The UK’s Financial Conduct Authority (FCA) seeks to combat illegal financial promotion on social media of crypto memes and other non-compliant investments.

Two days ago the regulator published a document listing strict guidelines that must be followed when advertising such cryptocurrencies on social media.

Are memecoins such as PEPE, SHIB and DOGE in danger?

See all the details in this article

Summary

UK’s FCA proposes strict guidelines regarding the issue of promoting crypto memes

Crypto memes are no longer looked upon favorably in the United Kingdom: the Financial Conduct Authority (FCA) has recently published what are the new rules in the area of social media dissemination, warning influencers that they are risking big to advertise their favorite shitcoin.

In particular, the UK regulator’s focus is on non-compliant financial promotion of cryptocurrencies such as memecoins, which pose a potential risk to the end investor.

All crypto memes that explicitly invite the public on social networking sites such as Twitter and Reddit to purchase these financial products violate the Financial Services and Markets Act 2000 and are subject to unlimited fines and imprisonment for up to two years.

In order to fall within the permitted limit, relevant disclaimers must be added under any content in which cryptocurrency such as PEPE, SHIB, DOGE is referenced, conforming to UK advertising regulations.

In addition, starting 8 October 2023, the FC will ban certain types of incentives to invest in cryptocurrencies such as the classic bonuses found in a multitude of “invite a friend” exchanges. Service providers related to crypto trading will also have to introduce clear warnings about the risks associated with this world, with a 24-hour cooling-off period to give novice investors time to consider their investment decision.

The federal body added that these rules will also apply to communications and recruitment activities that originate outside the United Kingdom but have an effect within the country.

What is most interesting to note is that the meme itself, which is part of the entertainment logic of social media, can be considered an act similar to financial promotion, hence punishable as a crime.

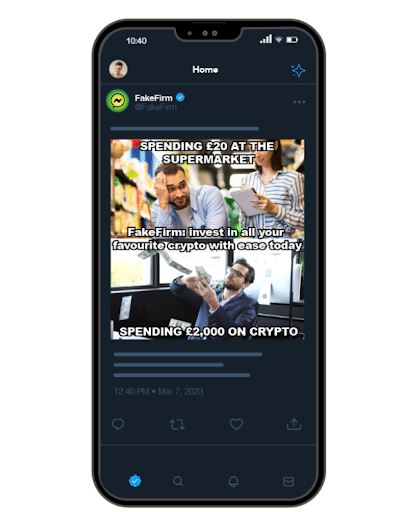

In this regard, the FCA provided an example of a meme (shown in the figure) that falls under the types of non-complimentary investment advice.

Overall, these strict rules are geared to hinder the emergence of crypto memes and highly volatile cryptocurrencies, potentially detrimental to less experienced investors. All of this could pose a serious problem for the future of memecoins, which survive primarily through “shilling” activity on social media.

In regards to the news Lucy Castledine, Director, Consumer Investments at the FCA, said:

‘We’ve seen an increasing number of ads that don’t live up to the guidelines we have in place to stop consumer harm. We want people to be on the right side of our rules, so we are updating our guidance to clarify what we expect from companies when they market financial products online. And for those who promote products illegally, we will take action against you.”

The role of influencers in promoting memecoins

In the sensitive context of crypto memes, it is clear that the figure of the influencer plays a crucial role in what in the jargon is called “shilling,” or the practice of pushing one’s audience to consider investing in these products, making them believe that there are opportunities.

Sometimes influencers who advertise memecoins are paid by the business that issues those tokens, while at other times they do so for free in order to gain indirect benefits, such as raising the price of a low-capitalization coin with low trading volumes.

In both cases, influencers will now have to be more careful, following the proposed guidance from the UK’s FCA aimed at combating this kind of behavior.

The body recognized the increased notoriety and recurrence of online financial promotions run by influencers, or as they are described by another term “finfluencers,” that could mislead investors.

These are the agency’s words:

“We have seen financial promotions communicated on chat rooms such as Reddit and Telegram, often using memes to advertise specific investments. Chat room or forum users should be aware that financial promotions on these channels will still be subject to the financial promotions restriction.”

The new guidelines on certain behaviors within social media such as Twitter or Reddit come after the watchdog set some goals in its 2023/2024 business plan with the goal of reducing and preventing violations of the Markets Act 2000.

The FCA has also partnered with the Advertising Standards Authority to help educate consumers and influencers about the risks associated with this activity: the work consists of publishing a number of infographics and forming roundtables and live events to spread awareness of the harms involved and the penalties that could apply.

Now finfluencers will have to be more careful when pushing the investment of crypto memes like PEPE.

Big Tech companies will also have to commit to working only with advertisements and promotions that have been approved and ultimately protect the end consumer.

The risks to the crypto meme market: focus on PEPE, SHIB and DOGE

Strict regulation such as that proposed by the FCA regarding social scope communication for crypto memes could cause harm to this niche market.

With the understanding that the guidelines are only meant to refer to financial promotions that take effect in the UK, this closure by the regulator could be copied by regulators in other countries, bringing major risks for memecoins in the sector.

As mentioned earlier, most of these currencies manage to survive within the crypto market primarily because of the publicity about them on social platforms.

Without the usual influx of promotional practices that entice people to buy, meme-based cryptocurrencies, especially those with lower capitalization, may have a hard time repeating the same performance as in recent years.

At the moment, the news does not seem to have impacted the 3 quintessential meme crypto assets at price levels, with PEPE registering +0.57% over the past 7 days, DOGE a +5.47% and SHIB a +2.42%.

Perhaps these coins, which have already gained the approval of their community and achieved a high level of notoriety, may not be affected by the dangers dictated by the FCA.

For emerging memecoins, on the other hand, this all poses a really serious problem, given the difficulties in gaining engagement without the help of influencers and promotion techniques such as shilling.

In any case, a stricter regulatory framework in this particular context is not in itself the ultimate evil: without misleading advertisements and shitcoin promotions run by armies of individuals on social media, perhaps Twitter and Reddit audiences will focus on other, more important issues and avoid falling into the trap of a myriad of cryptocurrencies that have zero intrinsic value.

Rather than seeing the homepages of social platforms clogged with financial advice, it would be beneficial to have much more educational content available that is capable of conveying important concepts and educating on informed investing.