Summary

Bitcoin Analysis

Bitcoin’s price closed up over 1% for Saturday and Sunday’s daily sessions and BTC’s price closed the week’s final daily candle +$439 on Sunday.

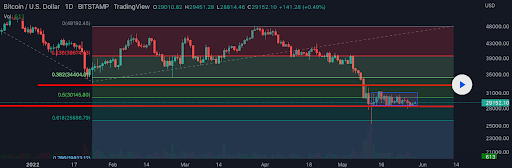

The first chart we’re going to analyze this week is the BTC/USD 1D chart below by knownAccount84951. BTC’s price is trading between the 0.618 fibonacci level [$25,886.79] and 0.5 [$30,145.80], at the time of writing.

Bullish BTC traders are aiming to regain the $30k level and then the 0.5 fib level before bears can do more damage. If bullish traders are successful and claim the 0.5, their secondary target is 0.382 [$34,404.81]. Bullish traders have a third target overhead of 0.236 [$30,674.43].

Conversely, bearish traders are trying to put an end to the struggle between bullish and bearish traders between $28,5k-$31k. The path back to retest BTC’s 2017 all-time high just under $20k will first take bears back down to test the 0.618 fib level. If they succeed and can push BTC’s price below $25,8k their next target is BTC’s former high at the 0.786 [$19,823.12].

Bitcoin’s Moving Averages: 5-Day [$29,335.61], 20-Day [$31,614.31], 50-Day [$38,086.66], 100-Day [$39,276.04], 200-Day [$45,947.30], Year to Date [$39,509.64].

BTC’s 24 hour price range is $28,906-$29,519 and its 7 day price range is $28,448-$30,546. Bitcoin’s 52 week price range is $26,600-$69,044.

The price of Bitcoin on this date last year was $35,615.

The average price of BTC for the last 30 days is $32,122.2 and BTC’s -26.1% over the same duration.

Bitcoin’s price [+1.51%] closed its daily candle worth $29,476 and in green figures for a second consecutive day on Sunday.

Ethereum Analysis

Ether’s price also rallied slightly over the weekend and finished Sunday’s daily candle +$21.30.

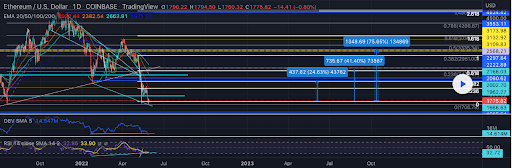

The second chart we’re looking at today is the ETH/USD 1D chart below from olliecoughland. Ether’s price is trading between a full retracement at 0 [$1,706.79] and 0.236 [$2,475.47], at the time of writing.

The bullish case is currently a bit bleak but if they’re going to stop the bleeding anytime soon they need to reclaim the 0.236 followed by 0.382 [$2,951.00], and 0.5 [$3,335.34].

Bearish Ether traders are currently in control of this market and should be testing the $1,400 level again soon if they can break the 0 fib level to the downside again.

Ether’s Moving Averages: 5-Day [$1,899.56], 20-Day [$2,207.64], 50-Day [$2,753.26], 100-Day [$2,793.03], 200-Day [$3,317.09], Year to Date [$2,829.14].

The price of ETH on this date in 2021 was $2,386.68.

The average price of ETH for the last 30 days is $2,238.83 and ETH’s -38.21% over the same timespan.

Ether’s price [+1.19%] closed its daily candle on Sunday worth $1,813.52.

Solana Analysis

Solana’s price followed the macro higher as well over the weekend and concluded its daily session on Sunday +$0.72.

The third chart we’re analyzing today is the SOL/USD 1HR chart below from maikisch. We can see that Solana’s price is trading between 1 [$44.04] and 2 [$54.41], at the time of writing.

The targets overhead for Solana bulls are the 2 fib followed by the 1.618 [$62.43].

Bearish traders have been controlling the market’s momentum for most of 2022 thus far. The primary target of bears is the 1 fib with the 1.382 fib level [$40.57] as a second target and a third target of 1.618 [$38.56].

Solana’s price on this date last year was $35.83.

The average price of SOL over the last 30 days is $62.03 and SOL’s -54.38% over the same time frame.

Solana’s price [+1.63%] closed its daily candle on Sunday worth $44.98 and in green figures for a second straight daily session.