Aave, the decentralised crypto lending protocol, has launched the V3 version of its platform on the Metis blockchain, accelerating the project’s expansion into the DeFi world.

The news followed the approval of the governance proposal, in which AAVE token holders were asked to decide whether V3 should be integrated into the Metis infrastructure.

Let’s take a look at what this means for the future of the DeFi world.

Summary

Aave crypto lending project launches V3 protocol on METIS

Aave, an open source decentralised credit/debt crypto project, has announced the launch of the V3 version of its protocol on Metis, a layer 2 blockchain.

The decision follows the approval of the governance proposal in Aave’s Community Decision section.

Over 650,000 AAVE tokens were delegated by voters to express their agreement with the integration of the Metis network into the decentralised lending platform, while no one voted against the proposal.

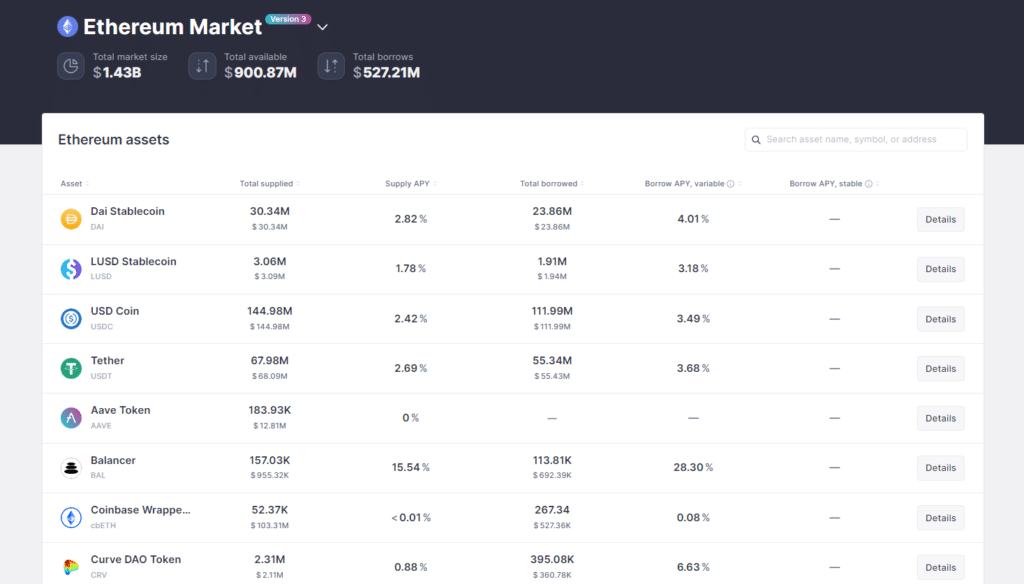

The result ensures that Metis’ layer 2 solution on top of Aave’s V3 protocol will be launched soon, where users will be able to deposit or borrow tokens such as WETH, USDC, USDT, DAI and METIS.

As part of this, the Metis team will offer 100,000 METIS tokens as an incentive to Aave’s liquidity pools, which will initially require liquidity to function properly.

The partnership not only strengthens the Ethereum Layer 2 ecosystem and on-chain liquidity, but also unlocks new DeFi functionality for Aave and Metis users, who will mutually benefit from this integration.

Commenting on the news, Metis co-founder Kevin Liu said publicly:

“For Metis, the launch of a flagship application like Aave V3 on Andromeda is incredibly valuable to our ecosystem, laying the foundation for an efficient and vibrant capital market. We are excited to join forces with Aave and further strengthen our DeFi offering for the Web3 economy”.

Stani Kulechov, founder and CEO of Aave Companies, said:

“Aave V3 is the perfect infrastructure for projects like Metis that are in a catalytic growth phase of their lifecycle, with V3 the Metis community will have much more flexibility and control over how new markets are created and incentivised”.

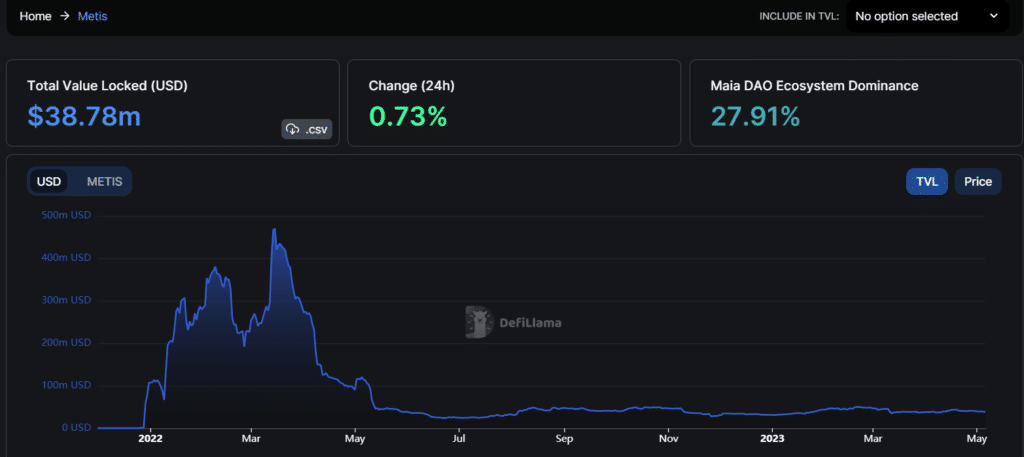

It will be interesting to see if, thanks to the presence of Aave, one of the most widely used and respected protocols in the DeFi world, new capital flows into Metis in the coming months, increasing the chain’s TVL, which has fallen 90% since the March 2022 peak.

Insight into Aave: DeFi’s third decentralised protocol for TVL

Aave is a crypto-lending protocol that operates in the world of decentralised finance, and has a hegemonic position compared to other lending platforms in the industry.

Basically, Aave works like a bank that issues mortgages and loans to its customers, except that the protocol is open source and therefore available to all, and the assets used in the debit/credit are not fiat currencies but cryptocurrencies.

On Aave, unlike a traditional bank, credit is not granted according to the income prospects of a profile, but solely on the basis of the collateral deposited in smart contracts.

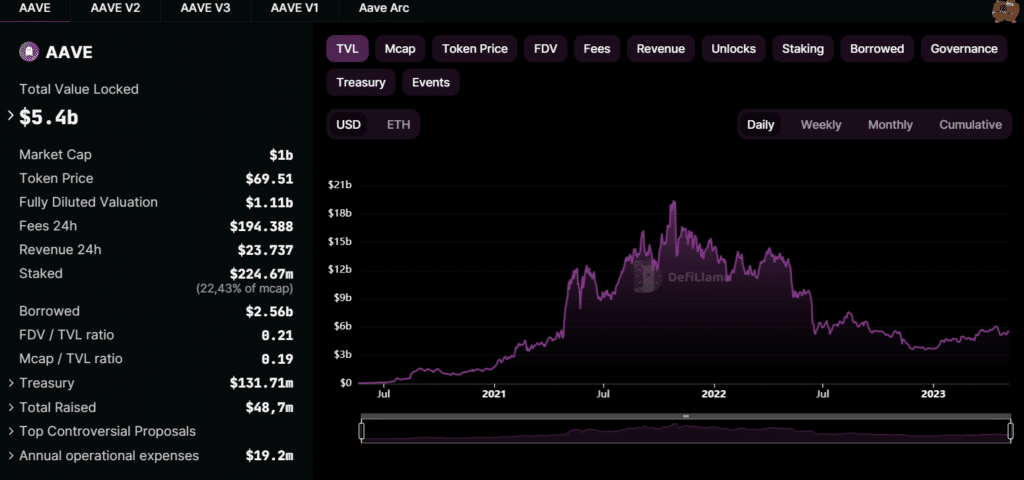

Born almost three years ago, it quickly established itself in the DeFi world, with its TVL (total locked value) rising to $19 billion during the bull market in October 2021.

After the 2022 bear market, TVL fell dramatically (in line with the liquidity of all markets) to its current level of $5.4 billion, while remaining the third most used and most capital-locked protocol in the DeFi world.

Today, it serves as the main lending platform for the Ethereum, Optimism, Polygon and Avalanche networks.

The operation of Aave is quite simple: for each asset supported by the platform, it is possible to perform two basic actions, i.e. to deposit it as collateral or to borrow it.

Borrowing can also take place between different assets: for example, you can deposit ETH and borrow DAI, or vice versa.

In each case, there is an interest rate to be paid to the party providing liquidity (the party acting as collateral) and to the party requesting liquidity, the former of course being lower than the latter for the same asset.

In order to request a loan, it is first necessary to deposit collateral of a higher value than the total amount to be requested.

With Aave in particular, the loan-to-value ratio (LTV), i.e. the ratio between the amount lent by the lender and the collateral provided, is 80%. At any time, you can decide to repay the debt and take back the assets provided as collateral.

However, since cryptocurrencies, with the exception of stablecoins, are inherently volatile, if the value of the collateral falls below the value of the loan, you will be liquidated.

If you are liquidated by the Aave lending protocol, in addition to the permanent loss of the assets deposited as collateral, you will have to pay a “‘liquidation fee” of 10%.

This situation is indeed a big loss for a trader, who generally tries to avoid it, unless the loan acts as a hedge for an opposite speculative position of a larger size (e.g. you are liquidated on an ETH put as collateral because the coin has fallen in value while you are short leverage in another market).

Crypto asset on the AAVE protocol

Price Analysis of AAVE Crypto, Protocol Governance Token

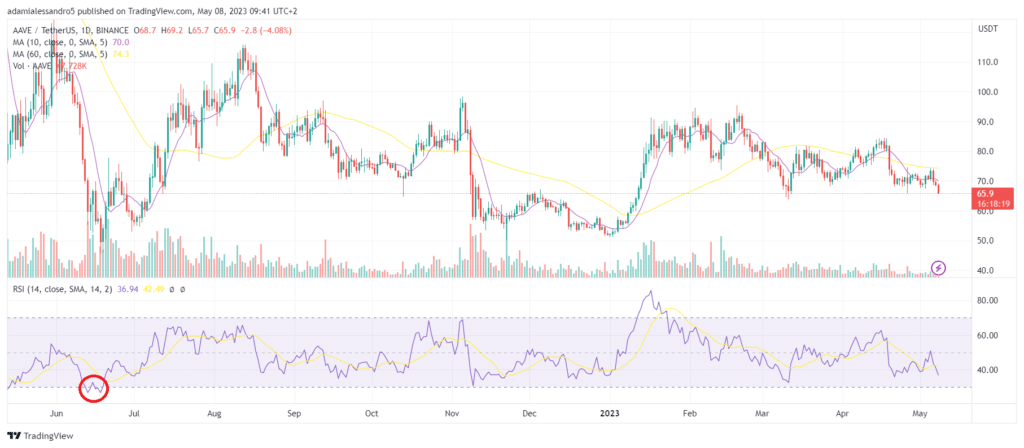

Let us now look at how AAVE, the protocol’s governance token, is performing. Currently, the AAVE token is priced at $65.9, with a market cap of $954 million and volume of around $45 million in the last 24 hours.

The crypto is suffering in terms of price, much like all the DeFi tokens that have been overlooked by investors, and more generally like the entire altcoin sector after the 2022 bear market.

AAVE’s distribution phase has been ongoing since May 2021, at which point it touched its ATH of $668, having started from a price of around $30 a few months earlier. The reason for the current weak price action could be exaggerated hype during the 2021 bull run, with an unusual price increase.

In any case, AAVE is still in a short-term bearish situation, but could soon reverse course, especially if the Relative Strength Index (RSI) readings fall into the oversold territory.

The last time this happened, in June 2022, there was a great buying opportunity when the price of AAVE more than doubled in 60 days.

However, if AAVE were to fall below $50, a very important support zone, and at the same time the RSI is not sufficient as a reversal signal (remember that one can remain in oversold and overbought zones for months), we could probably see a major dump for the crypto.

In the meantime, it will be important to monitor developments on the technical side of the Aave lending platform and see if it maintains its hegemony over the DeFi world in the coming months: if so, when the market recovers and LTVs return to pre-bear market values, then the price of Aave will also benefit.