Revolut, the global financial super app with 25 million customers worldwide, is set to launch Ultra, the new exclusive top-level subscription plan above the current Plus, Premium and Metal plans.

Ultra targets a growing consumer segment consisting of people interested in a more functional luxury lifestyle. More benefits and information about Ultra will be revealed in the coming months. In the meantime, customers can join the waiting list and follow Revolut on social media to get all the updates.

Summary

Ultra: Revolut’s new subscription plan, all the details

As anticipated, Revolut is preparing to launch Ultra, an unprecedented new subscription plan for its customers in the UK and Europe. The new plan offers exceptional benefits and will arrive in spring 2023.

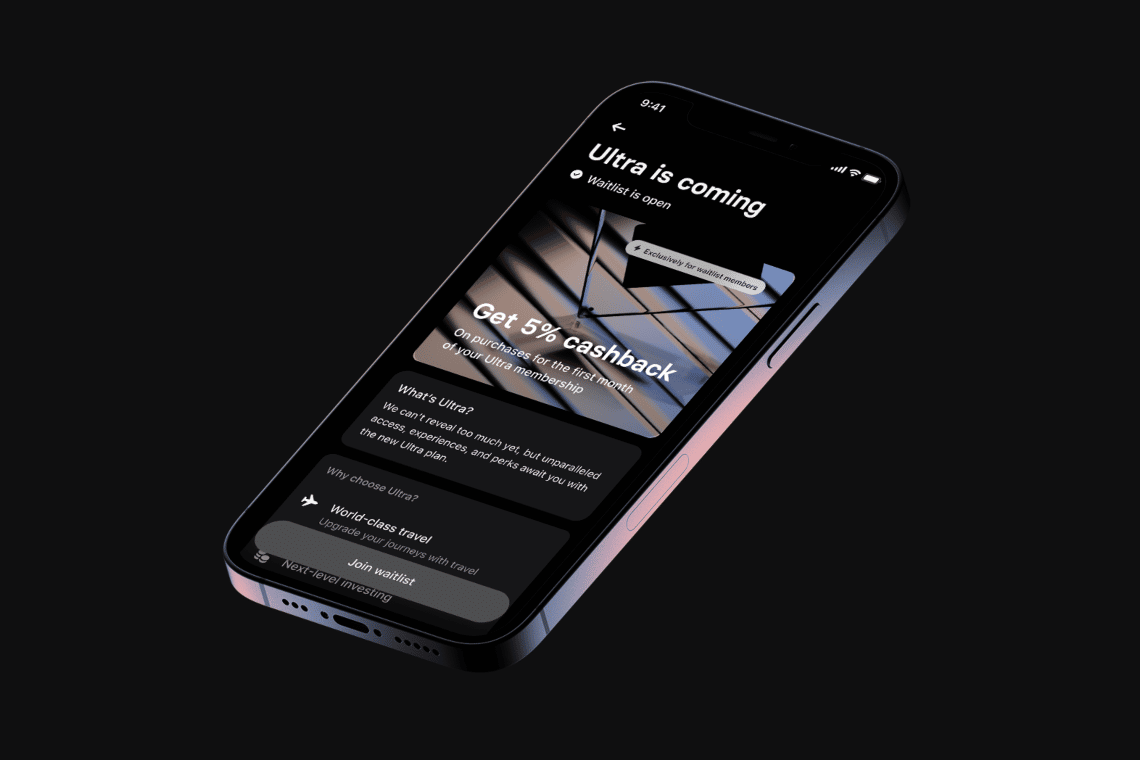

New and existing customers are invited to join the waiting list to unlock 5% cashback on purchases made in the first month with Ultra. Furthermore, Ultra will provide cashback in partnership with customers’ favorite brands to meet various wellness and lifestyle needs.

Not only that, Revolut’s new plan also presents itself as the best travel companion, providing free lounge access at more than 1,200 airports. Speaking about this, Tara Massoudi, General Manager Premium Products, said:

“Many of our customers are interested in financial products that offer greater convenience. This growing market share is focused on a new definition of more functional luxury. These are high income consumers, career people who want to build a steady passive income and who aim to enjoy life, keep up with the latest trends and travel several times a year.”

Therefore, in order to meet customers’ expectations, Revolut is launching a subscription that offers maximum choice and flexibility in managing finances. As a matter of fact, there is no offer similar to the one they are launching in Europe, and no other player can boast such a product at the moment.

The approach taken by Revolut is quite original: to offer a unique card and subscription plan to people who enjoy high-end travel and lifestyle experiences. Indeed, Revolut’s ultimate luxury subscription opens the door to a world of travel and lifestyle privileges and benefits.

Of importance is the fact that Revolut is creating the first truly global financial super app, with the goal of helping people get more out of their money.

In 2015, Revolut was launched in the United Kingdom to offer money transfers and currency exchange. Today, more than 25 million customers worldwide use Revolut’s dozens of innovative products to make more than 330 million transactions each month.

All the benefits of the financial super app: crypto support and more

Revolut is a solution that allows people to transfer money in more than 29 different currencies anywhere in the world, including, of course, the euro. What’s more, Revolut supports cryptocurrencies, including Bitcoin, Litecoin, Ethereum, Bitcoin Cash, and Ripple, which many other competitors do not

Sure enough, among the Revolut benefits is that of the availability of a Lithuanian IBAN code, which allows receiving and sending money via wire transfer to those living in the European Union

In addition, along with the account comes a debit card with which to purchase anything both online and in physical stores and to withdraw money from ATMs. The card is both virtual and physical, i.e., the former is present within the account, so there is no shipping cost, while the latter must be explicitly requested and has a shipping cost of around 7 euros

The convenience of a virtual card with Revolut lies in the fact that up to five can be requested. In addition, as far as account costs are concerned, for the standard one there is no monthly fee and one can withdraw money without paying fees up to 200 euros per month.

With the Stays feature, on the other hand, it is possible to get 3% cashback on hotel, vacation home or B&B bookings. The Premium version, on the other hand, has a monthly fee of €7.99. Currency exchanges are unlimited, cashback on bookings is 5%, travel insurance is provided, transfers are unlimited, and it is possible to withdraw up to €400 per month with the card.