Summary

Bitcoin Analysis

Bitcoin’s price closed Sunday’s daily candle -$441 and split its price action over the weekend between positive figures on Saturday and negative figures on Sunday to close the week’s final daily candle.

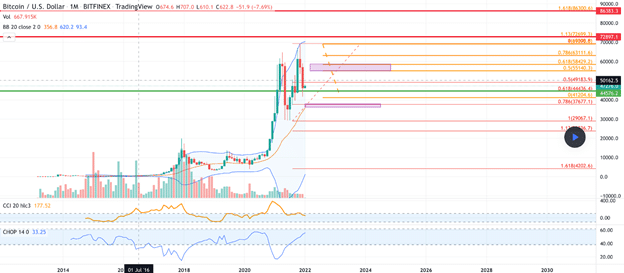

The BTC/USD 1M chart below from SkyRocketTrading shows BTC’s price closed below an important level on the monthly timescale. BTC’s price failed to close above the 0.5 fib level [$49,183.9] to close the monthly timescale and is now trading below its 30 day average price of $48,962.

The next level of support for BTC bulls is the 0.618 fib [$44,436.4] and if they fail to hold the 0.618 level then the 0 fib [$41,204.6].

Conversely, if bulls do manage a rally and hold off bearish traders before a trip to test the $44k level, they’ll need to reclaim $50k before a test of the 0.5 fib extension [$55,140.3].

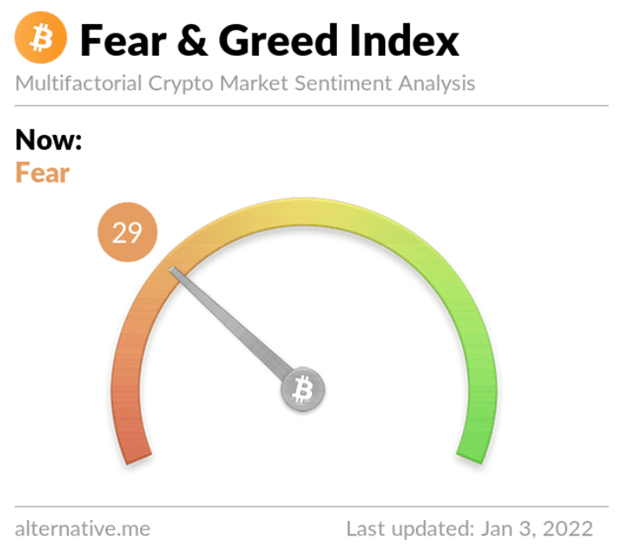

The Fear and Greed Index is 29 Fear and even from yesterday’s reading of 29 Fear.

Bitcoin’s Moving Averages: 20-Day [$48,643.22], 50-Day [$55,676.02], 100-Day [$52,718.13], 200-Day [$48,260.16], Year to Date [$47,402.47].

BTC’s 24 hour price range is $46,756-$48,011 and its 7 day price range is $45,921-$51,956. Bitcoin’s 52 week price range is $28,991-$69,044.

The price of bitcoin on this date last year was $32,163.82.

The average price of BTC for the last 30 days is $48,954.6.

Bitcoin [-0.92%] closed its daily candle worth $47,314 and in red digits on Sunday.

Ethereum Analysis

Ether’s price finished its daily candle on Sunday +$65.88 and is +414.3% for the last 12 months.

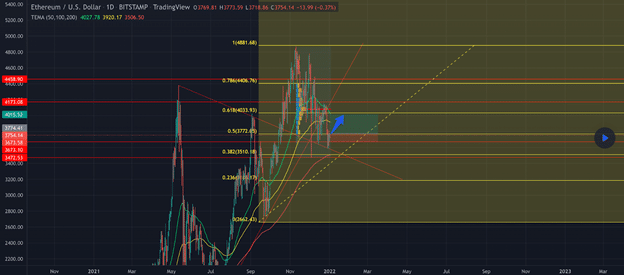

Today we’re looking at the ETH/USD 1D chart below from Tumendelgerjav. Ether’s price is trying to hold the 0.5 fib level [$3,772.05] and bulls are hoping they can reverse course back to the upside and reclaim the 0.618 fib level [$4,033.93].

If bullish traders fail to swing momentum back to their possession the next support below is the 0.382 fib level [$3,510.65]. Below the .382 bulls have one last line of major support at the 0.236 [$3,186.17].

Ether’s Moving Averages: 20-Day [$3,999.13], 50-Day [$4,241.18], 100-Day [$3,820.18], 200-Day [$3,165.33], Year to Date [$2,781.38].

ETH’s 24 hour price range is $3,720-$3,852 and its 7 day price range is $3,622-$4,123. Ether’s 52 week price range is $774.56-$4,878.26.

The price of ETH on this date in 2020 was $967.

The average price of ETH for the last 30 days is $4,012.22.

Ether [+1.75%] closed its daily candle on Sunday worth $3,831.24 and has closed in green digits for two consecutive days.

Fantom Analysis

Fantom’s price pulled back slightly on Sunday [-$.1] but is +71.6% for the last 14 days, at the time of writing.

The FTM/USD 4HR chart below from ja88ja8 illuminates the potential reversal that bulls are hoping is underway. If FTM bulls can again push FTM’s price above the $2.61 level there could be further upside still ahead and a longer bull trend emerging.

If bulls do fail to reclaim the $2.61 level then bearish FTM traders could again test the $2.11 level again over time.

Fantom’s price against The U.S. Dollar for the last 12 months is +15,400%, against BTC is +10,100%, and against ETH is 2,981% over the same duration.

Fantom’s 24 hour price range is $2.46-$2.6 and its 7 day price range is $2.05-$2.6. FTM’s 52 week price range is $.0162-$3.46.

FTM’s price on this date last year was $.0186.

The average price for FTM over the last 30 days is $1.76.

Fantom [-3.81%] had a daily candle close valued at $2.48 on Sunday and broke a streak of closes in green figures over the two days prior.