In recent months, Binance’s fee policy on major stablecoin-BTC trading pairs have created some anomalies in the market.

The stablecoin TUSD has increased its strength while trading volumes on BTC have plummeted since early March.

Let’s try to analyze the situation together.

Summary

The Binance effect and the choice to promote the TUSD stablecoin

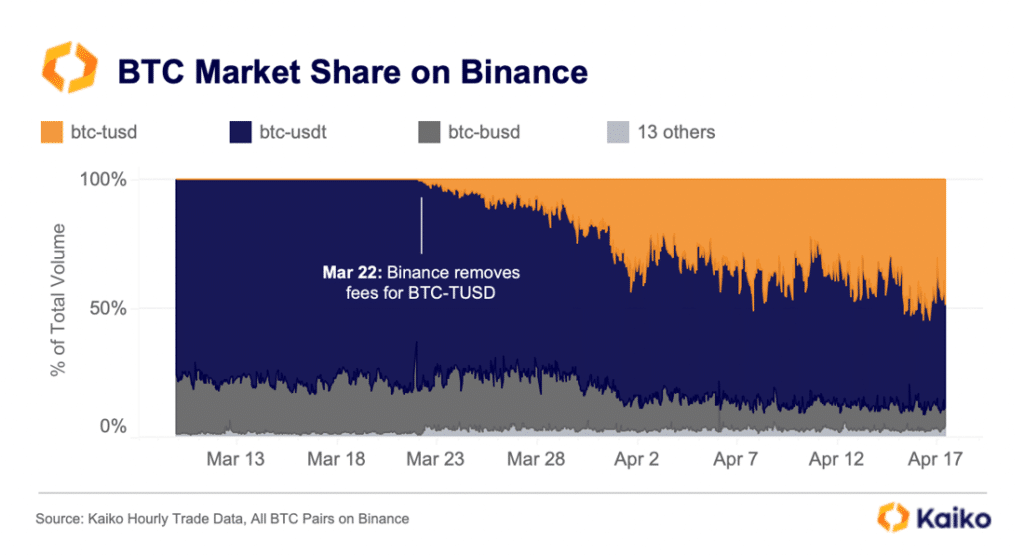

On 22 March 2023, Binance announced the end of the “zero-fee promotion on BTC trading” effectively re-introducing all standard fees for stablecoin-BTC trading pairs, except for the TUSD stablecoin.

To date, TUSD remains the only currency with value pegged to that of the dollar, to enjoy the discount on fees on the cryptocurrency exchange.

Specifically, there are 13 pairs in which TUSD is present and which users can take advantage of in order not to pay trading fees.

This decision has set the stage for the growth of TUSD, which, according to Kaiko’s data, now controls about 50% of the total volume of BTC on Binance.

This is a huge growth for the stablecoin, given that until recently its market share was close to zero when compared to that of USDT and BUSD.

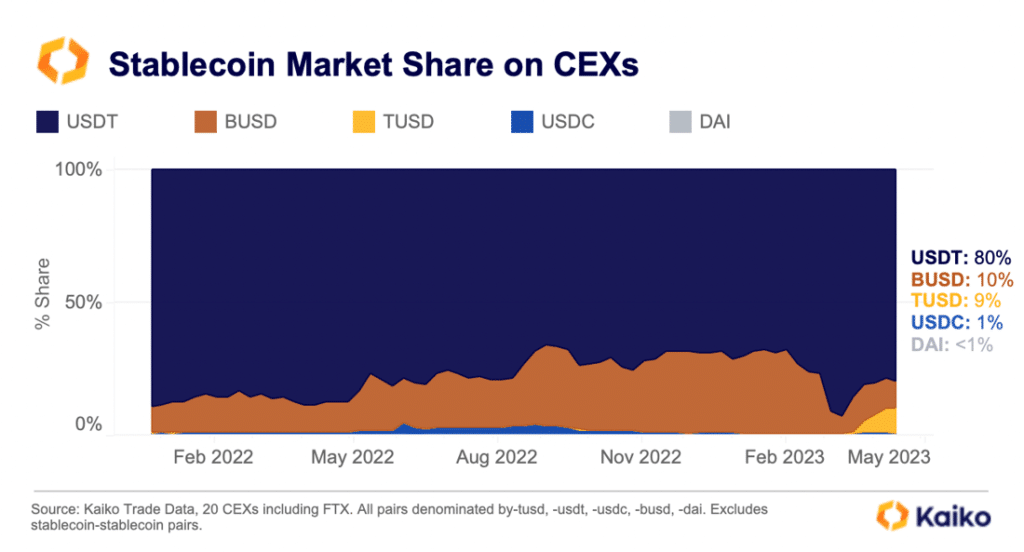

In truth, if we look at all cryptocurrency trading volumes on CEXs and not just those in BTC on Binance, we can see that indeed the major stablecoins in the sector are still dominant.

USDT, controlled and managed by Tether, is responsible for 80% of the volumes moved on the centralized exchanges, while BUSD, whose issuance was managed by Paxos until recently, handles 10% of these exchanges.

Nevertheless, TUSD has experienced tremendous growth when we consider that until recently it was totally irrelevant. The question becomes interesting given that the popularity of the stablecoin has arisen thanks to Binance, but the latter has no public ties to TUSD.

What are CZ and his team planning? Do they plan to acquire TrustToken, the company that manages the virtual currency, intending to replace BUSD, which has an expiration date and will be phased out before long by Paxos at the order of the SEC?

Most likely we will find out in a few months, in the meantime it remains interesting to watch the rise of TUSD and future changes on its market share.

Binance CEO excited about MiCA regulation in Europe.

Staying on the topic of exchanges and stablecoins, it is interesting to note that yesterday Binance CEO Changpeng Zhao was enthusiastic about the announcement of the European Parliament’s signature on the MiCA regulation presented by the European Commission.

MiCA represents the first regulatory framework outlining guidelines for crypto service providers wishing to conduct their business activities in the EU.

This is a significant milestone for the crypto world within the EU, as this sector will finally become fully regulated soon, and without any areas of uncertainty at the legislative level.

CZ, expressed himself thus on Twitter:

Now Binance will have 12/18 months to comply and be compliant with European regulations. Since Binance is an exchange headquartered outside the EU (Seychelles), it will not be able to do “active marketing” to convince European users to use its services, or it will have to register and obtain the necessary licenses to operate without limits

There is news coming on the stablecoin front as well: in case Binance decides to issue its own stablecoin pegged to the Euro in the future, it will not be able to exceed the value of 200 million euros of exchanges (trading on exchanges does not count) and the threshold of 1 million transactions per day.

Should these values be exceeded, the company operating the stablecoin will have to propose a plan to bring exchanges back within the allowed limit.

Trading volumes in BTC market plummet after choice to reintroduce fees on major pairs

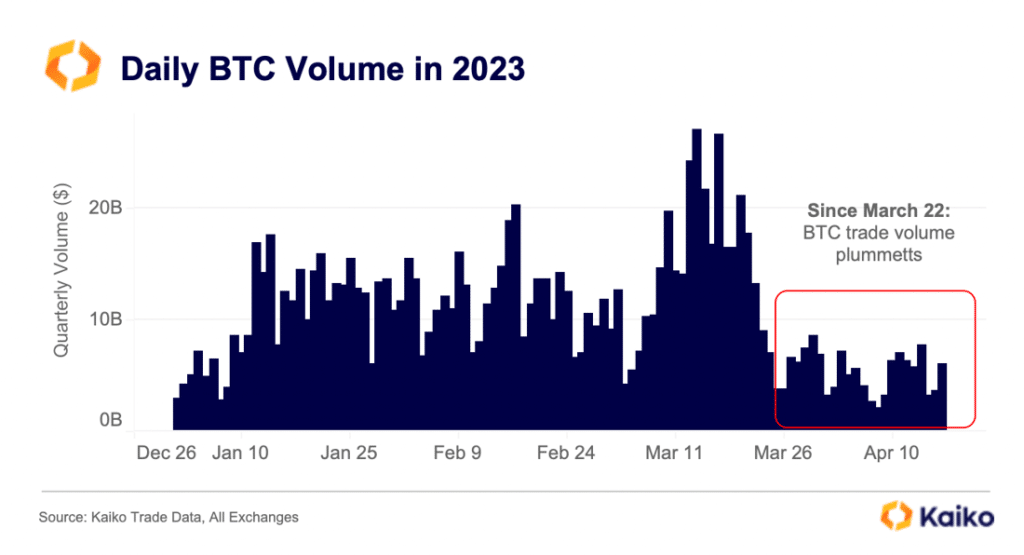

Since 22 March, which was when Binance reintroduced fees for the most liquid pairs except for TUSD, trading volumes in BTC on ALL exchanges have dropped dramatically.

This may give pause to the dominance that Binance has on all exchanges given that it has been the leading driver of this slippage in volumes.

Trading volumes for BTC pairs on centralized exchanges have been surprisingly high for the past 7 months in which Binance had introduced the zero-fee program, given and considering the market outlook and the bear market still not fully defeated.

Indeed, in periods of uncertainty and continued market declines, such as the year 2022, generally trading volumes should go through a distribution phase resulting in lower trading.

Perhaps the zero-fee program served to keep attention high in the markets and to not allow capitulations in Bitcoin’s value, in a difficult historical context for all markets, not just cryptocurrency markets.

Beyond that, volumes to date seem to have dropped heavily, returning to levels considered “normal” for the phase Bitcoin is going through.

These anomalies should prompt some thought about how much the market is doped by the influence of Binance, which is the main player in most of the events happening in the markets.

Even Tether and its USDT stablecoin have reached unheard-of levels of dominance like Binance’s, which threatens to endanger the entire industry if only these institutions fail in the future.

While the blockchain world is experimenting with ever more useful and interesting innovations for the future, such as the advent of zk rollups and the rise of layer 2s, the majority of the market still remains succubus to two centralized entities that together manage to make good and bad.

The issue is paradoxical when we think that Bitcoin and cryptocurrencies were created to give vent to the ideals of freedom and decentralization.

We hope that most users in the crypto world will realize this situation and begin to experience the appeal of non-custodial wallets and the DeFi world to counter the surreal dominance of these two entities.