Summary

Bitcoin Analysis

Bitcoin’s price finished up more than 2% for Monday’s trading session and when traders settled-up to close the day BTC was +$639.1.

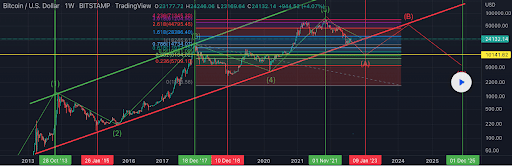

Today we’re kicking off our analysis with the BTC/USD 1W chart below from joselopez4053. BTC’s price is trading between the 1 fibonacci level [$18,245.61] and 1.618 [$28,386.4], at the time of writing.

As we can see, bitcoin’s price is trading on the weekly time frame in an uptrend dating all of the way back to 2013 on this chart. For BTC’s price to break that channel and the long time uptrend it would have to fall below $1,700.

The primary target for bullish BTC traders is 1.618, followed by 2.618 [$44,795.45], and a third target of 3.618 [$61,204.5].

Bearish traders are attempting to break the 1 fib level and again retest a 12-month low at $17,611. If they’re successful in making a new low their focus will shift to the 0.786 fib level [$14,734.07]. The third target for bearish bitcoin traders is 0.618 [$11,977.35].

BTC’s 24 hour price range is $23,067-$24,224 and its 7 day price range is $22,526-$24,224. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $46,293.

The average price of BTC for the last 30 days is $22,245.3 and its +10.2% over the same duration.

Bitcoin’s price [+2.76%] closed its daily candle worth $23,817 on Monday and in green figures for the third time over the last four days.

Ethereum Analysis

Ether’s price recorded its highest daily candle close since June 9th on Sunday and followed that up on Monday with another green candle on the daily timescale. Ether finished Monday’s trading session +$78.08.

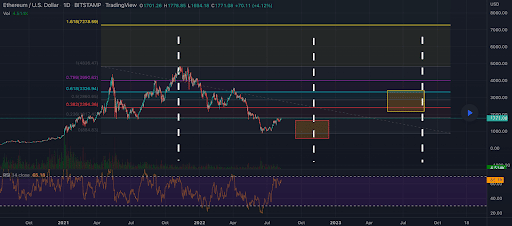

Today we’re looking at the ETH/USD 1D chart below by barendscrypto. Ether’s price is trading between 0 [$884.83] and 0.236 [$1,817.42], at the time of writing.

There’s been countless attempts by bullish ETH traders to crack the 0.236 but they’ve yet to be successful. The longer it takes to break that level, the more opportunity there is for bearish traders to stonewall bulls at that level and pivot to the downside.

The targets overhead for bullish Ether market participants are 0.236, 0.382 [$2,394.36], and 0.5 [$2,860.65].

Bearish Ether traders are seeking a return to the 0 fibonacci level and a full retracement. If they’re successful the next level of support for bulls may be the $400-$500 range on ETH.

ETH’s 24 hour price range is $1,693.87-$1,818 and its 7 day price range is $1,574.01-$1,818. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,162.05.

The average price of ETH for the last 30 days is $1,487.91 and its +43.21% over the same time frame.

Ether’s price [+4.59%] closed its daily candle on Monday worth $1,778.35 and in green figures for the second consecutive day.

Near Protocol Analysis

Near Protocol’s price marked-up more than 10% during Monday’s trading session and concluded its daily candle +$0.51.

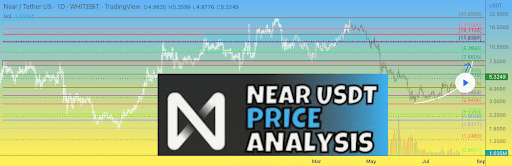

The last chart we’re providing analysis for today is Near Protocol and we’re analyzing the NEAR/USD 1D chart below from P_S_trade. NEAR’s price is trading between the $5.07 level and the $5.64 level, at the time of writing.

The overhead levels for bullish NEAR traders to overcome are $5.64, $6.90, and $7.66.

Conversely, bearish NEAR traders are seeking to push NEAR’s price back below the $5.07 level to stall the recent bullish success. Bears have a secondary target on NEAR of $4.15, and then $3.44.

Near Protocol’s Moving Averages: 5-Day [$4.82], 20–Day [$4.17], 50-Day [$4.08], Year to Date [$7.85].

Near Protocol’s 24 hour price range is $5.00-$5.73 and its 7 day price range is $4.08-$5.73. NEAR’s 52 week price range is $2.46-$5.73.

Near Protocol’s price on this date last year was $2.68.

The average price of NEAR over the last 30 days is $4.13 and its +50.60% over the same timespan.

Near Protocol’s price [+10.13%] closed its daily candle on Monday worth $5.49 and in green figures for the third time over the last four days.