Summary

Bitcoin price analysis

Bitcoin’s price was nuked just after the second half of Tuesday’s daily candle began and the price wicked down as low as $42,8k on at least one exchange. BTC closed Monday’s daily candle looking very strong technically and closed the day with its highest price since May 11 of this year.

Despite the recent momentum BTC’s price dropped double digits by percentage on Tuesday and at one point was down as much as -20% for the day.

It should have been a day for bitcoiners to rejoice as El Salvador officially made bitcoin legal tender but the party was somewhat spoiled by price action to the downside.

So, what opinion can be made from the charts on the short-term future of bitcoin and the probability that the bull cycle is yet intact?

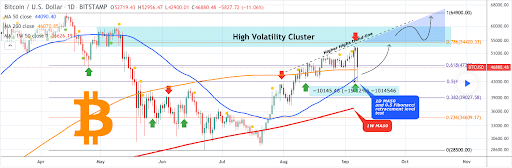

The below chart from TradingShot shows that bitcoin’s price dropped all the way below the 1D MA50 before bullish traders contained the price almost exactly on the .50 fibonacci level of the chart.

The chartist posits BTC closing above this region [1D MA50] suggests this is just another bump in the road during a stretch that’s seen bullish price action for more than 9 weeks consecutively.

If bitcoin can hold the .618 at the $46,880 level then bulls will probably remain confident.

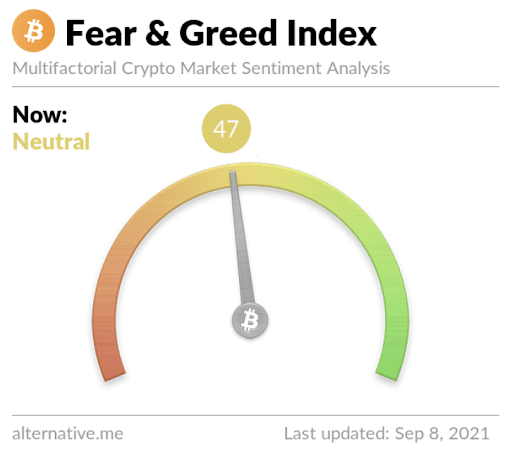

The Fear and Greed Index is reading 47 and -32 points from yesterday’s reading of 79.

BTC’s 24 hour range is $45,299-$52,853 and the 7 day range is $45,299-$52,853. Bitcoin’s 52 week price range is $10,007-$64,804.

Bitcoin dominance accounts for 40.6% of the aggregate crypto market capitalization of 2.17 trillion [-12.4%]. BTC dominance looks to be at an inflection point. Traders should know soon whether 40% dominance is broken to the downside and whether or not 37% is then challenged. The 37% level held up months ago as the floor for BTC dominance.

The average BTC price for the last 30 days is $47,732.

Bitcoin painted a bearish engulfing candle worth $46,778 on Tuesday and finished -11.2% on the day. Tuesday was the first daily close in three days that finished in red digits.

Ethereum analysis

Ether’s price was sent lower during Tuesday’s daily candle but the momentum on ETH actually stalled weeks ago. ETH’s price recovered strongly after last spring’s downtrend but is only +11.1% for the last 30 days and has been comparatively stagnant while many other alts ran to all-time high prices.

With the macro developments and ETH’s price already struggling, what should market participants expect from Ether in the interim?

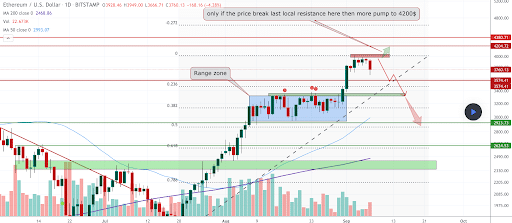

The below chart from MMBTtrader shows how much overhead resistance there is for Ether bulls at $4k. When traditional technical analysis is applied traders will note this level will take a substantial power move to the upside to break and then bulls can test ETH’s all-time high of $4,352.

Now that ETH’s local top is in, Ether bears will try to re-test the $3k level and then actually get follow-through price action to break the back of bullish participants.

ETH’s strength relative to BTC over the last week or so has been waning and it will be interesting to see which asset’s price rounds out a bottom on the chart and tries to begin a new uptrend firstly.

Ethereum dominance accounts for 18.6% of the aggregate crypto market capitalization.

ETH’s 24 hour price range is $3,300-$3,948 and the 7 day price range is $3,300-$3,972. Ether’s 52 week price range is $320-$4,352.

The average ETH price for the last 30 days is $3,341.

Ether closed Tuesday’s daily candle in red figures valued at $3,422 and -12.86%.