Yesterday’s words from Jerome Powell, chairman of the Federal Reserve who confirmed the American central bank’s policy of seeing current inflation as a temporary problem overheated not only stock indices but also Bitcoin and the rest of the cryptocurrencies, which at the close of the statements saw prices recover much of the ground lost at the start of the week.

Bitcoin is increasingly confirming itself as an alternative financial asset, not least because of Morgan Stanley’s announcement that financial institutions are officially entering cryptocurrencies.

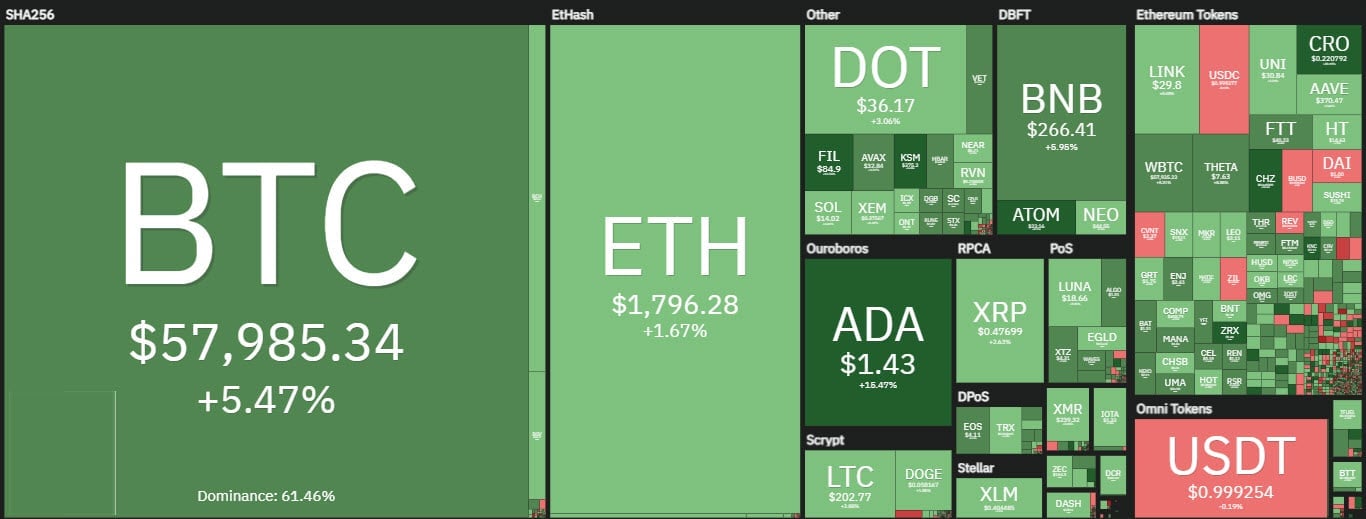

In the last few hours, not only prices have risen again, but also volumes, which are back above 450 billion dollars, a level that continues to be a long way from the records set last February.

Thanks to the Powell effect, 85% of cryptocurrencies are now in positive territory. Chiliz (CHZ) remains the queen, jumping another notch higher, climbing more than 30% on a daily basis, recovering 65 cents on the dollar.

Basic Attention Token (BAT), an addition to Grayscale’s basket, is keeping pace, posting a new all-time high at $1.40, a six-fold increase since the beginning of the year.

Today’s gains put total capitalization within a step of $1.8 trillion.

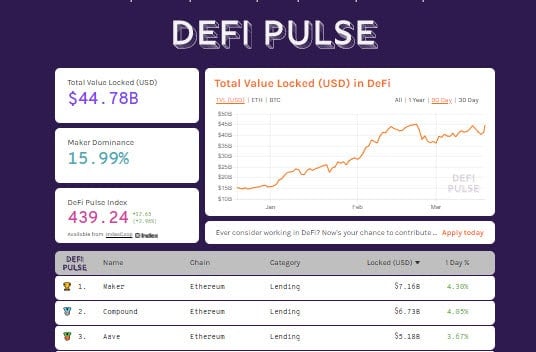

The rises also accompanied DeFi’s TVL above $44 billion, one step away from February’s record high of $45 billion. Confidence is restored after previous weeks had seen a liquidation of Bitcoin and Ethereum, which are now back up to early November levels.

Maker remains the leader in decentralized finance projects, back above $7 billion in terms of locked liquidity.

Bitcoin (BTC) prices above $59,000

In the last few hours Bitcoin has again put its head above $59,000, getting closer to revisiting last weekend’s records, when the price first saw $61,700.

The short to medium-term trend continues to strengthen to the upside. A confirmation of the holding of $54,000 in the coming days will lay the groundwork for new bullish stretches. On the contrary, a descent below these levels would be a warning sign of possible short-term weakness.

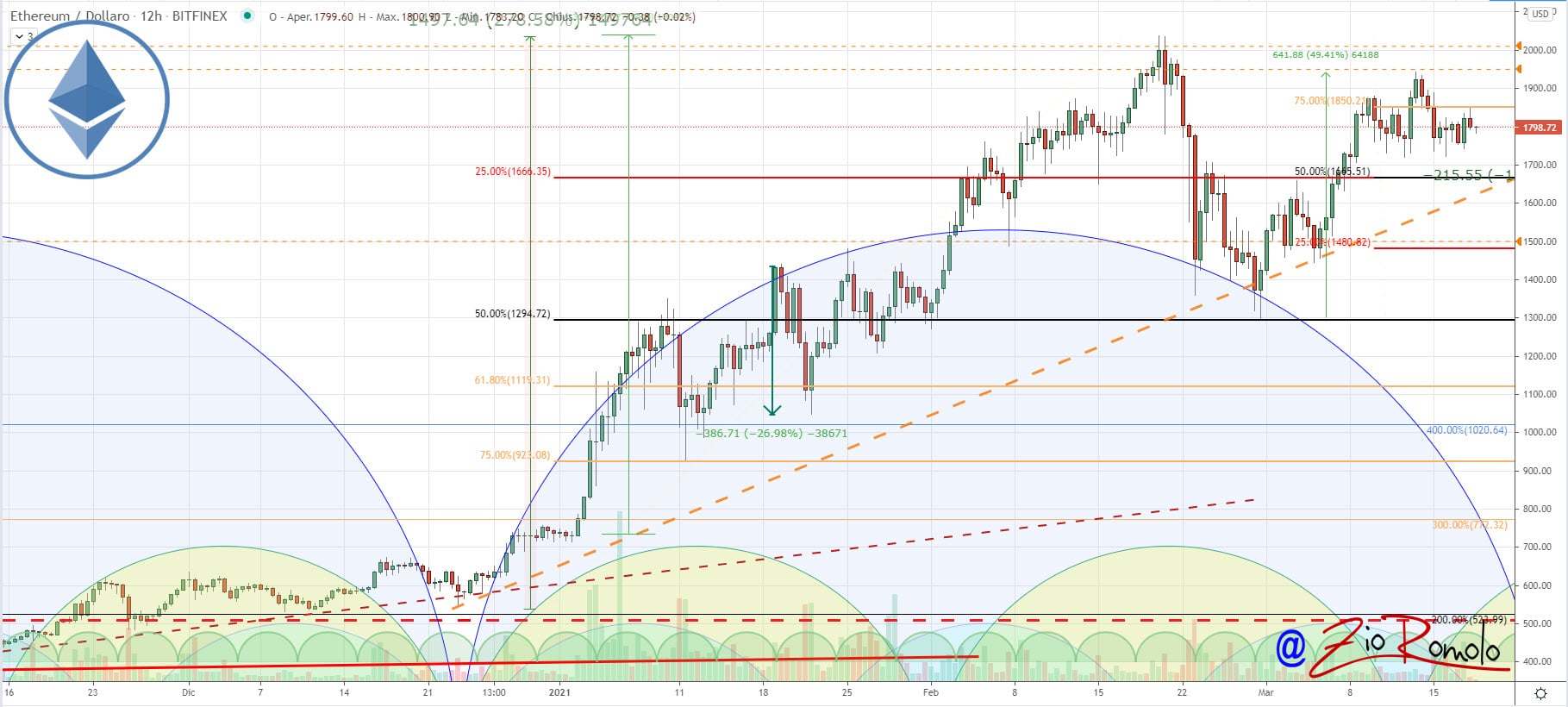

Ethereum (ETH)

Despite holding support at $1,700 for more than 10 days, the price of Ethereum is not showing signs of wanting to explode to the upside. Failure to exceed $1,850 in the coming days would reinforce the tensions that have been characterizing Ethereum’s performance over the past week.

What is needed for Ethereum is the return of the purchasing volumes that in this last week have never managed to go beyond $7 billion.