Summary

Bitcoin Analysis

Bitcoin’s price bearishly engulfed the daily time frame on Monday and concluded its daily session -$1,465.

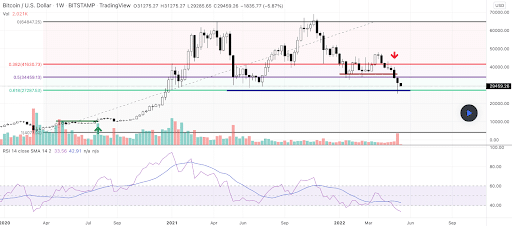

The BTC/USD 1W chart below by BradMatheny illuminates the importance of the $29k level to bullish and bearish traders alike. If bullish traders can reverse course there they’ll give a bit of hope to market participants that want to see a reversal to the upside in 2022.

From the bearish perspective, they’re hoping to push BTC’s price down, to next test the $26k level.

BTC’s price is trading between the 0.618 fibonacci level [$27,287.53] and 0.5 [$34,459.13], at the time of writing.

The overhead targets for bullish BTC traders are 0.5, 0.382 [$41,630.73], and 0 [$64,847.25].

The primary target to the downside is the 0.618 fib level [$27,287.53] with a secondary target of $20k.

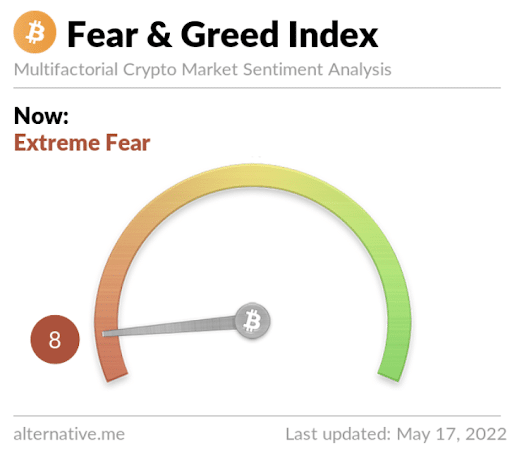

The Fear and Greed Index is 8 Extreme Fear and is -6 from Monday’s reading of 14 Extreme Fear.

Bitcoin’s Moving Averages: 5-Day [$29,532.08], 20-Day [$36,288.29], 50-Day [$39,990.75], 100-Day [$40,716.19], 200-Day [$46,695.18], Year to Date [$40,450.29].

BTC’s 24 hour price range is $29,293-$31,319 and its 7 day price range is $26,910-$32,270. Bitcoin’s 52 week price range is $26,600-$69,044.

The price of bitcoin on this date last year was $43,544.

The average price of BTC for the last 30 days is $36,554.7 and BTC’s -27.2% over the same timespan.

Bitcoin’s price [-4.68%] closed its daily candle worth $29,854 on Monday and finished back in red figures for the first time in four days.

Ethereum Analysis

Ether’s price also bearishly engulfed Sunday’s daily candle on Monday and finished its daily session -$123.01.

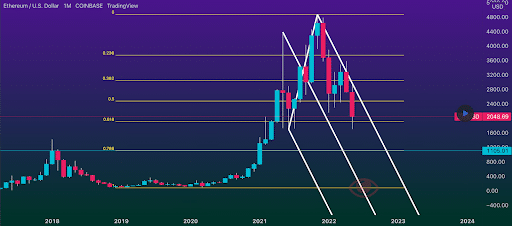

The second chart we’re looking at today is the ETH/USD 1M chart below by Great_Reset_Investing. Ether’s price is trading between the 0.618 fib level [$1,908.04] and 0.5 [$2,477.07], at the time of writing.

The targets for bulls to the upside are 0.5, 0.382 [$3,046.09], 0.236 [$3,750.15], and 0 [$4,878.56].

Conversely, bearish traders are taking aim at snapping the 0.618 fib level with a secondary target of 0.786 [$1,097.90].

ETH’s 24 hour price range is $1,991-$2,151 and its 7 day price range is $1,824-$2,443. Ether’s 52 week price range is $1,719-$4,878.

The price of ETH on this date in 2021 was $3,278.92.

The average price of ETH for the last 30 days is $2,689.87 and ETH’s -34.57% over the same duration.

Ether’s price [-5.73%] closed its daily candle on Monday worth $2,022.99 and also in red figures for the first time in four daily sessions.

Solana Analysis

Solana’s price has been in a downtrend since SOL’s all-time high of $259.96 on November 6th, 2021. Since that date, Solana’s price has lost 79.9% of its value and the positive momentum for the last 12 months is beginning to wane.

After being up over 1,000% at times in 2021, SOL’s price is only +8.3% for the last 12 months, at the time of writing.

On Monday, SOL followed the macro cryptocurrency market lower but didn’t bearishly engulf the daily time frame like BTC and ETH. Despite not bearishly engulfing the daily timescale, SOL still finished the day down more than 8% and -$5.03.

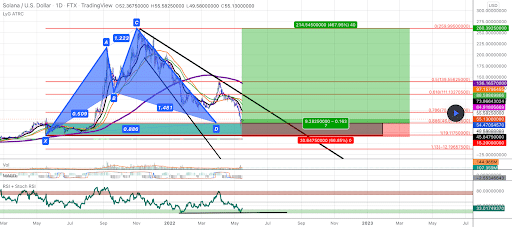

The third chart we’re analyzing for Tuesday is the SOL/USD 1D chart below from RizeSenpai. Solana market participants currently have special attention on two fibonacci levels. SOL’s price is trading between those two levels, 0.886 [$46.57] and 0.786 [$70.66].

If bullish traders can reclaim the 0.786 their next target is 0.618 [$111.13] followed by a third target of 0.5 [$139.55], and a fourth target of a full retracement at 0 [$259.99].

Bearish Solana traders are looking to snap the 0.886 with a secondary target of 1 [$19.11].

Solana’s 24 hour price range is $52.22-$58.85 and its 7 day price range is $40.89-$73.37. SOL’s 52 week price range is $21.46-$259.96.

Solana’s price on this date last year was $46.71.

The average price of SOL over the last 30 days is $84.07 and SOL’s -47.1% over the same duration.

Solana’s price [-8.57%] closed its daily session on Monday worth $53.64 and in green digits again after a streak of three consecutive days in red digits.