ideas public on his official LinkedIn profile suggests that this is a subject close to his heart.

Dalio further elaborates on his analysis by stating that the purpose of investments is to have money on deposit that can be converted into purchasing power in case of need or desire. Of course, inflation must also be taken into account.

At this point he adds:

“Rather than get paid less than inflation why not instead buy stuff—any stuff—that will equal inflation or better?”

Dalio does not mention Bitcoin, other than in a passage devoted to taxation and regulations, but it is well known that he is not an advocate of cryptocurrencies. However, the reasoning he makes could just as well be applied to BTC, should there be no bias in this regard.

Finally, he suggests that it would be better to borrow money, rather than keep it as a reserve, and buy higher-yielding investment assets that are not tied to debt.

Within such a framework it would seem that bitcoin could also be included.