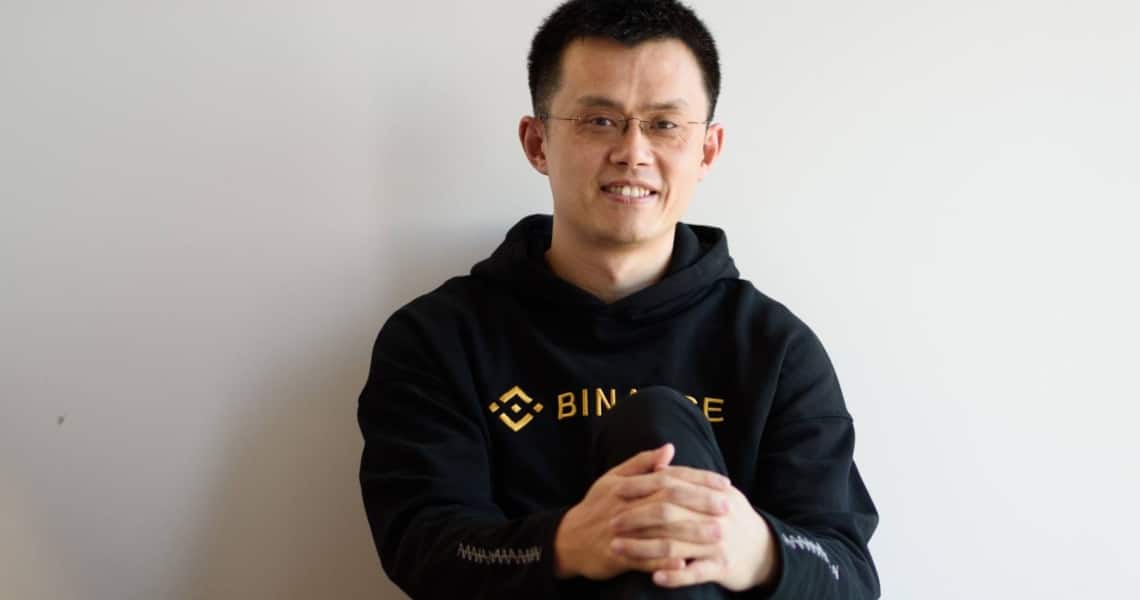

Binance CEO Changpeng CZ Zhao wrote on his personal Twitter profile that “banks refusing to work with crypto are like bookstores refusing to work with the internet”.

Banks refusing to work with crypto are like bookstores refusing to work with the internet.

— CZ 🔶 BNB (@cz_binance) May 6, 2021

Several years ago, when for example Amazon entered the market, which at the time only offered the possibility to buy books online, there were several bookshops that insisted on remaining offline.

Competition from e-commerce sites, where you could easily buy books from a huge catalogue, has seriously challenged many traditional bookshops, especially those that have remained offline.

According to CZ, something similar could happen to banks that refuse to deal with cryptocurrencies.

In fact, many banks, such as Goldman Sachs, have already started to operate within the crypto market, offering their clients services related to cryptocurrencies.

The CEO of Binance also said in an interview with India’s Economic Times that it’s not smart for banks to refuse to deal with cryptocurrencies, and that India is probably losing out on the possibility of having several crypto companies worth $50 billion or $100 billion due to significant restrictions.

CZ argues that dozens of crypto companies worth more than $100 billion could emerge in the US in the next ten years, which is a significant portion of the economy.

He also says that in India, this problem could affect other sectors of the economy as well, due to the financial restrictions their companies will be subject to.

In fact, India has long had a decidedly anti-cryptocurrency stance. Attempts have been made several times to restrict the exchange of cryptocurrencies, or even to make them illegal, without success. This wavering attitude creates a lot of uncertainty, and uncertainty is bad for business.

Recently, in an interview with Bloomberg, the CEO of Binance even said that he considered bitcoin to be a less volatile asset than several stocks, such as Tesla. Therefore, from this perspective, it would be very difficult to imagine why financial institutions would refuse to trade bitcoin when they do not refuse to trade very volatile assets such as Tesla or Gamestop stocks.

It is likely that, in the long run, the reluctance still very much present among the more conservative financial institutions towards those activities involving cryptocurrency will eventually fade away, but probably not without leaving a few bodies in the field.