Summary

Bitcoin Analysis

Bitcoin’s price closed Tuesday’s daily candle by taking a small step backward [-$907]. BTC’s price continues to struggle to crack $58,323 while also holding that level and successfully closing above that level on the daily time frame – that level is fundamental to market participants on BTC’s 4HR chart.

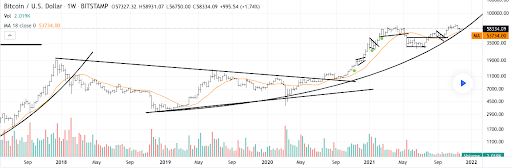

The BTC/USD 1W chart below from PeterLBrandt allows traders to visualize the strength of Bitcoin and the parabolic curve painted dating back to its December 2018 low.

Bullish bitcoin traders are pointing to this parabolic curve, and the duration of this pattern is further proof that upside is coming for bitcoin before this bull cycle draws to a close.

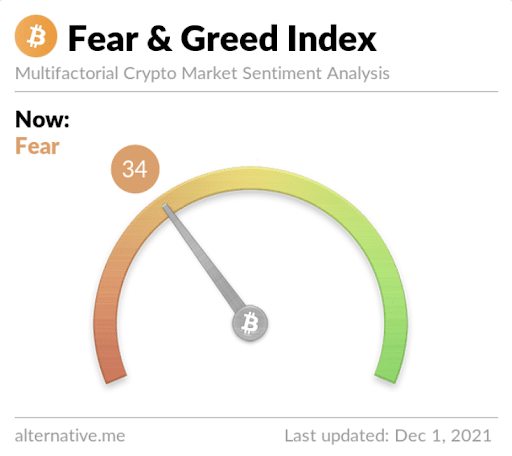

The Fear and Greed Index is 34 Fear and -6 from yesterday’s reading of 40 Fear.

Bitcoin is trading below its 50 Day MA [$57,468] at the time of writing but above its 100 Day MA [$50,353] and above its 200 Day MA [$48,699].

BTC’s 24-hour price range is $56,157-$59,184 and its 7-day price range is $53,827-$59,206. Bitcoin’s 52-week price range is $17,764-$69,044.

The price of bitcoin on this date last year was $18,857.

The average price of BTC for the last 30 days is $60,773.

Bitcoin [-1.57%] closed its daily candle worth $56,938 and in red figures in four days on Tuesday for the first time.

Ethereum Analysis

Ether’s price action diverged from BTC’s price action on Tuesday and finished its daily candle at +$188.4. Ethereum dominance is also at its highest level since early 2018 and makes up 20% of the aggregate crypto market capitalization at the time of writing.

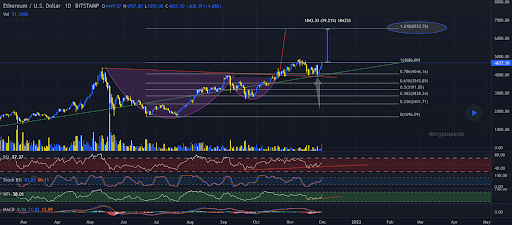

The ETH/USD 1D chart below CRYPTOPICKK shows overhead targets for Ether bulls at 1 [$4,686] and 1.618 [$6,533.76].

Ether’s trading above all important moving averages, its 50 Day MA [$3,998], 100 Day MA [$3,476], and 200 Day MA [$2,906].

ETH’s 24-hour price range is $4,372-$4,740, and its 7-day price range is $4,021-$4,683. Ether’s 52-week price range is $541.28-$4,878.

The price of ETH on this date in 2020 was $589.58.

The average price of ETH for the last 30 days is $4,433.

Ether [+4.24%] closed its daily candle on Tuesday, worth $4,631.22 for a fourth straight day in the green digits.

DOT Analysis

Polkadot’s price continued its march to higher prices on Tuesday and finished its daily candle [+$.77].

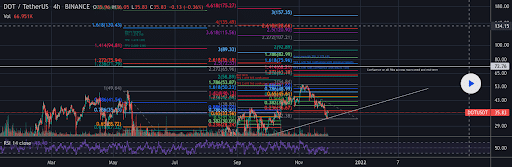

The DOT/TetherUS 4h chart below from Andy1GP shows the most important targets for DOT market participants.

Polkadot bulls hope to hold the 0.38 fib level [$39.60] and flip that to support. Above that price, the following targets for DOT bulls are 0.5 [$42.14] and 0.618 [$44.84].

Conversely, bearish DOT traders seek a break of the 0.236 [$36.67] and send DOT’s price lower than its been since making its most recent all-time high of $54.98 [27 days ago].

Despite being +18% over the last 90 days, DOT is trading below its 50 Day Moving Average [$40.25]. DOT’s price is still holding above its 100 Day Moving Average [$31.96] and its 200 Day Moving Average [$30.98].

DOT’s 24-hour price range is $35.55-$39.07, and its 7-day price range is $33-$40.89. Polkadot’s 52-week price range is $4.61-$54.98.

Polkadot’s price on this date last year was $5.10.

The average price of DOT over the last 30 days is $44.36.

Polkadot [+2.08%] finished Tuesday’s daily candle worth $37.88 for a fourth straight day.