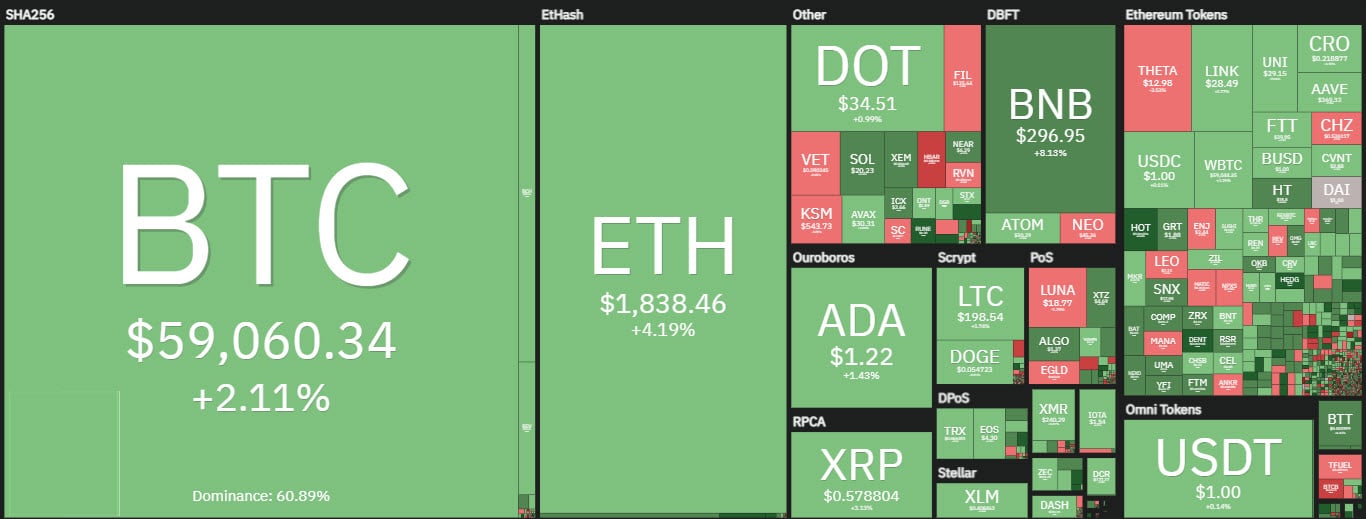

The price climb continues led by Bitcoin dragging the rest of the sector. Today, 80% of the most capitalized cryptocurrencies are above parity.

Among the top cryptocurrencies, Binance Coin (BNB) jumped up over 7% to just above $300, its highest point in three weeks.

BNB’s rise today takes it back to third place on the list of most capitalized coins, displacing Cardano (ADA) with a difference in dominance of $6 billion.

At the moment, the only thing missing to confirm the validity of the climb are the volumes, which, except for Bitcoin, continue to remain low.

Total volume in recent days is just over $300 billion, at the low end of the average of recent weeks.

Among the top 100 capitalized, Holo (HOT) has risen by 100%, doubling its price from yesterday’s levels. The rise is due to the approval of a patent in the United States that allows the implementation of the open source protocol that characterizes Holo. It is a patent that allows communication between nodes in the dApp network.

Filecoin (FIL) follows with +70% and Pancake Swap (CAKE) with +50%, one of the leading DeFi projects on Binance Smart Chain.

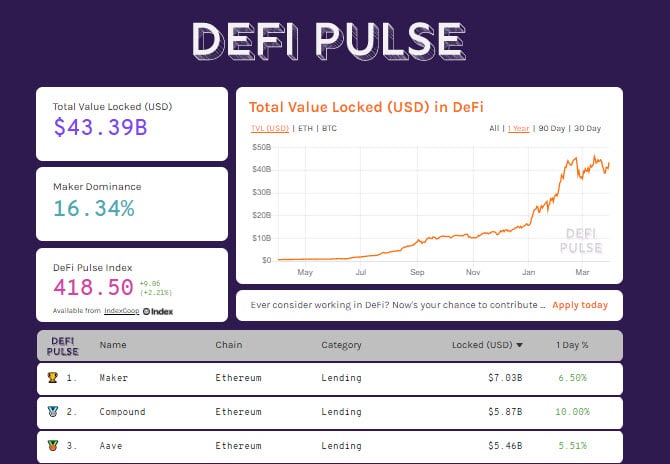

The strengthening of prices further boosted DeFi’s total value locked to above $43.5 billion.

Maker, the leading decentralized finance project, is now above $7 billion in terms of the value of its locked collateral. Compound and Aave follow, both above $5 billion.

In decentralized finance, the growth of locked Ethereum continues and it is now just short of 10 million ETH. This is the closest peak ever to the all-time high of 9.8 billion recorded in September. In contrast, Bitcoin’s outflow continues, falling below 30,000 units, its lowest point in six months.

Summary

Bitcoin (BTC) prices on the rise

The climb in recent hours pushes the price of bitcoin above $59,000. Technically, this is a crucial level in the medium term as a consolidation of this level in the next few hours increases the chances of seeing prices over $60,000 again.

On the contrary, a return of weakness with prices back in the $55,000 area would begin to frustrate the climb that began from the lows of last Thursday.

Ethereum (ETH)

Despite low volumes, Ethereum continues to benefit from the positive momentum with prices returning to the $1,850 area, the equilibrium point that characterized the price fluctuations in the first 20 days of March.

It is necessary for Ethereum, besides attracting solid buying volumes again, to return above $1,900 to confirm the current price rebound that began from last Thursday’s lows. A rebound that currently marks a recovery of about 20%.