The gist is that MiCA or MiCAR (Market in Crypto Asset Regulation), was approved, on schedule before the end of the month. The proposal, after a series of steps and discussions, in which from time to time new aspects had surfaced (such as the one that aimed to introduce limitations for those blockchain projects based on Proof-of-Work, on the assumption of its unsustainability in terms of energy, then somewhat neutralized), was waiting for the so-called trilogue phase to be initiated. The trilogue is a three-way discussion phase between the Parliament, the Council and the European Commission.

This phase ended in the past few hours and produced an agreement on the proposed regulation. Clearly, the official statements have celebratory tones and emphasize anything that can be peddled as a good result.

Summary

The Council’s press release on the approval of MiCA

The Council’s official press release states that the new regulation will protect consumers, and prevent fraudulent schemes. For the sake of consumer protection, service providers will have to prove that they meet important requirements, and will be liable for any losses. Anti-money laundering rules contained in the Transfer of Fund Regulation, the EBA (i.e., the European Banking Authority) will be tasked with keeping a registry of all operators in crypto assets, which are found to be non-compliant.

Strong measures are announced regarding stablecoins, to protect savers, which will have to ensure adequate liquidity thresholds and be subject to EBA supervision, and will be subject to additional rules, limitations and controls, depending on the function and nature of asset referenced tokens.

Also in the press release, it says that in general, CASPs (Crypto-Asset Service Providers) will be required to have a specific authorization to operate in the EU territory, which the authorities of individual member states will have to issue within 3 months and communicate the essential data to ESMA (European Securities and Markets Authority).

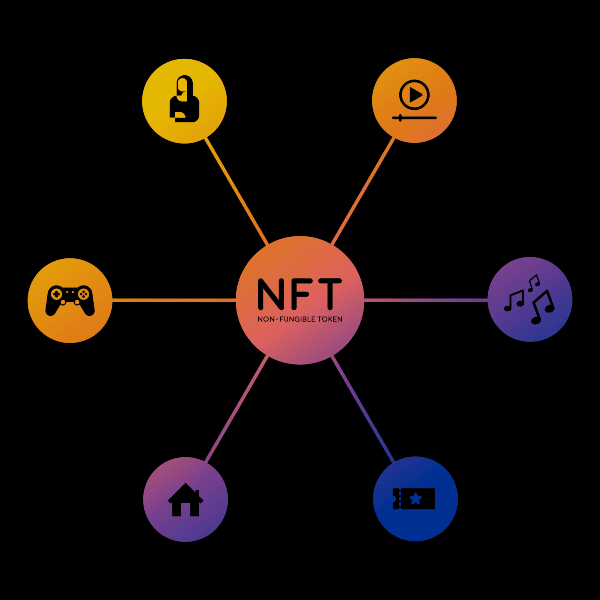

NFTs representing works of art will be excluded from the scope of the regulation, unless they end up falling into other existing categories of crypto assets. The Commission, however, plans to conduct a full assessment of the phenomenon within 18 months to assess any risk profiles that may emerge from these kinds of new markets.

On a strictly procedural level, once the consensus (and thus approval) of the Commission, Council and Parliament has been reached in the “trilogue,” the next step is to formally initiate the adoption procedure. In this case, this should be the ordinary legislative procedure, involving both Parliament and the Council, during which amendments could be included.

Advantages and criticalities of the new regulation

Now, putting slogans aside, let’s try to understand what is good and what, on the other hand, could be the criticalities of this body of legislation.

The text that can be downloaded online from the website of the EU Parliament is still the one that preceded the agreement reached in the past few hours, and it consists of a body of legislation of 126 articles, preceded by extensive petitions of principle, ranging from the objectives of saver protection, to the consideration of the fundamental rights of the individual, to anti-money laundering and so on.

The text that is supposed to have come out of the agreement has not yet been published. Therefore, we cannot go beyond an à vol d’oiseau analysis here, based on the contents of the various press releases and tweets of the various MEPs.

Certainly, one of the key points is that the body of legislation will include a package of provisions requiring the various operators to possess specific characteristics that should offer consumers and savers a minimum of guarantees about the reliability of the various service providers.

In addition, there will be minimum content requirements on the white papers of token-based projects and initiatives.

As much as a significant part of the crypto operator community lives with a kind of inherent impatience with the imposition of any kind of regulation, there is no doubt that these kinds of provisions meet the need to finally create some forms of protection in favor of non-professional investors. This may disturb the free spirits of the cryptoeconomy as much as they want, but there is no hiding the fact that in the history of crypto there are quite a few scammy or even reckless ventures that have wreaked havoc on the finances and ruined the lives of ultimately blameless people.

Transparency, Proof-of-Work and NFTs in the MiCA

On the adoption of transparency rules in communications and on the identification and characteristics of those who solicit and collect investments and savings from non-institutional investors, it is hard not to agree and argue that they are not welcome.

Another relevant aspect that seems to be emerging is that the much-feared ban on Proof-of-Work based assets has not come to pass. In its place there will be the declaration of the so-called footprint: in short, if one wants to buy such assets or invest in blockchain-based initiatives that work with PoW, one must be aware of the level of environmental sustainability they entail. Essentially a form of investor empowerment.

And on to the topic of NFTs: apparently tokens functional for conveying artistic works (works of art in the proper sense, but also music and video products) would remain outside the scope of the MiCA regulation. That is, unless the token ends up, in terms of substantive functions, among other types of tokens that fall under the purview of other regulated cryptographic assets.

This being so, there are two considerations to be made: the first is that a valuable opportunity was missed to provide clarity on assets with respect to which most EU member states’ legal systems are in fact groping in the dark. The second is that perhaps it is precisely from the exclusion of NFTs from the scope of MiCA that it may provide legislators and regulators of member states with an indirect indication, in the sense that tokens with, shall we say, a financial value cannot be framed as tokens, except in special cases (related to their substantive functions).

This issue, however, is postponed for eighteen months, during which time the Commission has reserved determinations based on an assessment of the risk profiles of these types of markets.

How are DeFi and stablecoin dealt with?

Another sensitive topic involves DeFi and stablecoins.

The statements anticipate strict measures on “asset-referenced-tokens” (i.e., stablecoins based on reserves of underlying assets, such as gold or fiat currencies, that can guarantee parities) and the entities that will issue and operate them in European markets. These rules would not affect so-called algorithmic stablecoins, that is, those currencies that pursue the goal of maintaining a stable value over time, not by pegging to an underlying asset, but by intervening, through algorithms, to constantly balance, the equilibrium and dynamics between supply and demand.

Commenting on the provisions on this specific matter will have to wait for the publication of the text of the proposed regulation, not only because it is a particularly heartfelt issue, due to the recent events surrounding the Terra – Luna project, but also and above all because it is an issue full of technical and financial implications. It is best to reason with the texts of the provisions in hand.

Controls on transfers made with unhosted wallets

The last topic, is that of controls and reporting on crypto transactions of amounts of €1,000 or more in countervalue and the limitations on transactions on unhosted wallets: these are provisions that will partly find their place among the MiCA provisions (where, according to the communiqués, the creation of a sort of blacklist for operators found to be non-compliant is envisaged), but for the most part they will be regulated in detail within the Transfer of Fund Regulation and linked to the application of the so-called travel rule.

This is perhaps one of the most critical areas of the body of regulations intended to create the European legal framework on cryptoassets. This area is, in fact, where unjustified asymmetries of treatment between bank-based transactions and intrusive forms of control are concentrated, which mainly affect individual private users, in the part where transactions of such small amounts are scrutinized and de facto unhosted wallets are criminalized, creating a kind of inversion of the burden of proof.

Britain decides not to adopt the same European provisions in the unhosted wallet area

This is a diametrically opposed approach to that followed, for example, by the British Treasury, which, when updating its anti-money laundering regulations, chose not to introduce specific limitations on transactions using unhosted wallets, based on the consideration that many people hold cryptocurrencies for legitimate purposes, and that nothing in practice shows that this type of wallet is used primarily for criminal activities.

Therefore, they decided that the collection of personal information should take place only for those transactions with specific indices and characters of high risk that are the fruit of illicit finance activity.

The comments of MEP Raffaele Fitto

While waiting to read the text of the regulation, Raffaele Fitto, MEP, Co-Chair of the Ecr Group and member of the Econ Commission that has worked a great deal on MiCA, comments:

“The objective intended is primarily that of investor protection and financial stability, creating effective tools to counter fraudulent schemes. It is in this key that the provisions on the tracking and identification of cryptocurrency transfers should be interpreted: to prevent money laundering, the financing of terrorism and other crimes, such as child pornography.

It is also from this perspective that through the agreement that was reached, work was done to extend the so-called “travel rule”, which already exists in traditional finance, to cryptocurrency transfers as well. With respect to these kinds of objectives, the agreement that was reached seems very satisfactory and reflects many of the priorities that our group had also indicated during the work in the Econ Commission”.

In the face of these declarations of intentions, commendable per se, we will try to understand, as soon as the text of the proposed regulation in its current formulation becomes available, whether it will actually be able to pursue a fair balance between the requirements of control and countering criminal activities, consumer/saver protection, and the protection of the sphere of fundamental freedoms of the individual, also emphatically referred to in the preambles.

However, the sense from the entirety of the anticipations is that this heavy regulatory superstructure introduces disproportionate constraints and limitations, which could have a significantly negative impact on the entire productive sector related to crypto finance. And above all, underlying the choices of the European legislator there is a preconceived distrust of the innovations of the crypto-economy, which ends up indulging the interests of those large groups in conventional finance to whom the prospect of widespread decentralization and disintermediation in financial activities is quite frightening