After a bumpy start of the week, the last 48 hours have brought back a general momentum with Bitcoin prices returning close to all-time highs.

In the last few hours, Deutsche Bank has published a report highlighting that Bitcoin is now an asset that should not be ignored.

The week is coming to an end with a prevalence of positive signs. Bitcoin is up over 4% on a weekly basis. Ethereum lags behind but is up nearly 2%.

Cardano (ADA) made a strong comeback during the week, climbing to third place in the list of the most highly capitalized coins for a few days. Despite the declines in recent hours, Cardano has recorded a 15% gain since last Friday and new all-time highs with prices above $1.5.

The NFT hype is boosting interest in and the prices of tokens in the digital art ecosystem. Enjin Coin (ENJ), Terra (LUNA), Decentraland (MANA) and Chiliz (CHZ) tokens are benefiting, all up more than 30%.

Among the best rises was that of Basic Attention Token (BAT) with a gain of over 50%.

The only drawback is the volume. The average trading volume is at its lowest level in recent weeks. Bitcoin has traded over $11 billion in the last 24 hours, with Ethereum outperformed by Cardano, which traded over $4 billion.

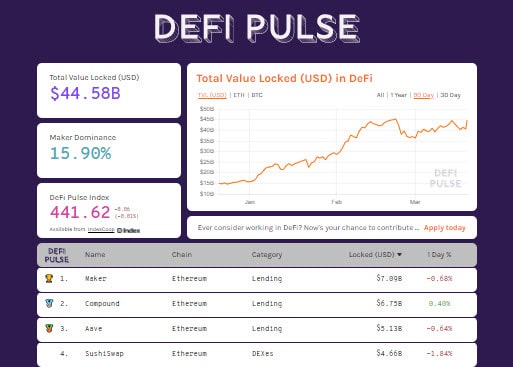

Decentralized finance is benefiting from the return of trust by users, who are once again pledging their tokens in decentralized projects. Ethereum’s number above 9.2 million units, the highest value since last November.

DeFi’s TVL exceeds $44.5 billion with Maker remaining the industry leader, consolidating above $7 billion.

Recent developments in the SushiSwap project bring volumes traded in the last seven days to within $2 billion, propelling the DEX to fourth place as the most-used project with around $5 billion total value locked.

Bitcoin (BTC), new all-time highs for open interest

After the highs of the weekend, Bitcoin returned to the $60,000 mark in the last few days, an important signal supported by good volumes, with new records for open interest in derivatives. Options recorded new all-time highs rising for the first time over $14 billion in open interest. At the start of the week, aggregate open interest in futures exceeded $23 billion for the first time.

The weekend promises to be interesting, with prices that if they were to consolidate above $56,000, would lay the groundwork for the start of new stretches. In the medium term, only a drop below $54,000 would trigger the first sign of tension.

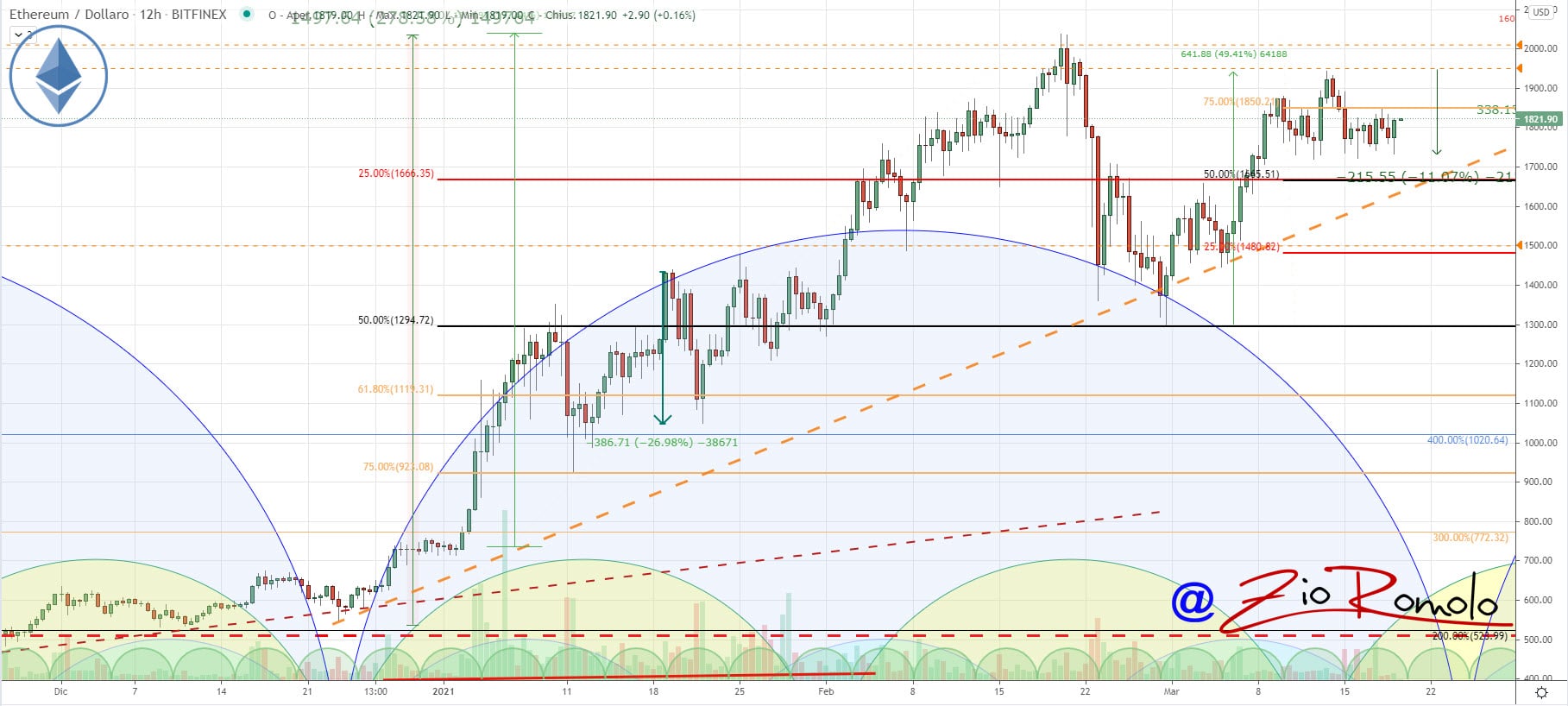

Ethereum (ETH)

For Ethereum, the phase of indecision, which began more than 10 days ago, continues, with prices moving above 1,750 dollars without however providing signs of consolidation.

A signal of strength will only arrive with a move above 1,900 dollars, a level from where the recent attack of the last weekend was repelled by profit-taking. Despite the difficulties of the past week, Ethereum’s trend remains firmly set to the upside. Only a break below $1,650 would trigger speculative action in the short to medium term.