The SEC seems to have declared war on cryptocurrencies, and many are wondering who the next victim might be: all eyes are on Crypto.com.

Let’s analyze the situation together.

Summary

Crypto.com could be the SEC’s next target

Over the past week, the US Securities and Exchange Commission has attacked the crypto exchange world by filing civil lawsuits against Binance and Coinbase.

The SEC’s war against cryptocurrencies has just begun, and the federal agency’s next target could be Crypto.com

After the events of the last week, which saw the US Securities and Exchange Commission file lawsuits against Binance and Coinbase, there is speculation about who could be the next to be attacked.

Rumors point specifically to Crypto.com, a well-known cryptocurrency exchange that operates in more than 100 countries around the world, including US territory.

The reason for this assumption is very simple: given that the federal agency has accused Binance and Coinbase of violating laws regarding the “sale of unregistered securities,” it is thought that the SEC will employ the same strategy against the platform run by Kris Marszalek.

Notably, many of the “security tokens” that the subpoenaed exchanges offered to US investors are also present in Crypto.com’s marketplaces.

These include high-capitalization cryptocurrencies such as ADA, BNB, BUSD, MATIC, SOL, SAND, AXS, MANA; COTI, and ATOM

In addition, Crypto.com also features a native token, CRO, which has not yet been considered a “security” by the SEC, but has been managed by the platform in a similar way to what Binance did with BNB.

Many therefore expect CRO and its respective exchange to be besieged in a US district court by Gary Gensler, chairman of the SEC.

Yesterday Gensler himself stated publicly in an interview with CNBC:

“We don’t need more digital currencies, we already have digital currencies, and they are called dollars, euros and yen.”

It thus emerges from the words of the federal agency’s main spokesman that there is a deep willingness to fight all cryptocurrencies in the US, except for Bitcoin and Ethereum, which have never been mentioned in recent days.

Could Crypto.com’s regulatory compliance hinder the SEC?

Crypto.com’s trump card against the SEC’s bullying is undoubtedly the relative power of regulatory compliance enjoyed by the exchange.

Indeed, it is well known that the crypto exchange platform has received several approvals from regulators around the world in recent years, demonstrating a consistent commitment to the regulatory compliance of its business.

It is by no means easy to level a structure such as Crypto.com’s to a multitude of disciplines in terms of digital currency exchanges between different continents, yet the exchange has spent many of its resources to succeed.

It has regulatory approvals of its operations in countries such as Italy, Singapore, Argentina, the United Kingdom, Brazil, France, Japan, and Canada, as well as several certifications such as SOC 2 and ISO 22301.

In addition, Crypto.com is headquartered in Singapore, distant both in terms of kilometers and regulatory jurisdiction with Washington, D.C. and its vigilantes..

In any case, despite the illustrious bulletin board of compliance-level accolades and the absence of physicality in the United States, it still remains a fundamental problem:

Crypto.com has been offering to US residents the same cryptocurrencies that a few days ago were cited by the SEC as “securities” and requiring approval by the agency itself.

The exchange thus risks being electrocuted by US regulators and losing a market that is critical to the platform’s business.

In any case, it is still unclear whether Gary Gensler and his team will continue the siege on crypto exchanges or whether the planned move included an attack exclusively on the world’s leading crypto exchanges.

Then again, Crypto.com is much smaller than Binance and Coinbase and could fortunately be ignored by the SEC, whose ultimate goal is to convince the US courts to issue heavy sentences and destroy the industry in the country.

Focus on Crypto.com’s financial situation

As mentioned, Crypto.com has a completely different financial reach than Binance and Coinbase, with significantly smaller balance sheets and market share.

In CoinMarketCap‘s ranking, the exchange ranks #17 with a low-to-medium reliability score, trading volumes of only $94 million in the last 24 hours, just over 500 markets, and weekly website visits of less than one million.

It is far less established than the world’s leaders among centralized cryptocurrency exchanges, which are extremely more present in the market in all statistics

The CRO token, in comparison with BNB capitalizes 20 times less and plays a completely marginal role in the utility token industry. The cryptocurrency had a heyday only during the bull run of 2021, where it was bought by users of the platform mainly to enjoy credit card benefits.

Now that these benefits are no longer there having been eliminated by the company, particularly the decrease in cashback on spending, CRO has lost its usefulness and adoption.

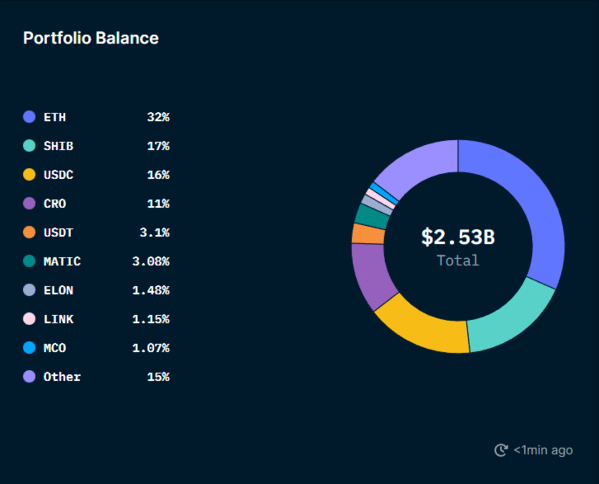

In the financial arena, Crypto.com has a balance sheet of $2.53 billion (counting only the Ethereum blockchain), with a somewhat questionable token allocation.

In fact, it is eye-catching that the memecoin SHIB has a 17% share of the exchange’s portfolios, which still remains a choice of investors rather than the platform’s management itself.

For the rest, the exchange is also estimated to hold $750 million in BTC, which raises the exchange’s wallet to $3.28 billion, still much lower than the giant Binance, which holds $58 billion in assets.

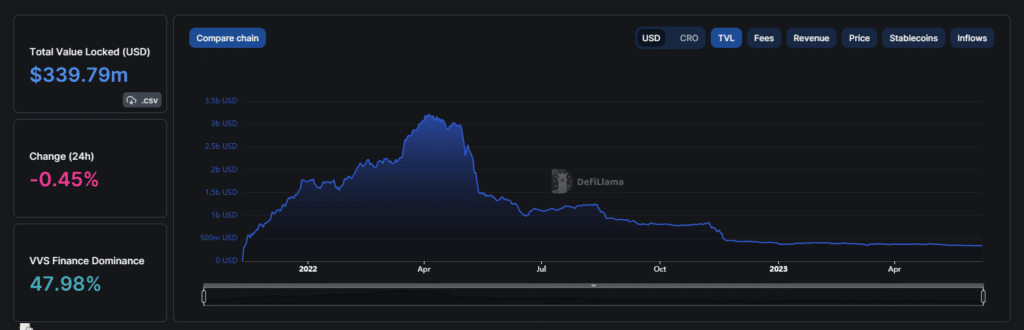

Even on the DeFi front, Crypto.com does not seem to be positioning itself very well with its Cronos Chain infrastructure.

In fact, the decentralized network is tenth in the ranking of chains with the highest TVL and seems to be losing ever more market share as time goes on.

Since April 2022, or in just over a year, the Cronos Chain has lost about 90% of the capital allocated in the various protocols, showing little interest from investors.