Over the past week, Bitcoin has achieved a greater level of price stability than gold and Nasdaq, with dull and unattractive price action for speculators.

The level of correlation with the two asset classes is also very low.

Usually such situations end up generating a sudden increase in volatility, which could translate into an imminent rise for the value of the cryptocurrency.

Let’s look at all the details together

Summary

Bitcoin volatility below that of gold and Nasdaq

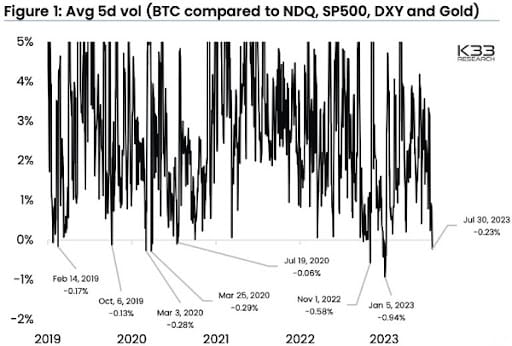

A study by digital asset analysis firm K33 showed how Bitcoin’s 5-day volatility fell below that of gold, the Nasdaq, and the S&P500 in a context of stability not seen in years.

The price of the cryptocurrency remained in the $29,000-30,000 trading range throughout July with brief excursions above $31,500 immediately absorbed by the bears.

Indeed, Bitcoin’s 30-day volatility also marks one of the lowest values in the past five years, and it seems to want to continue this downward trend.

As pointed out by Vetle Lunde, senior analyst at K33, these situations usually result in a price explosion and a sudden increase in liquidity, which could lead to a liquidation spree for overly aggressive traders.

These are his words:

“My short-term thesis is that the market’s volatility pressure is about to climax and that an eruption is near. The market is clearly in an unprecedented stable stage, which has typically acted as a massive pressure valve for volatility once it finally reignites.”

The majority of financial traders after Bitcoin’s last price rise had placed short orders, then had to add collateral to cover their positions.

In recent days, where we can observe less interesting price action than that of gold and Nasdaq, most traders are increasing longs albeit very slightly.

The upcoming decisions on spot BTC ETFs will determine the short-term fates in the market, leading to increased volatility for the crypto asset, which so far has been relatively low.

It will be very interesting to follow the trend of open interest for Bitcoin and monitor investors’ attitudes as we approach a final ruling by the SEC for an approval or rejection of the long-awaited ETF

Bitcoin and the decorrelation with gold and Nasdaq

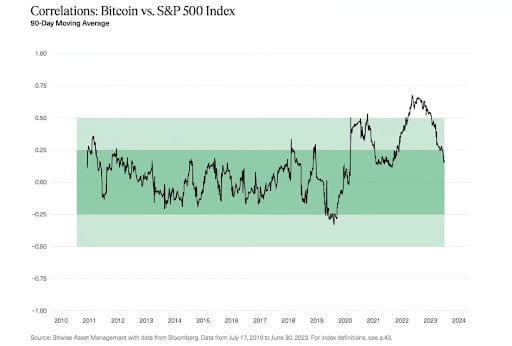

As Bitcoin barely moves and experiences very low volatility, the correlation with traditional asset classes such as gold and stocks also reaches outliers.

Usually the cryptocurrency follows the trends of the Nasdaq and the S&P 500, especially when strong price movements occur.

However, since the beginning of the year, while US stocks have recovered all their 2022 losses and are about to approach new all-time highs, Bitcoin still sees -57% from its all-time high, despite having grown 78% since the beginning of the year.

This is a very peculiar situation that sees a disinterest in the crypto sector by investors, who seem to prefer a more serene and less risky market for the time being.

The failure of the FTX exchange was a catalyst event that triggered a strong decorrelation between the stock market and the crypto market: indeed, the 90-day average of the correlation index between Bitcoin and the S&P500 is about to fall below its 2021 lows.

Against a backdrop of uncertainty on the macroeconomic side and with problems on the US regulatory front, the cryptocurrency sector has been severely penalized by the choices of traders who have opted to position themselves on traditional asset classes.

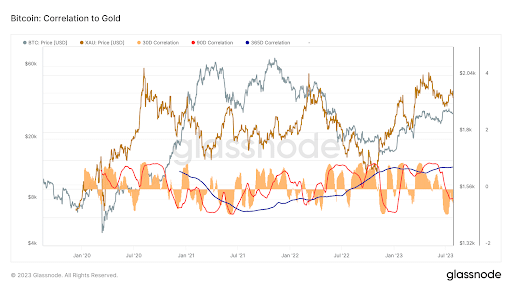

Even on the gold front, we can observe a low correlation with the cryptocurrency counterpart, which seems to be increasingly going its own way.

Such low levels have not been recorded since November 2022.

It was only the announcement of BlackRock‘s entry and the first presentation of a spot ETF that recently prompted an entry of capital. In June, BTC ETPs recorded inflows of 13,822 BTC bringing back interest in the crypto industry.

Vetle Lunde in this regard had discussed the impact of the ETF narrative and increased speculation on Bitcoin:

“Flows have been strong in all jurisdictions, with Canadian and European spot ETPs and US futures ETFs all experiencing solid inflows.”

Bitcoin short-term price analysis

Bitcoin has moved little in the past month, prompting traders to move to more attractive markets such as gold or equities.

In the Nasdaq we can find cases of stocks such as Microsoft and Nvidia where new all-time highs have already been touched since the beginning of the year, with bullish forecasts until the end of the year.

By contrast, in the case of BTC there is little interest and price action commanded by the bears, at least in the short term.

In July, any attempt at a bullish breakout was immediately halted, driving the cryptocurrency back below the 60-period moving average on a 4h time frame.

Low trading volumes do not improve the ‘general outlook of the market, which seems to be waiting for new developments on the spot ETF case before making the next big move.

In the last few hours, we have witnessed a brief rise for Bitcoin that brought prices close to the $30,000 mark for the umpteenth time, without succeeding in a definitive breakout.

The leg up has been stuck exactly at $30,025 with rejection down to the current $29,540. It will now be important for BTC to hold above the EMA 60 if it is to reverse the short bearish trend and try to go beyond the levels touched in mid-June.

A break of 30,000 accompanied by noteworthy volume could trigger a continuation to 31,000, where the bears will surely come back into focus.

Should there be a bearish reversal from these levels once again, we would likely see the currency drop below $28,000 and approach lower prices.

Watch out for the $29,000 cluster, where bulls may be waiting to make their entry. In an environment like this, watch out for false moves that are the order of the day. Be on the lookout for traders.