Bitcoin trend

The Bitcoin train began to shift in momentum to the bulls favor over the course of last weekend but is at a major inflection point.

BTC’s continuing its course upward early this week and will be looking for a 4th consecutive higher daily close on Wednesday.

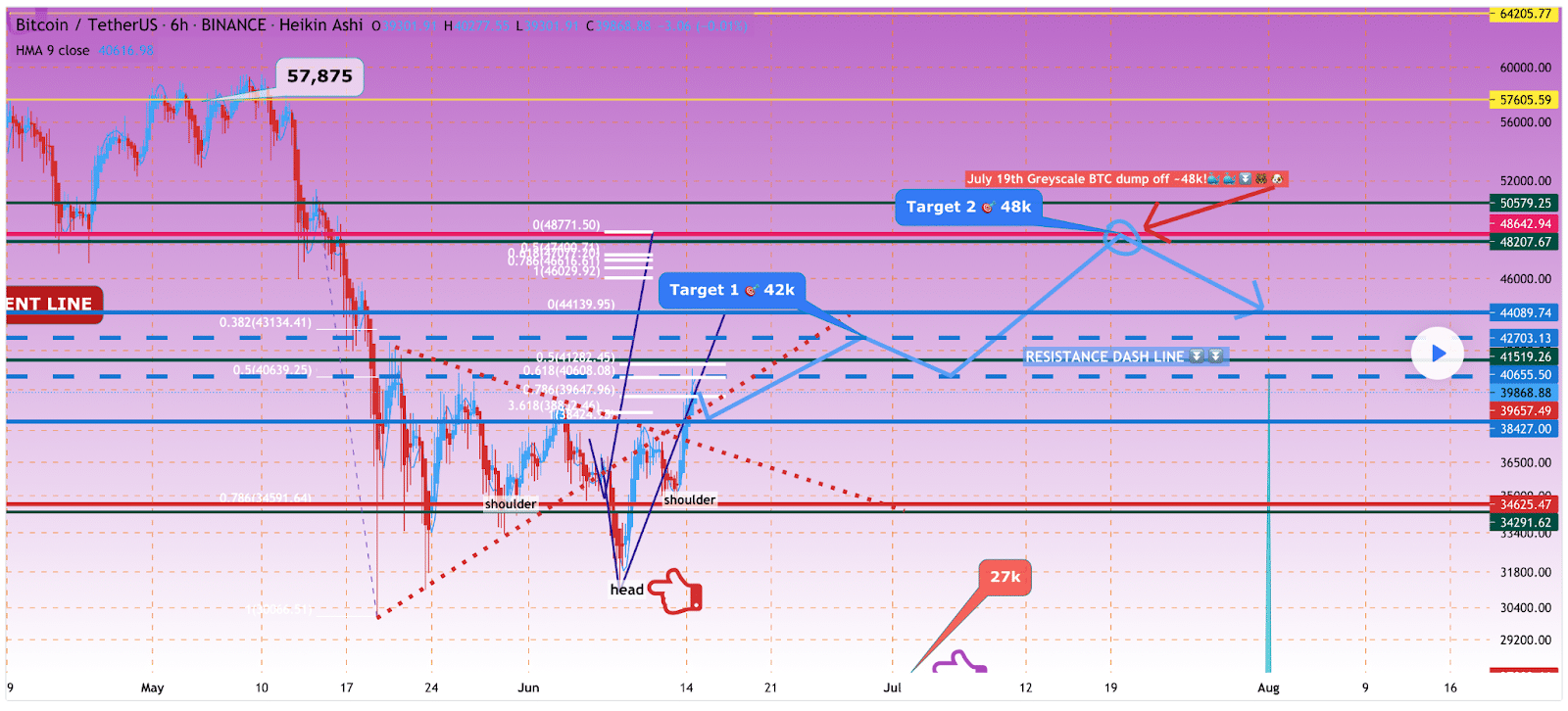

The Bitcoin 6HR Chart below from TradingView’s , jazerbay, posits that BTC is currently playing out an inverse head and shoulders pattern with the first target being $42k.

The second target laid out on the chart is $48k which the chart denotes could also intersect with the unlock of 16,000 BTC owned by Grayscale.

To be in compliance with the Security and Exchange Commission investments in GBTC have to be locked up for a minimum period of 6 months before investors can sell. While some are claiming this is likely to be a bullish event for BTC I’m not so certain it will be short term bullish.

The event increases the available supply on the market by 16,000 units which is equivalent to $657,568,000 at the time of writing. Ceteris paribus the price of BTC suffers a short term pullback or remains constant until the new BTC on the market is absorbed.

Grayscale became a reporting company to the SEC on January 21, 2020. Later that year on April 21, 2020 the required holding period for GBTC was reduced from 1 year to 6 months.

The unlocking event takes place in 33 days and accounts for less than 2% of Grayscale’s aggregate of more than $34 billion of digital assets under management.

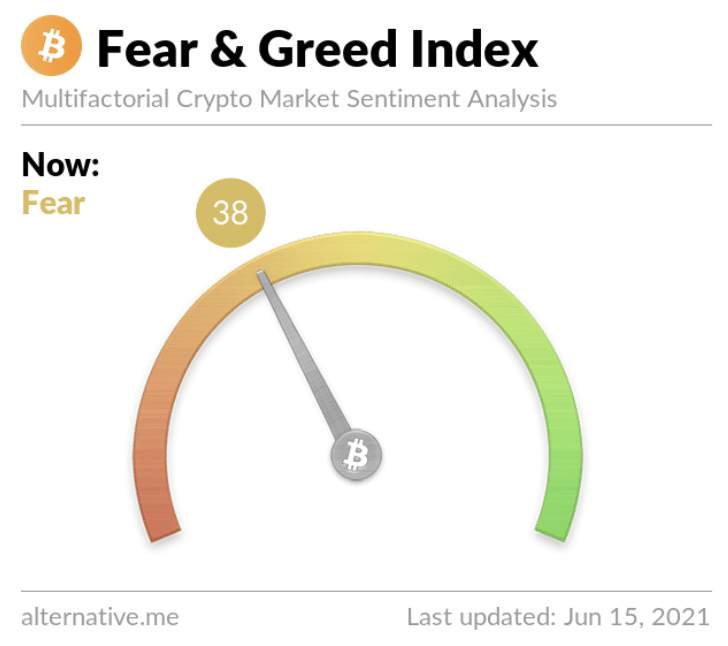

Bitcoin’s Fear and Greed Index is +25 points since last Thursday and meandered out of the Extreme Fear region of the indicator.

BTC had a daily candle close on Tuesday of $40,360.

Cardano (ADA)

Cardano’s outperformed every other crypto asset in the Top 10 for the last 12 months.

IOHK, the team responsible for Cardano and the network’s token, ADA, launched the first smart contract on their test network recently despite Cardano launching in 2015.

The lack of smart contract capability thus far has opened up IOHK’s Cardano to a lot of scrutiny. That being said, the scrutiny about the lack of dApps being built on the network and the pace at which Cardano is being developed haven’t hampered ADA’s price.

ADA is +1,931% for the last 12 months against the U.S. Dollar and +368% against BTC.

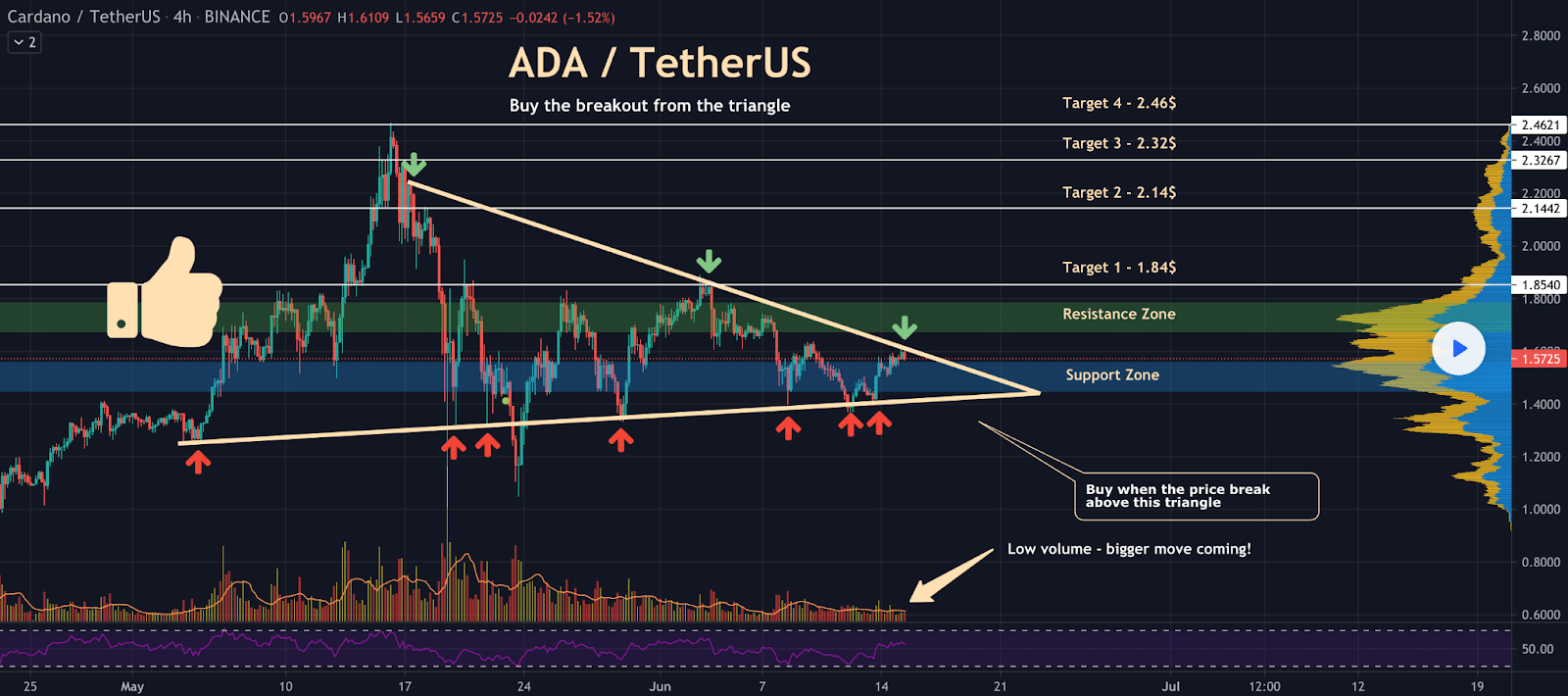

The above 4HR Chart shows how close ADA is to a true breakout of the triangle it’s been trading in since early May.

A clean breakout to the upside of the triangle could send traders to the first target on the chart of $1.84. The following targets $2.14, $2.32 and $2.46 are calculated areas to take profits by the TradingView chart’s author, MJI786.

A more bearish outlook would be the asset’s failure to get enough volume to break the triangle to the upside and then ending up back inside the range tracking towards the bottom of the structure once more.

A breach of the structure to the downside could spell a much longer bearish outlook on the number #5 cryptocurrency by market capitalization [$49.8 billion].

ADA closed Tuesday’s daily candle valued at $1.57.