Summary

Bitcoin Analysis

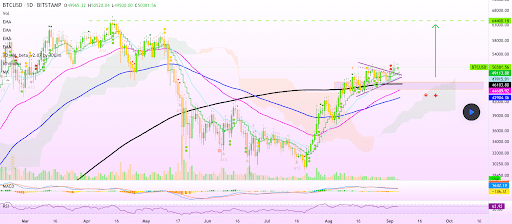

Bitcoin continued it’s sideway trajectory over the weekend until late in Sunday’s daily candle when the price marked up above a critical inflection level. Over two weeks bitcoin bulls and bears battled at $50,3k and finally bulls drove the price higher on Sunday and closed the daily candle above that important price point.

What are the bullish and bearish scenarios for bitcoin moving forward?

As you can see on the above 1D chart from AlanSantana there’s not much looking left for bitcoin bulls resistance wise until it’s all-time high. It’s highly probable that following a bullish engulfing candle that bulls are able to at least test the next overhead resistance in coming days.

There’s some resistance at $57,5k on the 4hr BTC chart but how strong that overhead resistance will prove to be is yet to be determined if tested.

Bears will need to reverse course soon or BTC bulls will be approaching the all-time high of $64,804 in coming weeks or months potentially. Bearish traders may be approaching their last stand at this level and will want to send the price beneath $50k with a close on a significant timescale to manage a small short-term victory.

Bitcoin bullishly engulfed on the weekly candle and is still trading securely above the 200 Moving Average.

The aggregate cryptocurrency market capitalization also closed at its highest level since May 12th which is another indicator of just how many bullish indicators are flashing green.

Bitcoin’s RSI is above 60 on the daily, 3 day, weekly, and monthly timescales at the time of writing. This stat suggests bullish traders could be about to embrace a very promising week ahead. All significant timescales are showing bitcoin setting up for higher prices.

The Fear and Greed Index is reading 79 and the ‘Extreme Greed’ region. BTC’s reading is +6 from yesterday’s reading of ‘Greed.’

Bitcoin is +18.91% for the last 30 days, +43.93% for the last 90 days, and +404% for the last 12 months.

BTC’s 24 hour price range is $49,500-$51,833 and the 7 day price range is $46,857-$51,833. Bitcoin’s 52 week price range is $9,964-$64,804.

Bitcoin closed Sunday’s daily / weekly candle worth $51,762 and in green digits. BTC also closed the weekly candle in green figures for a 9th consecutive week.

Quant Price Analysis

Quant’s ascent as one of the hottest projects over the last 12 months is continuing into September – QNT is +49.5% for the last 24 hours at the time of writing.

QNT is +688% against The U.S. Dollar over the past 90 days, +412.3% against BTC, and +417.9% against ETH over the same duration.

The asset made multiple new all-time highs on Sunday and was actually greater than $100 at times. Quant’s price pulsated above 50% gains for the day at times.

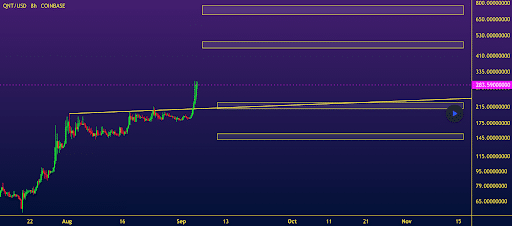

The below 8hr chart from Correction shows how much room Quant has left to run before possible overhead resistance.

Bulls are in control above $226 which bulls have now flipped to support resistance and a level that could be strong. Overhead bulls can set their sights on a first target of $450 and a secondary target of $486. If bulls can push the price through that level it could be a quick trip to the $685 level.

It’s imperative for bears if they’ve any chance at short term success to push QNT beneath yesterday’s daily low – the $226 level.

QNT’s 24 hour price range is $224.8-$337.14 and the 7 day price range is $180.47-$337.14. Quant’s 52 week price range is $6.73-$337.14.

Quant closed Sunday’s daily / weekly candle valued at $318.87 and in green figures for the 5th consecutive day. QNT’s weekly close was also in green figures for a 4th straight week.