Bitcoin analysis

Bitcoin’s price action over the weekend was a mixed bag with the price pumping much of Saturday and early on Sunday’s daily candle before pulling back to a weekend low of $42,790.

Despite a lot of worries over impactful and hurried cryptocurrency sector legislation in the U.S. developing over the last week, the BTC price remains in a major uptrend. Bitcoin’s already marked up over $16k from the recent low of the downtrend to the recent high.

The aggregate cryptocurrency market capitalization is $1.83 trillion at the time of writing and bitcoin dominance accounts for 44.8% [$822b] of that total.

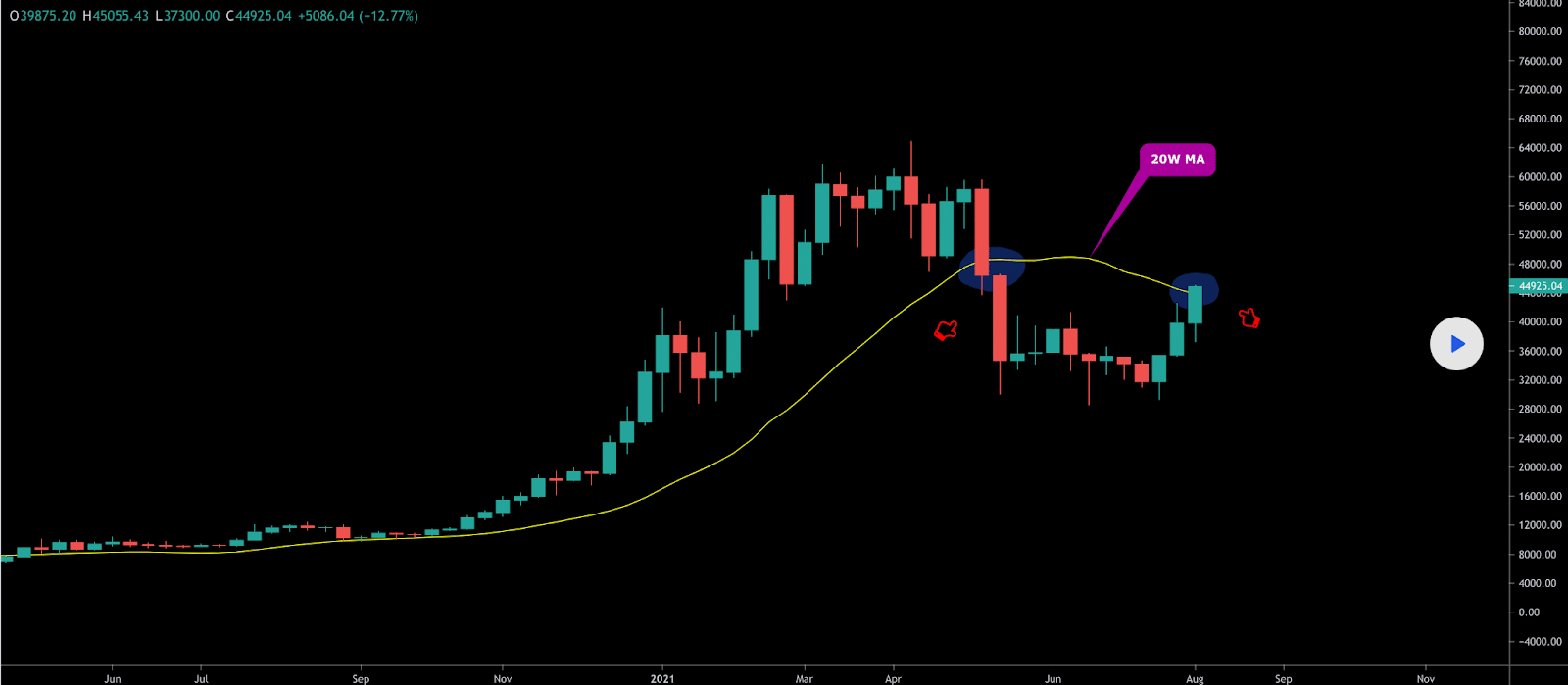

The chart below from Babenski is focusing on BTC’s weekly performance which still finds it beneath the 20W MA. If bulls really want to kick-start the next phase of the bull market and get to an eventual bull run then breaking above the 20W MA with a close on a significant timescale like the weekly is required.

Bitcoin has typically launched after bulls have taken over the 20W MA to the upside. Bears in opposition to the bullish momentum ongoing need to push the price beneath $42k which should be a strong support resistance for bitcoin bulls.

If bears can drive the price beneath $42k then the high $30k will be the next target but $40k should be a strong level for bulls with their current momentum.

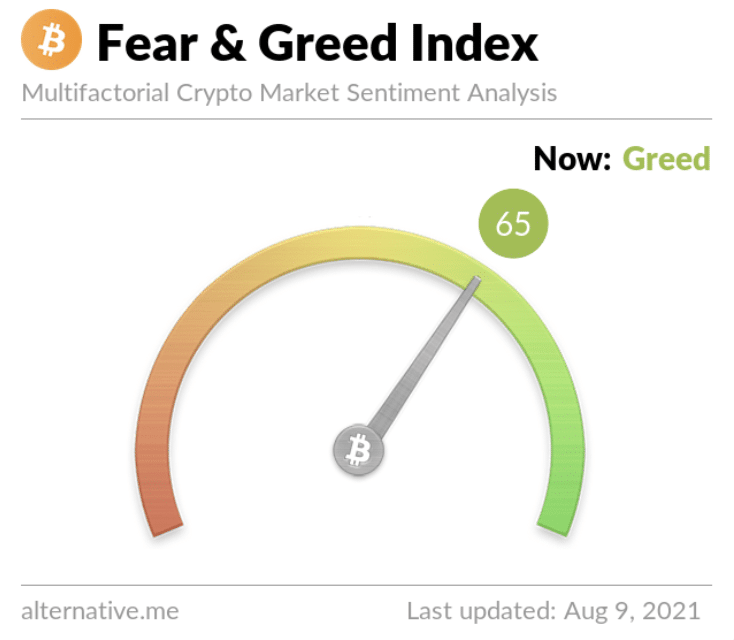

Bitcoin’s Fear and Greed Index is reading 65 for Monday and is -9 points from yesterday’s reading.

BTC’s 24 hour price range is $42,790-$45,250 and the 7 day price range is $42,790-$45,250. Bitcoin’s 30 day average price is $36,482.

Bitcoin [-1.84%] closed Sunday’s daily / weekly candle worth $43,770.

Ethereum analysis

Ethereum’s price action is very much resembling the macro but is really setting the pace for the Top 10 crypto assets by market capitalization.

After marking up more than 80% from the low of the recent downturn to where the recent high was made ETH could be setting up to be range bound in the interim. There’s strong overhead resistance at $3,200 that may need to be knocked on multiple times before bulls get through the door.

The above 4hr chart from OptimoomFX shows that if bears can push the price beneath $2,900 bulls will look for support resistance at $2,600 next.

ETH’s 24 hour price range is $2,897-$3,185 and the 7 day price range is $2,475-$3,185. Ether’s 30 day average price is $2,295.

Ether closed the daily / weekly candle on Sunday worth $3,013 and in red figures for the first time in five days.