Summary

Bitcoin analysis

Bitcoin’s price action leveled-off a bit after finding support resistance for now at the $40k level. Since wicking down below $40k yesterday on some exchanges, BTC’s price has rallied back above $43k, at the time of writing.

As discussed in yesterday’s article, bitcoin’s price is currently in a descending channel and bumping up against the top of its channel on the 4hr chart.

Traders can see on the 4hr chart below that if BTC closes above the $43,8k level on the daily timescale bulls could send the price higher in the short term and challenge the middle of its range again around $46,5k.

Another good sign for market participants that are long bitcoin is the fact that BTC has also broken out of its descending channel to the upside on the daily timescale.

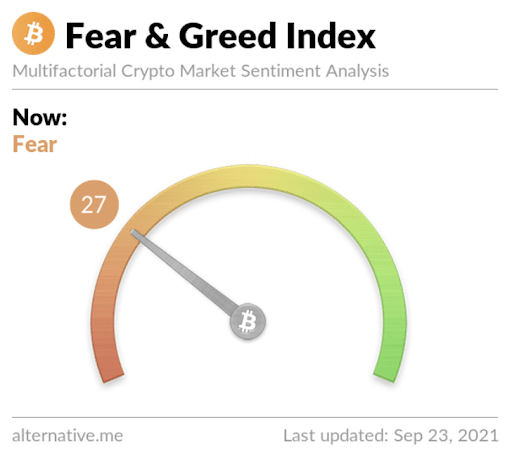

The Fear and Greed Index is reading 27 ‘Fear’ and +6 from yesterday’s reading of 21 ‘Extreme Fear.’

BTC’s 24 hour range is $40,263-$44,172 and the 7 day range is $40,263-$48,852. Bitcoin’s 52 week range is $10,255-$64,804.

Over the last 30 days the average BTC price is $47,765.

There’s still not much help on the oscillators for BTC but Wednesday’s rally was important for bulls.

BTC [+7.18%] closed Wednesday’s daily candle worth $43,582 with a bullish engulfing candle. Bitcoin’s price reversal came at an important inflection point of $40k and gave bullish traders a bit of relief on Wednesday.

Ethereum Analysis

Ether’s price was up more than 10% at times on Wednesday and reclaimed the $3k price level before ETH’s daily close.

The 1D chart below from CryptoPatel shows that ETH’s now successfully fulfilled its impulse wave pattern and could be heading back to test $3,5k.

With Ether’s price above an important inflection point at $3k bulls will want to reclaim the $3,5k level before the weekly close to mitigate damage and virtually erase much of this week’s negative momentum.

If bears can again send the price below $3k then they’ll aim to push the price back below $2,891 as a primary target and then $2,372 as a secondary target.

ETH’s 24 hour price range is $2,733-$3,099 and the 7 day price range is $2,733-$3,655. Ether’s 52 week price range is $320-$4,352.

Ether’s average price for the last 30 days is $3,402.

ETH [+11.31%] closed Wednesday’s daily candle worth $3,077 and in green digits which snapped a three day streak of negative daily candle closes.

Quant Analysis

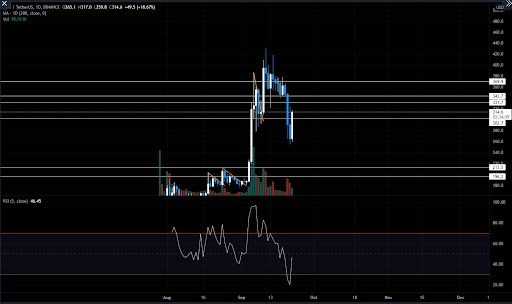

Quant’s price has been one of the most volatile in all of crypto over the last 6 months and a dream for day traders that see that as an opportunity.

QNT’s currently back above an important inflection point at $300, at the time of writing.

If QNT bulls want to keep Wednesday’s momentum rolling they’ll want to send the price above $330 in the coming days.

Conversely, if bears wish to flex their muscles further they’ll want to breach $300 to the downside again and eventually send the price much lower. The secondary target for QNT bears to try and crack will take a big gap down to the next support resistance at $213.

Quant’s 24 hour price range is $262.06-$315.6 and the 7 day price range is $262.06-$374.14. QNT’s 52 week price range is $255.4-$416.6.

QNT’s 30 day average price is $339.01.

Quant [+17.91%] closed Wednesday’s daily candle worth $312.1 and in green digits.