Bitcoin Analysis

Bitcoin [+9.5%] managed to bounce from its weekly low of $31,188 and was up as much as 16% on Wednesday.

The market got a much needed lift up on news that El Salvador passed legislation to recognize bitcoin as legal tender. The El Salvadorian congress passed the law with a majority vote of 62 / 84 representatives.

The law takes effect in 90 days and there’s already rumors swirling about further bitcoin legal tender legislation attempts in other Central and South American countries.

BTC has long been known to move massively in one day from good or bad news so it should come as no shock the market responded so bullishly to such a historic event.

The 24 hour range for BTC had more than a $5,000 spread, $32,469-$37,622.

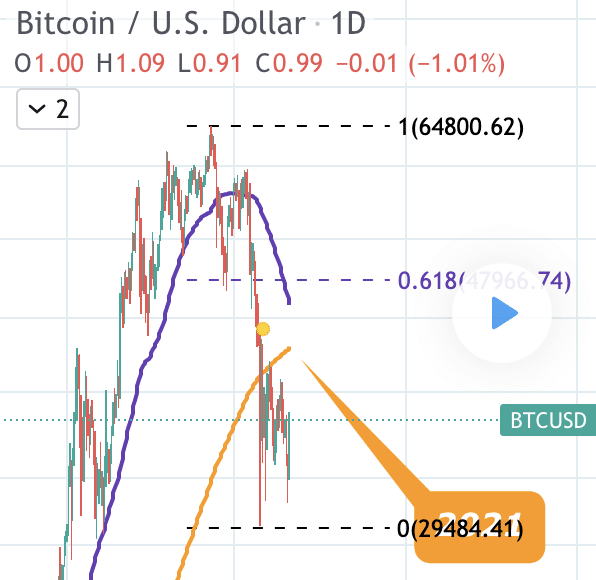

The above chart from TradingShot on TradingView shows how close BTC is to currently having a death cross on the 1D Chart.

A death cross occurs when the 50 MA dips below the 200 MA, this basically implies that the longer timescale has ended the bullish trend and has entered a bearish phase. This indicator isn’t apodictic but the short term probability is generally bearish when this event takes place.

The Fear and Greed Index is still reflecting some short term doubt as well despite the El Salvador announcement. BTC only managed to bounce 1 point, up from 13 and Extreme Fear on Tuesday.

Bitcoin lost greater than 57% of its value over less than a month’s span but is still +237% for the last 12 months.

On Wednesday BTC managed to climb above $37k again in the hours leading up to the daily close but failed to close above $37k.

BTC closed Wednesday’s daily candle at $36,634 and was +$3,219 to close the day.

The aggregate crypto market cap is $1.68 trillion and bitcoin dominance accounts for 41.5% of the total figure at the time of writing.

There’s very little argument that bitcoin doesn’t account for much of the macro sentiment across the cryptocurrency landscape and alts performed nicely on Wednesday as well.

Monero

Monero [+7.4%] is one of the many alts that were positively impacted on Wednesday by the macro outlook showing strength. XMR’s +$24 for the day at the time of writing.

Monero’s history is interesting and there’s no doubt that like Bitcoin with p2p money and Ethereum’s first mover advantage with smart contracts, Monero also boasts a first mover advantage of its own in confidential transactions.

There really hasn’t been any competition to Monero’s throne as the world’s top privacy coin by market capitalization in the asset classes history.

XMR’s market capitalization is $4.8 billion at the time of writing and XMR’s 24 hour volume is $337 million.

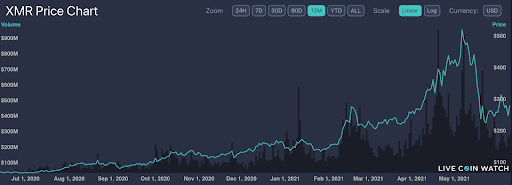

Monero’s +296.2% for the last 12 months.

Traders will be watching to see if XMR can again climb back above an important psychological resistance level of $300 in the coming weeks.

From peak to trough XMR lost 62.03% of its value on the most recent market correction.

XMR’s 12 month range is $60.17-$514.78.