The community of GMX, a perpetual trading platform, has announced the introduction of a proposal to integrate Chainlink low-latency oracles to improve crypto price feeds within the decentralized exchange.

This is a partnership that is not yet confirmed and has only been discussed within the Governance section of GMX.

Full details below.

Summary

GMX and the proposed integration of Chainlink oracles

A few days ago, user “Coinflipcanda” posted a really interesting proposal within the GMX Protocol Governance page.

It is a partnership with Chainlink to introduce low-latency oracles within the V2 protocol so as to guarantee stable and tamper-proof price feeds to traders.

The price to be paid by GMX is a 1.2% fee on the commissions the platform earns when people use it to do decentralized trading.

Protocol fees include fees paid by users, currently proposed as opening/closing position fees (“margin trading”), lending fees, swap fees, and any other fees of which GMX Treasury subsequently retains a portion from the protocol.

It is worth recalling that the GMX community had previously approved a proposal to divert 10% of the fees collected by the exchange to the treasury.

This money supposedly would be used for research and development and for integrating solutions that would improve the protocol’s internals and the end-user experience.

In this case, the spending seems to fit the previously established intent.

Chainlink represents a staple within the decentralized finance landscape in terms of the oracle structure that guarantees reliable and hard-to-compromise price feeds to more than 950 different protocols on blockchain.

The decision to devolve 1.2% of fees in economic incentives to Chainlink nodes helps ensure that data is provided independently and transparently.

Network data operators are thus motivated to always ensure low-latency feeds, which are critical to the proper functioning of markets and necessary for the expansion of GMX on other blockchains

Currently, the Arbitrum testnet has developed a beta version of these low-latency oracles, and testing by key contributors is ongoing.

The mixed opinion of the community

The GMX community has expressed mixed thoughts on the announcement of this proposal.

Many believe that this partnership is essentially what the protocol needs to grow both in terms of product improvement and user base.

As Chainlink is the leading entity in the DeFi industry for what concerns the flow of data from the real world to the on-chain, it is believed that integration with the project’s oracles can serve to achieve a higher level of reliability and notoriety than can be achieved with other lesser oracles.

In fact, there is no protocol that can compete with the growth and expansion of Chainlink, which over the years has made more than 1,700 integrations between price feeds, automations, API calls, VRFs and proof of reserve, on 7 different blockchains.

On the other hand, a segment of the community remains reluctant to the proposal.

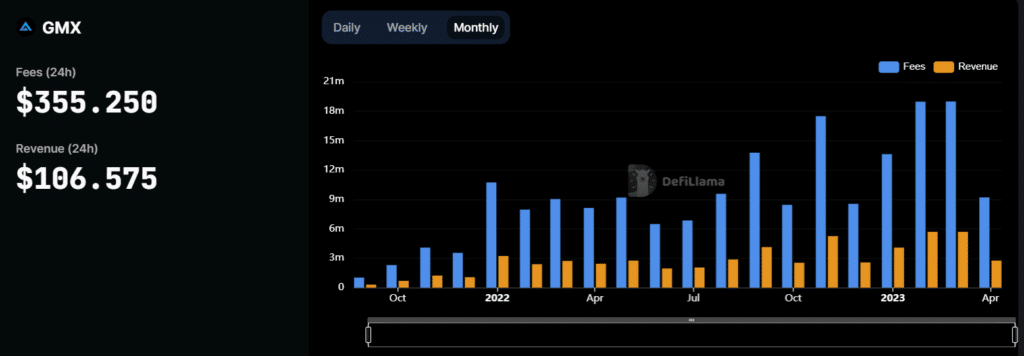

The main reason for this hesitancy is the high price to be paid to get the low-latency price feeds: 1.2% represents a significant figure when we think about the future growth margin of GMX.

It is estimated that Chainlink, considering the fees generated by the protocol this year, would earn about $2.5 million annually.

This is an exaggerated figure according to the community.

The other reason why a segment of users active in Governance discussions disagree with the partnership concerns the fact that the same product proposed by Chainlink was also previously developed by Synthetix.

According to some users, this would be a violation of intellectual property since Synthetix had initially conceived and shared the idea, specifications and requirements for the development of low-latency price feeds with Chainlink with the understanding that the latter would develop the solution with Synthetix itself.

Instead, Chainlink preferred to go its own way without acknowledgment of the Synthetix team’s contribution.

Obviously, there is no evidence of this violation on the part of Chainlink, and the discussion on the forum seems likely to be attributable to a sterile whining by some Synthetix supporter, frustrated that Chainlink is doing a better job and interpersonal relations with the DeFi world.

How is the LINK token doing in the marketplace?

Should this partnership go the distance, it would be an excellent opportunity to redeem the LINK token from a long phase without utility, in which the price has suffered.

In fact although oracle infrastructure and the presence of network data operators are central within the development of decentralized platforms, this cannot be said for the LINK token, which is still seen as simply a currency to be sold at market once redeemed for its service.

Integration with GMX V2 could open the door to an era in which LINK assumes utility within the crypto space and becomes an asset to be held in a wallet rather than one to be sold as soon as the right time comes.

The SCALE and BUILD programs could also increase LINK use cases, increasing popularity and effective on-chain usage, leading to higher prices.

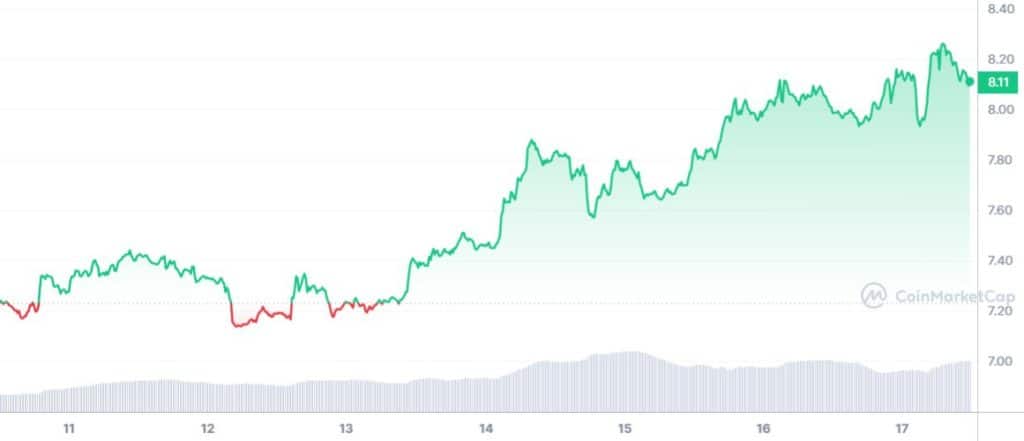

Right now the LINK token has a price of $8.10, a market capitalization of $4.19 billion, and a circulating supply that is 52% over the maximum supply set.

The all-time high was touched in May 2021 when LINK reached the $53 mark. After that a long descent to the bottom of $5.3 and an accumulation phase that has been going on for about a year in which the token has been traveling between $5.3 and $9.47.

Over the past 7 days, LINK seems to be moving well having seen its value increase by about 12%, perhaps also driven by the growth of Bitcoin and Ethereum.

It will be interesting to see what the future price movements will be for LINK to assess whether indeed this integration with GMX and the many implementations it is working on will bring results.