After the most turbulent weekend since the beginning of the year, the recovery attempt that began yesterday morning is not confirmed by the rebound that stops at short-term resistance, also for the prices of Bitcoin.

On a day that saw more than 80% of cryptocurrencies in the red, only two green signs stood out in the top 25 capitalised: Binance Coin (BNB), which rose by around 2% with prices returning above $535, and Monero (XMR), which climbed by almost 12%, attacking the highest highs of the last three years, rising above $380.

It was also a busy day for volumes. Total trading in the last 24 hours remained above 800 billion dollars. Trading volumes for both bitcoin and Ethereum halved in the last 24 hours, compared to the peaks recorded on Sunday.

In contrast, Dogecoin’s volumes, with more than 15 billion in the last 24 hours touch the highest level of the day.

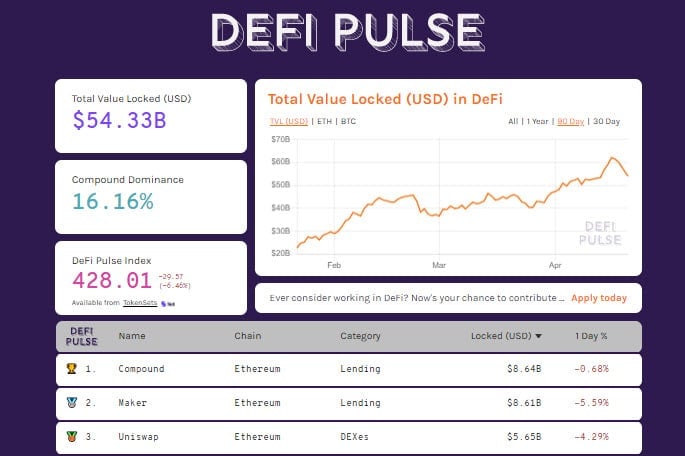

In a moment of particular tension, the number of Ethereum locked on DeFi remains at 11 million ETH, the highest levels ever. Despite these records, the TVL falls to $54 billion, exactly the levels of a week ago.

The collateral stuck in Compound, which has $8.6 billion at this time, is also downgraded and is joined by Maker. The Uniswap DEX rises to third position at $5.6 billion, overtaking the Aave lending and financing project.

Bitcoin (BTC) prices to monitor

Uncertainty remains as to how prices will react after the sharp drop on Sunday that pushed bitcoin to within a hair’s breadth of $50,000. The rebound that yesterday brought prices back to the $57,500 area, at the moment does not provide decisive signals of a return of strength.

In the short and medium-term, it is necessary to recover the $59,000 area as soon as possible.

In the event of a price return below $53,000, the danger of further speculative selling increases.

Ethereum (ETH)

The trend of Ethereum mirrors that of bitcoin, even if the price remains at a safe distance from the dynamic support that at this time passes just below $1,900. This continues to be the level to monitor over the next few days.