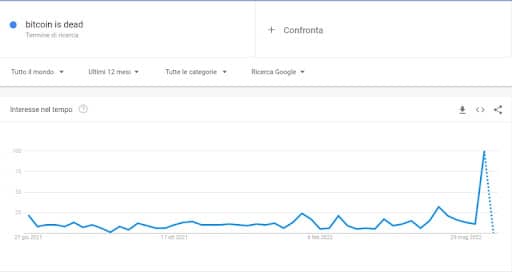

According to Google Trends data, the search query “Bitcoin is Dead” reached an ATH, hitting a high of 100 out of 100 on 18 June.

Summary

Google Trends records a new peak for the search query “Bitcoin is Dead”

By now it is clear. The general market sentiment is totally negative. This is confirmed by Google Trends data, which record a peak for the search phrase “Bitcoin is Dead”.

As can be seen from the image above, the highest search volumes come from Canada, the United States and the United Kingdom.

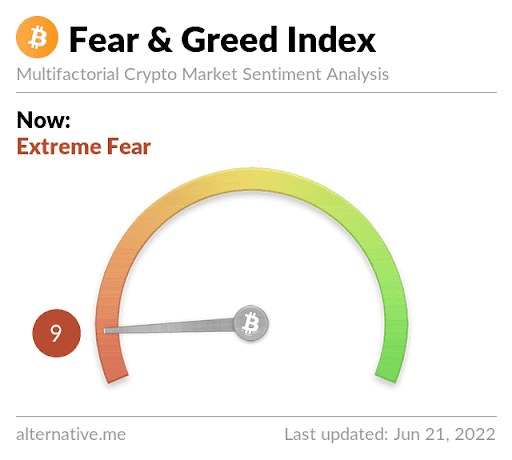

It is well known how general market sentiment is influenced by the performance of the asset in question. Less experienced investors are almost never rational and their choices are mainly driven by emotions.

When new highs are reached and we are in a prolonged bullish phase, enthusiasm and euphoria take over. Conversely, when such a sustained slump occurs, people begin to feel fear and lose confidence in their investment choices.

This is confirmed by the data recorded by the Fear and Greed Index, which currently stands at 9, a level indicating “Extreme Fear”.

Sentiment analysis explained in brief

Clearly, the type of research also changes depending on the performance of the asset. During a bull phase, one can see that most people talk about it in a positive sense. Now, apparently, they all think Bitcoin is dead. So, once again, it is returns that drive emotions, and vice versa!

In a market as irrational as the cryptocurrency market, it is not hard to believe that it is general sentiment that largely drives the price of a digital asset. Indeed, there are several studies that find applications in the field of Natural Language Processing (NLP). The aim is to predict short-term returns by exploiting complex machine learning models, using sentiment analysis as a basis.

The losses recorded by Glassnode and the “deaths” of Bitcoin

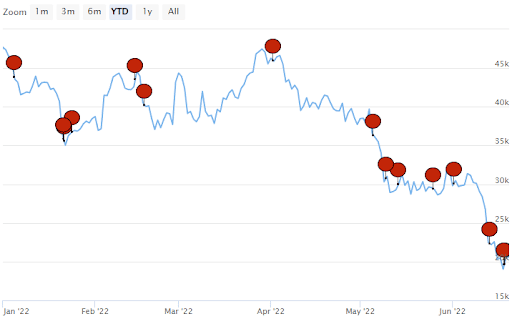

In the last few days, Bitcoin has broken through the famous $20,000 support, reaching a low of $17,593. At this point, it is easy to see how a total negative sentiment has turned into a massive sell-off of the held asset.

Glassnode, a leading crypto analytics firm, shared a thread on Twitter detailing what has happened over the past three days:

The last three consecutive days have been the largest USD denominated Realized Loss in #Bitcoin history.

Over $7.325B in $BTC losses have been locked in by investors spending coins that were accumulated at higher prices.

A thread exploring this in more detail 🧵

1/9 pic.twitter.com/O7DjSK2rEQ— glassnode (@glassnode) June 19, 2022

Investors, who had bought at much higher prices, realized a total loss of $7.325 billion on the market, described as the largest in Bitcoin‘s history.

Bitcoin obituaries

There is also the curious case of the 99bitcoins portal, which records how many times Bitcoin has died in a given period of time. The obituary list on the site shows how BTC “died” 15 times in 2022, and 455 times throughout its history.

Any content that explicitly expresses the end of Bitcoin, describing it as useless or worthless, is defined as “Bitcoin Obituary”.

The latest source dates back to a tweet by the famous economist Peter Schiff, who has always been against the queen of cryptocurrencies:

Long-term Bitcoin #HOLDers aren't worried as they've been through 73% declines before. But previous declines didn't involve anywhere near the total market cap lost during this decline, nor did they involve massive leverage. This crash is just beginning. #Bitcoin will not recover.

— Peter Schiff (@PeterSchiff) June 18, 2022

In this case, death was recorded by the phrase “Bitcoin will not recover” at the end of his tweet. His perspective on the cryptocurrency market remains quite clear:

“… This crash is just beginning. #Bitcoin will not recover”.