The weekend saw new all-time highs for Bitcoin, which rose above $61,600 for the first time.

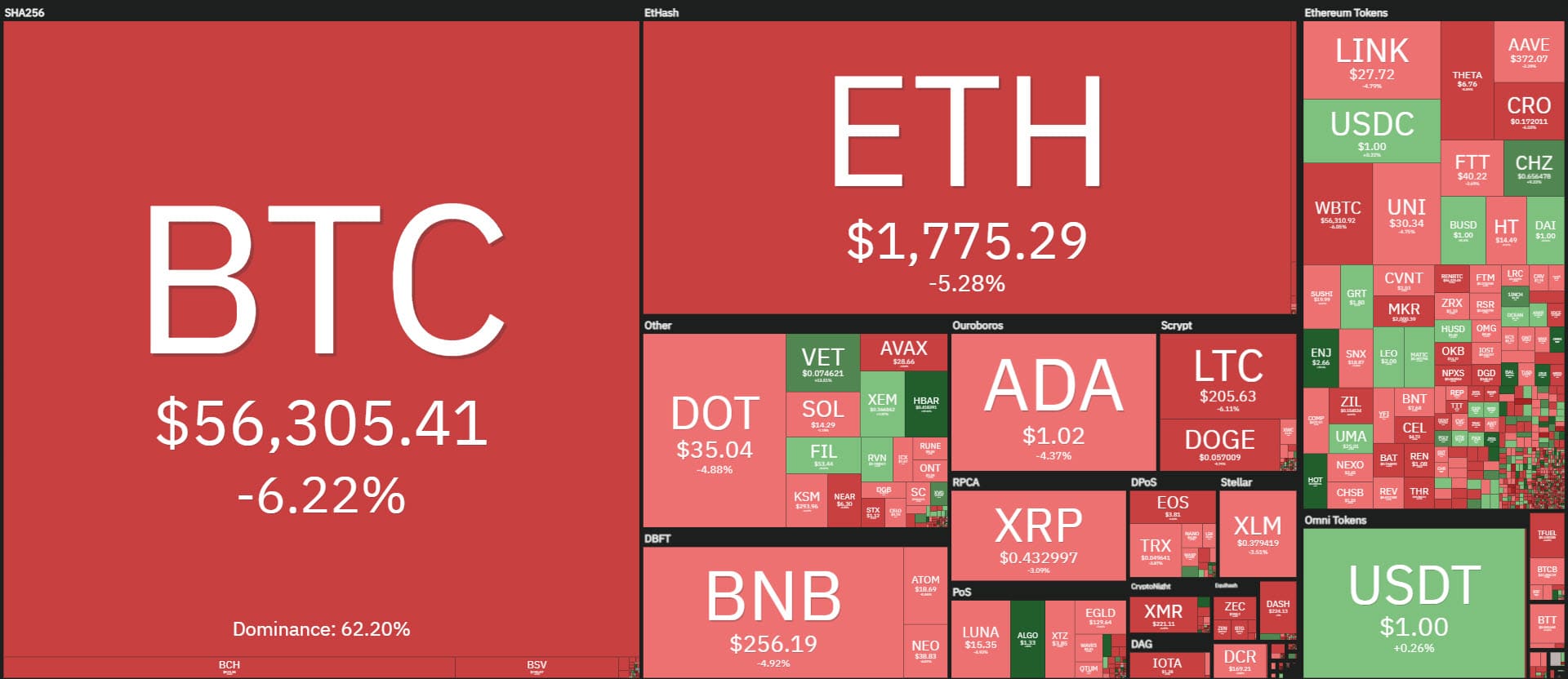

Today’s drop is one that is not scary but sees over 80% of the major cryptocurrencies in negative territory. In the early hours of the day, Bitcoin is down more than 7%, followed by Ethereum, -6%.

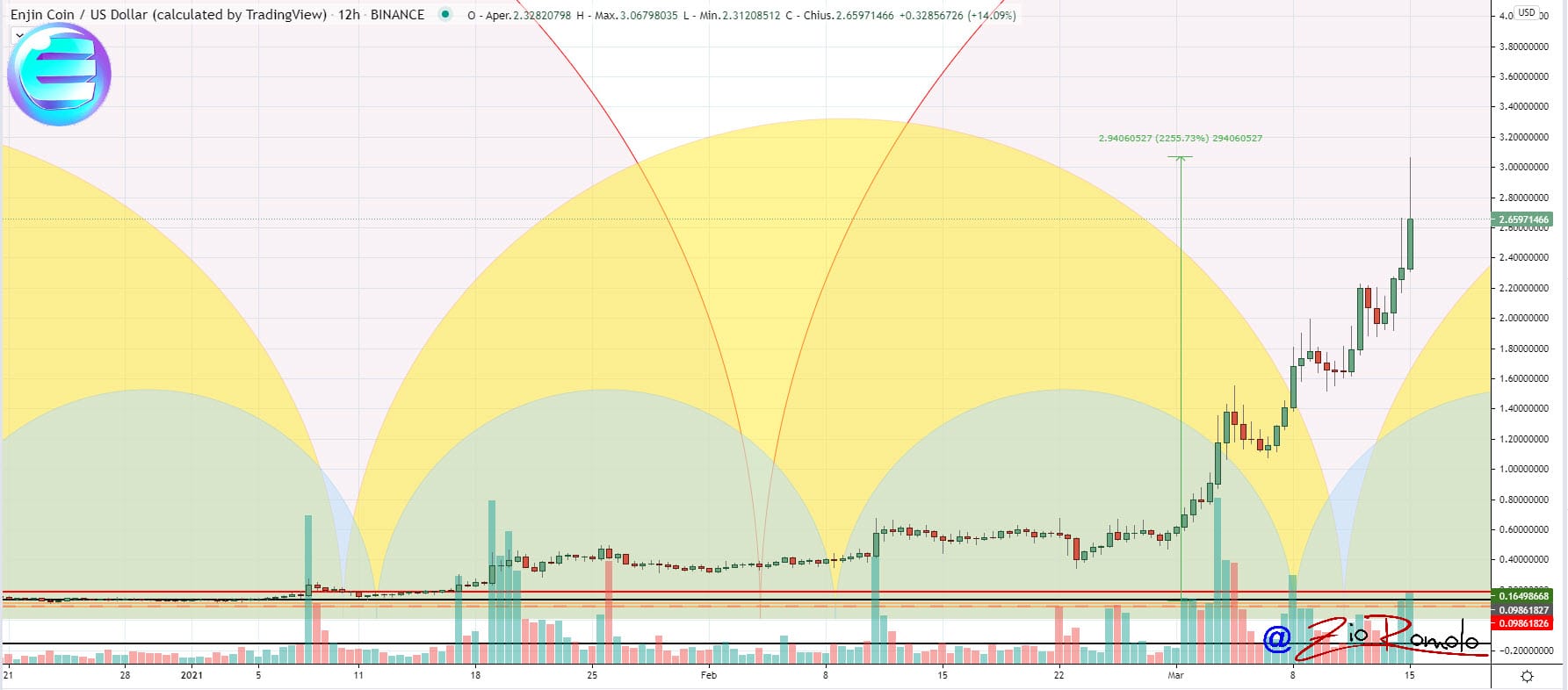

Among the big names, the worst is Uniswap (UNI) along with Dogecoin (DOGE), down about 10% from yesterday’s levels. The best performer on this predominantly red day was Enjin Coin (ENJ), which stood out with a rise of over 30%.

Enjin reached new all-time highs above $3, making a gain of more than 20 times since the beginning of the year. Today’s rise is due to the listing of Huobi Exchange, which promises high rewards to Enjin token holders. Algorand (ALGO) was the other good riser of the day, rising more than 10% to regain the $1.30 mark.

The weekend was characterized by double-speed volumes. While volumes on Saturday rose above the week’s average, Sunday saw a slump that did not accompany the strong gains. This could be the reason that, given the lack of new purchases, led to the reversal to return to test the medium-term supports valid in the past week.

Conversely, this morning’s declines are accompanied by lively trading. By mid-day, volumes traded for Bitcoin exceed yesterday’s total. The same is true of Ethereum, which remains within the average trading range of last week, far from the highs of mid-February.

Despite the heavy day, the market cap remains above $1.7 trillion, with over $1 trillion for the seventh consecutive day on Bitcoin.

With the rises of the last 24 hours, Bitcoin is back over 62% dominance. Ethereum also maintains market share at 12%.

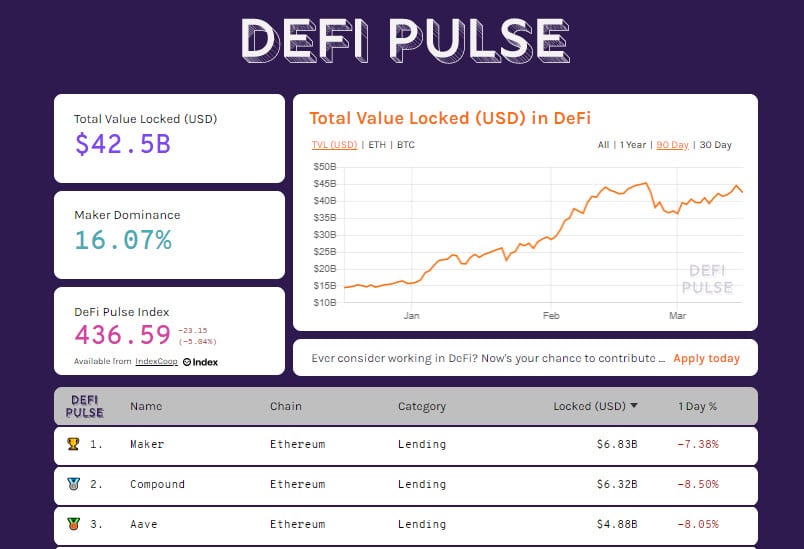

Despite today’s decline, DeFi remains above $42 billion after pushing the TVL above $44.5 billion over the weekend. The value remains close to yesterday’s highs despite today’s declines, this is thanks to the return of locked tokens on decentralized finance projects. The number of Ethereum rises above 9 million ETH for the first time since mid-November. The number of bitcoin, after falling to its lowest level in early September, below 25,000 units, is now also back above 34,000 BTC.

This is the reason why the total value locked remains decidedly high.

Bitcoin (BTC) falls after historic highs

The drop in recent hours brings Bitcoin prices back to test the $55,000 mark, the lowest of the last 5 days. The step back does not spoil the upward trend that has surprisingly been accompanying the rise since the beginning of the month that led to the historic records of the weekend.

A signal of reversal in the medium term would only occur with prices below $51,000.

Ethereum (ETH)

The prices of Ethereum yesterday, dragged by Bitcoin, returned above $1,900 for the first time since February 21st, coming close to new all-time highs recorded in those days.

Ethereum’s medium-term trend is also firmly on the upside. The first bearish sell offs would only come with drops below 1,500 dollars.