Summary

Bitcoin Analysis

Bitcoin’s price closed at its highest level since June 12th on Wednesday and when traders settled-up at 12:00 UTC BTC’s price was +$817.8.

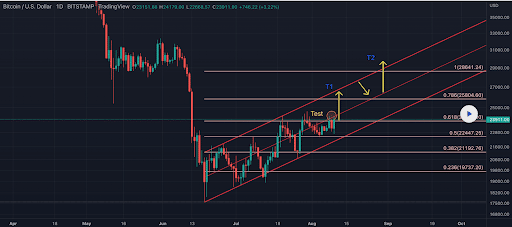

The first chart we’re looking at today is the BTC/USD 1D chart below from goldcrypto7. BTC’s price is trading between the 0.5 fibonacci level [$22,447.25] and 0.618 [$23,776.00], at the time of writing.

Bullish BTC traders have targets overhead of 0.618, 0.786 [$25,804.6], and 1 [$28,641.24].

Conversely, the targets to the downside for bearish traders are the 0.5 fib level, followed by the 0.382 [$21,192.76], and 0.236 [$19,737.2].

Bitcoin’s Moving Averages: 5-Day [$23,171.83], 20-Day [$22,728.69], 50-Day [$22,826.16], 100-Day [$30,121.43], 200-Day [$38,360.86], Year to Date [$34,066.2].

BTC’s 24 hour price range is $22,650-$24,227 and its 7 day price range is $22,526-$24,227. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $45,546.

The average price of BTC for the last 30 days is $22,358.5 and its +9.7% over the same duration.

Bitcoin’s price [+3.53%] closed its daily candle worth $23,963.8 and in green figures for the third time over the last four days.

Ethereum Analysis

Ether’s price was the top performer of today’s assets and concluded its daily session +$150.62.

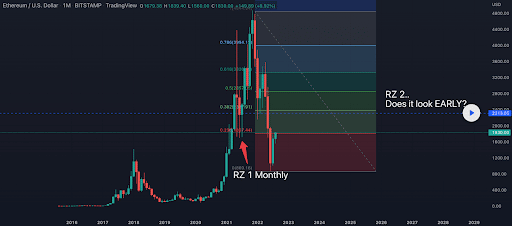

Today’s second chart for analysis is the ETH/USD 1W chart below WillSebastian. Ether’s price is trading between 0.236 [$1,807.44] and 0.382 [$2,387.91], at the time of writing.

ETH’s price is bumping up against resistance at the 0.236 and bullish traders want to eclipse that level before the monthly candle concludes to signal to market participants that further upside could be forthcoming.

Above the 0.382 fib level the targets to the upside on ETH are 0.5 [$2,857.05], and 0.618 [$3,326.19].

Those that are short the Ether market are looking to push ETH’s price back below 0.236 with a secondary target and a full retracement at 0 [$869.44].

ETH’s 24 hour price range is $1,656.78-$1,885 and its 7 day price range is $1,592.48-$1,885. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,162.71.

The average price of ETH for the last 30 days is $1,522.21 and its +49.79% over the same time frame.

Ether’s price [+8.85%] closed its daily candle on Wednesday worth $1,853.42 and in green digits also for the third time over four days.

Solana Analysis

Solana’s price also marked-up on Wednesday to pull the hat trick for today’s assets and SOL’s price finished +$2.1 for its daily session.

The last chart we’re analyzing today is the SOL/USD 4HR chart below from Cryptobees_buzz. SOL’s price is trading above an important level on the 4HR chart at $41.25 and is trying to flip the $42.37 level to support, at the time of writing.

If bulls can eclipse that level the top of that range is $46.91 and a break above that price will encourage bulls to aim next for the $50 level.

At variance with bulls are bearish traders that are looking to break a fairly long trend line that dates back to July on the 4HR chart below. To break that trend line, bearish SOL traders need to send SOL’s price below $39.76.

Solana’s Moving Averages: 5-Day [$40.73], 20-Day [$40.6], 50-Day [$37.73], 100-Day [$61.58], 200-Day [$104.32], Year to Date [$78.33].

Solana’s 24 hour price range is $39.15-$42.87 and its 7 day price range is $38.32-$43.32. SOL’s 52 week price range is $25.97-$259.96.

Solana’s price on this date last year was $41.66.

The average price of SOL over the last 30 days is $39.8 and its +8.8% over the same timespan.

Solana’s price [+5.2%] closed its daily trading session on Wednesday worth $42.45 and SOL’s finished in green figures three of the last four days as well.