On a historic day that saw the listing of the first exchange, Coinbase, on the Nasdaq financial market, the cryptocurrency sector recorded new absolute records, with bitcoin reaching $64,500 for the first time.

Ethereum is doing even better, reaching $2,400 for the first time in its history, up more than 50% from its March lows and gaining more than 220% since the start of the year.

The day of celebrations saw Ripple (XRP) touch the $2 mark for the first time in over three years.

Dogecoin (DOGE) also celebrated, gaining 70% and flying for the first time to 14 cents, a record that when added to the performance of recent months records a gain of 2800% since the beginning of the year.

Chainlink (LINK) also had a record-breaking day with a daily leap of 8%, breaking through the $38 mark for the first time.

The market cap advanced by leaps and bounds, rising above $2.22 trillion. Although bitcoin is moving below 54% dominance, BTC’s market cap reaches $1.2 trillion for the first time.

In these hours the total altcoin capitalization (excluding bitcoin from the calculation) exceeds $1 trillion for the first time, precisely twice the highs of January 2018.

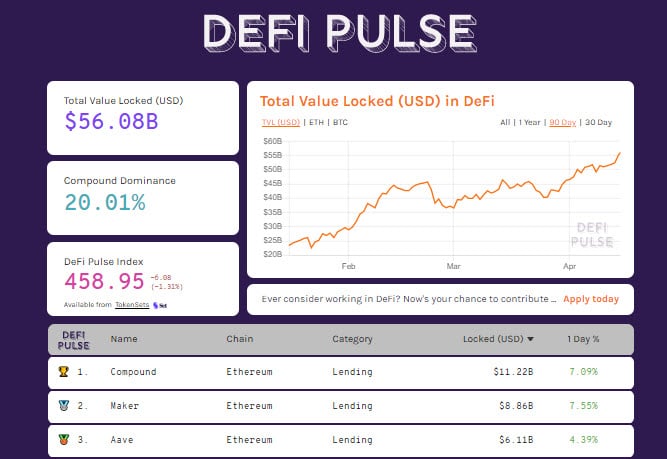

DeFi’s TVL climbs above $56 billion, with Compound pushing to $11.2 billion in value locked on its protocol.

Bitcoin, new records

Bitcoin travels to new all-time highs for the second day in a row, giving confirmation, a few days behind Ethereum, of the start of the new quarterly cycle. Since the lows of late January, bitcoin has gained over 120%. At the same level, the bullish trendline that joins the rising lows and accompanies the rise for about three months becomes the only level to observe and take as a reference, a level that passes just above $58,000.

Ethereum, another all-time high

Ethereum, after having violated the previous highs above $2,230 last weekend, is heading towards its next target at $2,630. The recent movement of Ethereum confirms the hypotheses developed in previous weeks, moving further and further away from the critical threshold of $1,900, the first warning level in case of reversal of the trend.