Bitcoin analysis

On Saturday much of the alt coin market sold off but BTC was barely in the red and that has strengthened the narrative that this is an accumulation phase for Bitcoin. Bitcoin dominance is continuing to rise and back to 43.4% at the time of writing.

After hours of bouncing off of $35k as support resistance BTC had a Sunday afternoon rally of +9.5% and is back above $39k.

The 24 hour range is $34,902-$39,396 and BTC’s 24 hour volume is $31.4 billion.

So much of the macro outlook relies on BTC’s performance and the entire market is at the whim of the world’ preeminent digital asset and wondering what’s coming next.

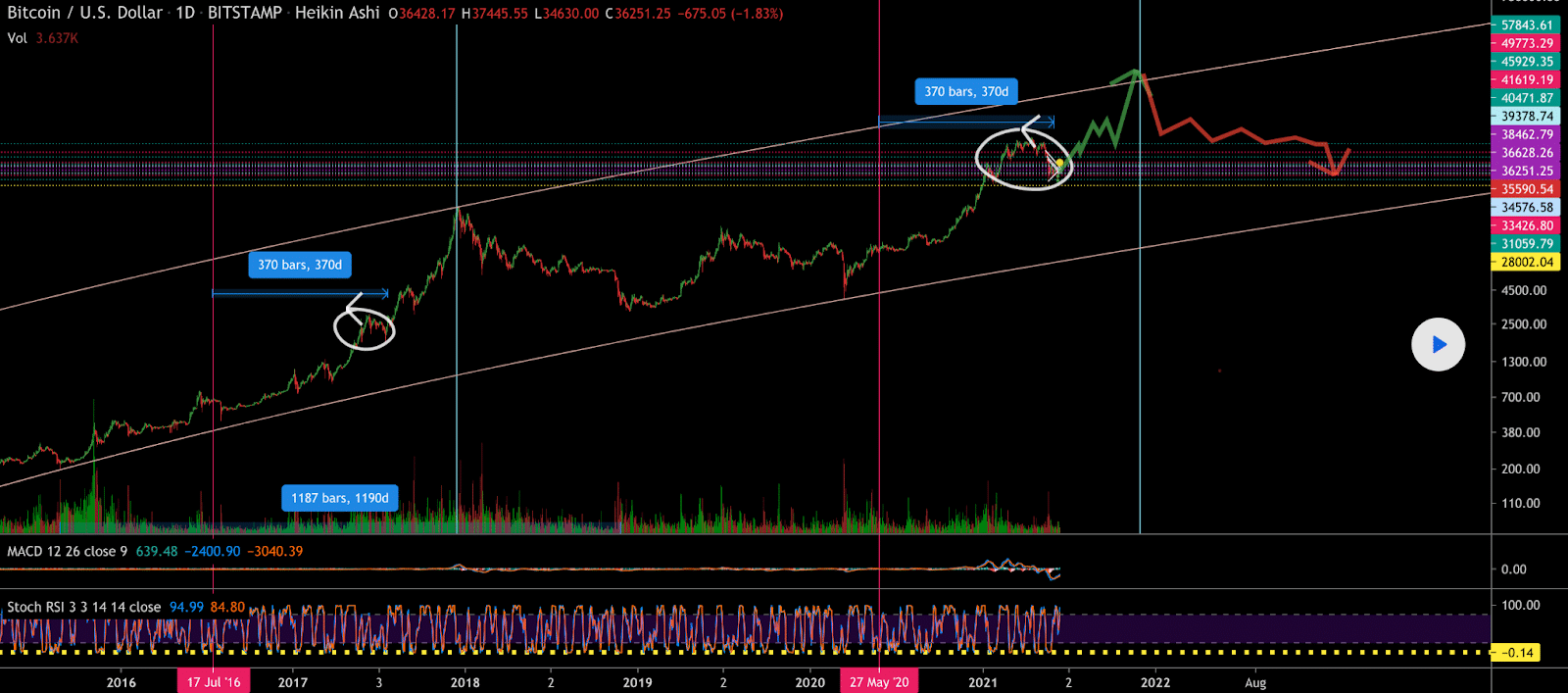

The below TradingView chart puts BTC’s 1D trend under a microscope and the author, harrisssoonnn, believes $200k is still in the picture for this bull run.

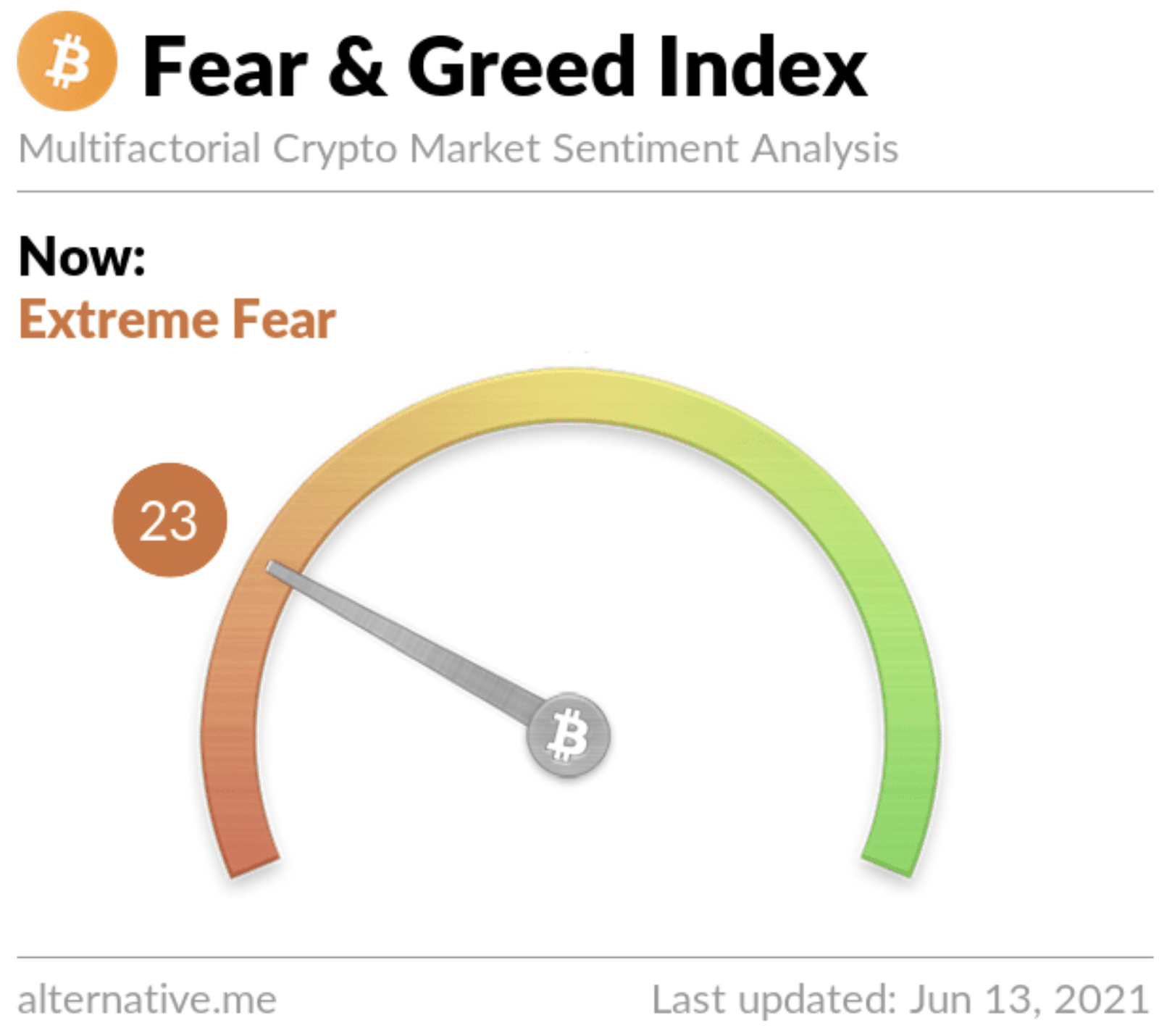

Another sign that the pain may at least in the interim be heading towards relief is BTC’s Fear and Greed Index has bounced 10 points since last Thursday – yet is still in the Extreme Fear zone.

Bears will hope they can again retest the bottom of the structure at $30k. If they fail they’ll potentially risk losing the ball to bulls with a flip of $40k.

Bitcoin closed Sunday’s daily / weekly candle at $39,051.

Nano analysis

The last 30 days of Nano [-52.15%] have been pretty consistent with much of the alt coins across the blockchain spectrum.

Nano is the number 87th ranked cryptocurrency project by market capitalization and accounts for $849.3 million of the $1.68 trillion aggregate cryptocurrency market capitalization.

The 24 range of Nano is $5.94-$6.48 and the 24 volume is $27 million.

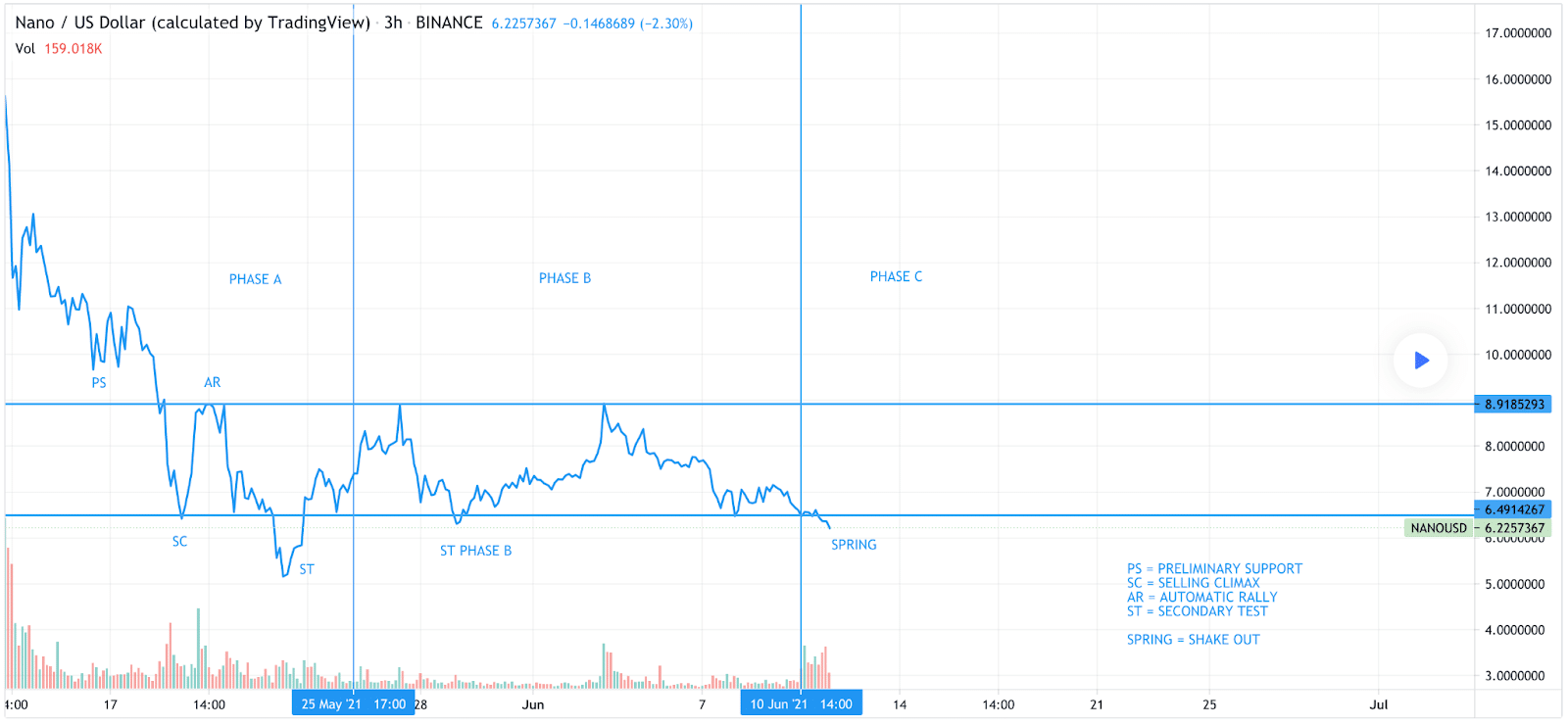

The above chart makes the case that Nano, much like BTC, is currently in the middle of a Wyckoff accumulation phase.

This chart puts Nano in Phase C of Wyckoff accumulation where the chart’s author, apolloriver , posits the last of the weak hands will be shaken out. Post shakeout he believes the resistance above will be tested and eventually breakout violently to the upside over the next two phases.

Nano is +26.8% for the last 90 days and +478% for the last 12 months.

Nano closed Sunday’s daily / weekly candle valued at $6.53 per unit.

The aggregate crypto market capitalization closed the daily / weekly candle at $1.68 trillion on Sunday.