A day of weakness for Bitcoin and cryptocurrencies, partly masking tensions ahead of the Federal Reserve Chairman‘s conference in the coming hours.

In recent hours, the rise in US bond interest rates brings back memories of what happened in late February and early March.

In the last few hours, US bond yields have returned to their highest level in a year, at 1.6%.

Bitcoin is now considered a real hedging asset against inflation, and in the short term, it could be affected by the words of Jerome Powell this evening.

Looking at what is happening to the rest of the altcoins, the day is once again predominantly red.

Among the big names, the only move in the opposite direction was Cardano (ADA), which rose more than 20%, regaining $1.3 and moving up to the third place with a capitalization of around $41 billion.

The day was a slow one, as evidenced by the low trading volume of under $400 billion.

The only exception is Cardano itself, which with just under $4 billion traded in the last 24 hours exceeds the $3 billion traded by ETH.

Market shares remain unchanged from yesterday.

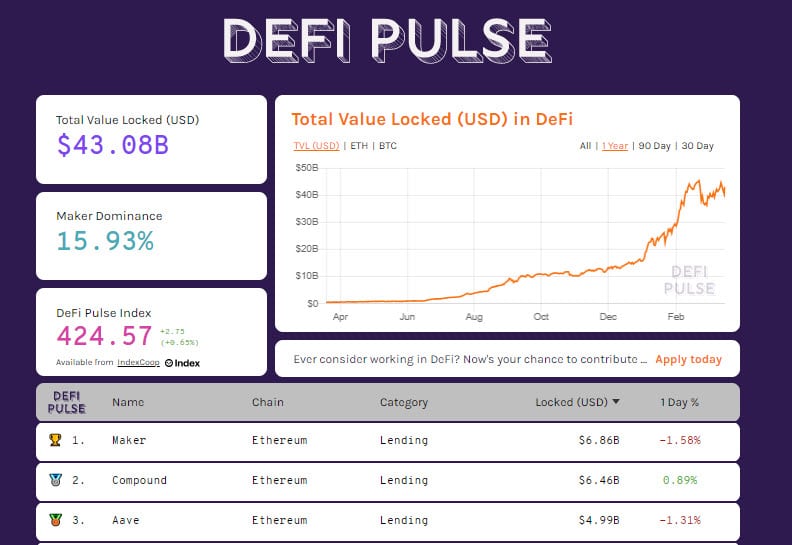

The total value of DeFi remains above $43 billion, while the increase in ETH locked on decentralized projects continues, over 9.5 million pieces, the highest peak in the last 5 months.

Bitcoin (BTC) weakness continues

Bitcoin is back within a step of the lows recorded yesterday morning, just above $54,000. The day sees little movement. The level to follow is $53,000, the low of yesterday, which coincides with the previous low of March 10th, forming short-term support.

On the upside, the first level to watch is the $58,000 area.

Ethereum (ETH)

Ethereum fluctuates between 1,750 and 1,850 dollars without giving different indications compared to what was reported in the previous update.

In the medium term, it is important for Ethereum to hold 1,650 dollars, the level where the dynamic bullish trendline that brings together the rising lows from the end of last December passes.

Despite the difficulties of these last 48 hours, for the medium term, the bullish structure of Ethereum remains solidly set to the upside.