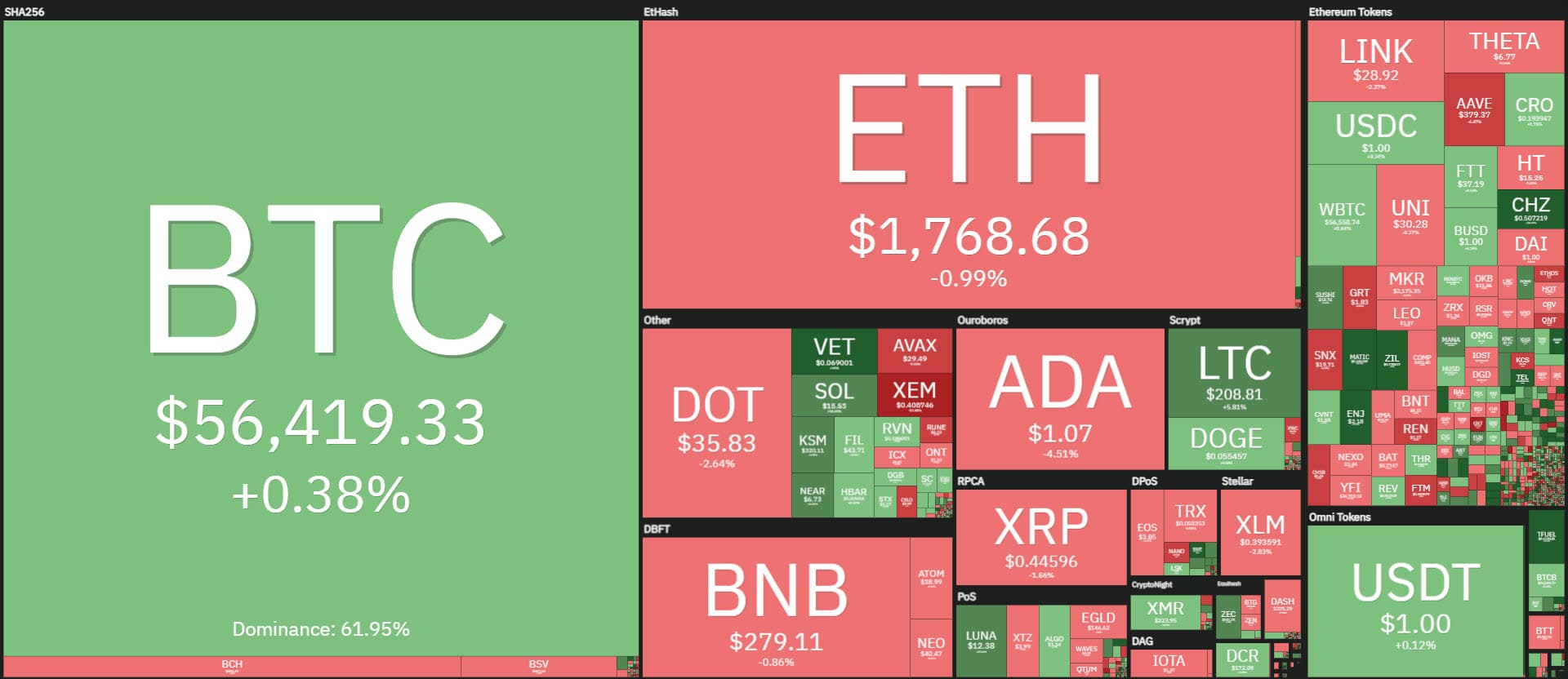

The second week in a row for the cryptocurrency sector is about to end on a positive note, led by the rise in the price of Bitcoin, which with the jump of the last few hours recovers all the decline suffered in the last week of February in a period in which BTC has suffered a loss of 21% in 7 days.

The movement is driving part of the altcoins with Ethereum regaining $1,850.

Among the big players, Bitcoin and Ethereum both posted weekly performances with a recovery of over 20%.

Uniswap (UNI), the token of the first decentralized exchange, is also on the rise, pushing prices above $30 for the first time since the token’s launch. This pushed UNI’s market cap above $16 billion, putting it in eighth place among the top capitalized coins.

Chiliz (CHZ) was the best performer of the day, soaring more than 85%, running above 50 cents for the first time. This performance also strengthened the weekly performance, with the token gaining over 300% since last Friday. Polygon (MATIC) was also on the rise during the day, climbing more than 55%, benefiting from the moment of euphoria in NFTs, which led to the token being promoted and listed on Coinbase. MATIC exceeded 50 cents for the first time, an all-time high.

Total market cap consolidates above $1.7 trillion, with Bitcoin reinforcing dominance over 61% and its market cap returning above $1 trillion

Trading volumes remain contracted with just over $500 billion traded in the last 24 hours.

Decentralized finance is set to end the week holding above $41 billion locked in over 80 protocols. Ethereum’s numbers remain near 5-month highs, with over 8.75 million ETH locked. In contrast, tokenized BTC falls below 31,500 BTC.

Maker remains the top project with around $7 billion in locked counter value, followed by Compound and Aave.

Bitcoin (BTC) price up at $57,000

With the jump in the last few hours, Bitcoin is back in the $57,000 area, less than 1% from the records of mid-February. During the weekend it will be necessary to confirm the holding of $54,000, the first short-term support level, while a descent below $50,000 would bring back bearish fears in the medium term.

Ethereum (ETH)

The failure to break through the $1,900 mark continues to cause weakness for Ethereum prices, which in recent hours have returned to test the $1,750 area. With the rise of the last week, Ethereum’s medium-term trend has turned bullish. It will remain so if the prices over the weekend should confirm the holding of $1,600.

For any upward movement, Ethereum needs the confirmation of the volumes that are still low with trades of about 5 billion dollars per day, less than half of the peaks recorded in February.