Bitcoin price analysis

It feels like much of the cryptocurrency space is just waiting for Bitcoin’s next big move. On Tuesday there wasn’t a big move to report with much of the Top 10 basically trading sideways with minimal losses or gains.

Bitcoin [$35,983] is -1.88% for the last 24 hours at the time of writing and is teasing bears and bulls anticipating BTC’s next move.

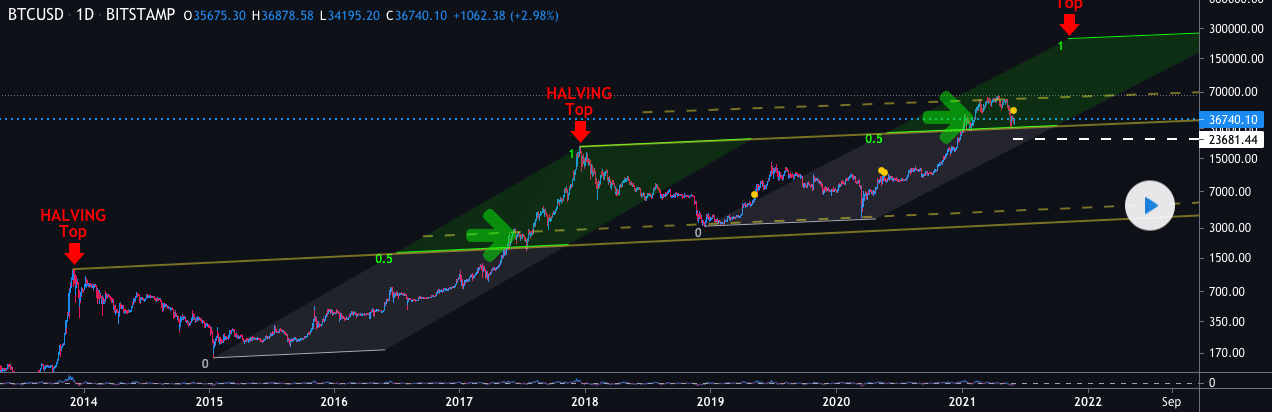

Long term BTC holders will take solace in the chart below by tradingview’s BTCINVESTING on how the second half of 2021 may play out.

The daily range for BTC is $35,663-$37,836. The 7 day LOW is $34,775 and HIGH is $39,406.

BTC’s done $33.3 billion in trading volume for the last 24 hours and boasts a $672 billion market capitalization that makes up 40.1% of the aggregate market capitalization.

The gap between Bitcoin dominance [40.8%] and Ethereum dominance [17.9%] is 22.9% for the top market cap in all of the cryptocurrency space.

Bitcoin’s price closed Tuesday at $36,691.

Polygon [Matic]

Matic continues to be one of the hottest projects price wise and the popularity is showing up on google trends as well with it continually finding its way into the top searches across the cryptocurrency sector.

Polygon is -1.8% for the last 24 hours at the time of writing and bouncing off of support at $1.80.

Matic’s daily range is $1.8-$1.97. The 7 day LOW is $1.69 and HIGH is $2.22.

Tuesday’s candle closed at $1.82 and Matic posted a lower close than Monday’s candle close [$1.87].

Matic is +8,078% for the last 12 months.

With so much speculation about layer-2 and sidechain options to ETH’s scaling woes abound lately, Matic’s certainly been a prominent player of late and the price has responded.

It’ll be interesting to see how Arbitrum’s launch last week contributes positively or negatively to the price of other projects designed to scale Ethereum. Ethereum’s gas fees have been trending downward recently.

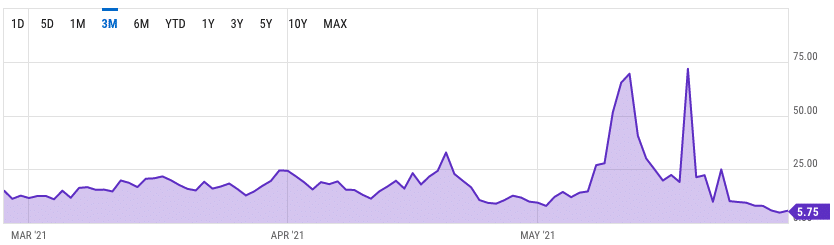

The three month chart above illustrates the decline in gas prices since the recent peak in May on the Ethereum network.