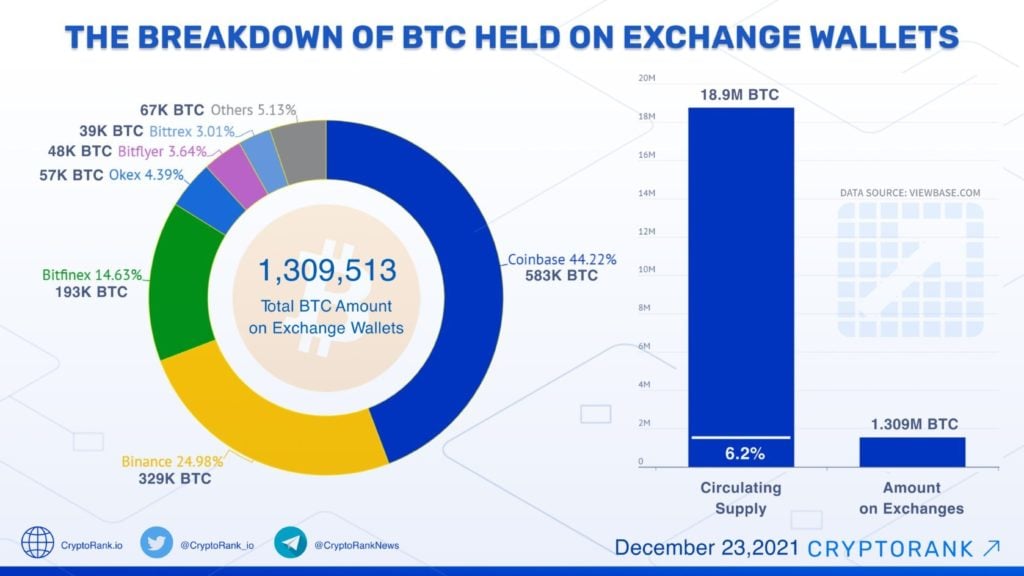

There are only 1.3 million Bitcoin left on cryptocurrency exchanges, out of the 18.9 million in existence.

Summary

Cryptocurrency exchanges with the most Bitcoin

That’s reported by CryptoRank, which also reveals that the exchange that holds by far the most is the US-based Coinbase, followed by Binance. In the third position is Bitfinex, while the others are far behind.

📈Crypto Exchanges Hold 6.2% of #Bitcoin Circulating Supply@Coinbase – 583K BTC@Binance – 329K BTC@Bitfinex– 193K BTC

@OKEx – 57K BTC@Bitflyer – 48K BTC@BittrexExchange – 39K BTC

Other exchanges – 67K #BTC👉https://t.co/nYhYMYoYXp pic.twitter.com/itrMohLyss

— CryptoRank Platform (@CryptoRank_io) December 23, 2021

So in total, only 6.2% of all existing Bitcoins in the world are currently on cryptocurrency exchanges.

The distribution of Bitcoins (Source: CryptoRank)

Lost Bitcoins

However, you have to keep in mind that probably two or three million BTC should be considered lost forever because the wallets’ private keys on which they are stored were lost. In reality, this percentage is purely theoretical because the real one is definitely lower. However, not knowing exactly how many Bitcoin are lost is impossible to calculate the real percentage.

Assuming, however, a maximum of 4 million lost BTC, this percentage would only rise to 8.7%, so the fact remains that more than 90% of the Bitcoin actually in circulation today were not deposited on cryptocurrency exchanges to be traded there.

Bitcoins on exchanges decreasing

It should be added, however, that a significant portion is held, for example, by the Grayscale Bitcoin Trust (GBTC), whose shares are tradable on the exchange to meet the demand of those who want to take a position on the price of Bitcoin but without having to buy and hold BTC directly.

In addition, large BTC trades occur on OTC platforms that do not become part of this analysis. It is currently impossible to know how many BTC are traded worldwide on OTC platforms.

Therefore, the most interesting data is not so much the absolute amount of Bitcoin held by exchanges but the fact that they have been declining for some time.

Suffice it to say that as of October 2020, the percentage of total BTC present on exchanges was as high as 9.5%, dropping to 7.3% in July 2021. The current 6.2% is by far the lowest figure of the year, a third lower than in October a year ago.

The price implications

The increased scarcity of BTC on exchanges could produce a price increase should demand increase.

Since the beginning of the month, the price has been fluctuating between $45,000 and $52,000, after a descent that lasted less than a month and started at $69,000.

If the offer on the exchanges has decreased at this stage, it means that someone could have bought Bitcoin recently on the exchanges and then withdrawn them to store them elsewhere for the medium or long-term. In such a situation, any sudden increase in demand could have immediate repercussions on prices.