The number of unique addresses holding the crypto Worldcoin (WLD) is up 200% since 24 July.

Despite the excellent figure we can already see a risk of supply concentration, with the top 20 wallets holding more than 90% of the circulating supply of WLD.

Summary

Worldcoin: growth in the number of unique addresses owning the WLD crypto

Since 24 July, the day of the official launch of the Worldcoin project, the number of unique addresses holding the WLD crypto has been rising sharply, demonstrating high interest from retail investors.

Specifically, from the initial 136,692 addresses to date, another 280,694 entities have been added for a total of 417,386 holders on Optimism‘s blockchain.

Overall in the first two weeks that WLD token trading was open to the public, cryptocurrency holders increased by about 200%.

The high number of wallets present from the very first day of listing is justified by the fact that many users received an airdrop from the Worldcoin Foundation for testing the company’s products as early adopters.

In detail, those who had surrendered their biometric data by performing an iris scan through the “orb” devices then received a contribution equal to 25 WLD, equivalent to $67 according to the token’s first prices in the markets.

However, not everyone was able to participate in the airdrop since the presence of “orb” is limited and available only in some countries of the world.

It is also very interesting to note that the number of “WorldApp” wallets has seen a sharp rise. As early as mid-June, users could download their Worldapp address and explore the Worldcoin ecosystem: about 40% of these entities have since been rewarded as early adopters.

Currently, the total number of wallets amounts to 1.1 million units and continues its upward trend day by day.

On 17 June this figure could count only 9,685 wallets. The real surge occurred from 26 June onward, reaching a total of half a million units on 1 July.

Centralization risk for Worldcoin: supply of the WLD crypto concentrated in the top 20 wallets

Besides the number of addresses holding the WLD crypto and the number of Worldapp wallets, it is interesting to observe how the circulating supply of the Worldcoin project’s native token is distributed.

On 24 July, an amount of 101,411,213 WLD tokens was issued, corresponding to about 1% of the total supply set by Sam Altman and his team.

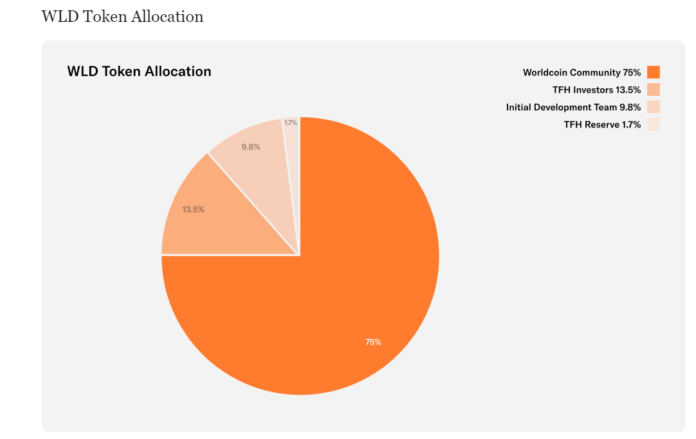

According to the tokenomics data in Worldcoin’s Whitepaper, the community would be entitled to an extremely high share of tokens, 75% of the total, but this will be unlocked over the next 15 years.

The remaining 13.5% goes to Tools for Humanity investors, 9.8% to the initial development team, and 1.7% held as a reserve.

Vesting for token unlocking by project investors will begin in August 2024, resulting in a risk of dump for the cryptocurrency.

Prominent figures who have invested in Worldcoin and the WLD crypto include Reid Hoffman, Andreessen Horowitz, Anatoly Yakovenko, Gavin Wood, Day One Ventures, Digital Currency Group (DCG), Coinfund, Blockchange Ventures, and others.

Despite the large chunk of supply dedicated exclusively to the project community, we can currently observe a strong concentration of circulating supply around the top 20 holders.

In detail, according to Etherscan data, the top 7 addresses hold more than 90% of WLD’s circulating supply, with the share reaching above 95% if we get to the top 20 addresses.

In itself this distribution may seem more clustered than it really is given that the top two holders, which hold about 72% of the supply, are addresses internal to the Worldcoin Foundation that are used as a base for distributing rewards to users and developing the work of the platform.

In any case, we can still see the strong presence of market makers in the ranking of top WLD holders, with the big whales controlling the crypto market.

Among them we obviously find the king of centralized exchanges Binance with the third largest address in the ranking, followed by Wintermute and other crypto service providers such as Bithumb, Okx, Huobi, Flow Trades, Uniswap, Gate.io, Bitget, Bybit, Mexc etc.

The only two unknown addresses, probably attributable to two real holders are present between the top 10 and top 20 of the ranking, together forming less than 0.7% of the number of tokens in circulation.

Hence, the situation seems to be in the hands of the powers-that-be, and not in that of the community, as predicted by the Worldcoin Foundation.

Focus on the prices of the WLD crypto

Taking a more focused look at the prices of WLD, the native crypto of the Worldcoin project, we can see how traders have maintained a trading range between $2 and $2.65 in the first two weeks of trading (not counting spikes).

Currently WLD has a value of $2.054 per unit with a market capitalization of $244 million.

After the very first hours of the launch on 24 July, in which the coin touched a high price of $5.29 on Binance (immediately absorbed), prices began to fall to the lowest value ever recorded at $1.85.

Traders then proceeded with a buying session bringing the value of WLD back above $2 and trading it thereafter with less volatility.

Right now the trend for the cryptocurrency appears to be trending downward, with bulls having to defend current prices to prevent a drop in demand.

Unfortunately, a high concentration of supply around market makers means that prices can be manipulated, with high risk for retail investors.

In the long run, the WLD crypto could see long downward periods, considering that 99% of the total supply has yet to be unlocked, resulting in increased selling pressure.

As early as year-end, we could see another 500,000 WLD unlocked in the market, ready to be dumped. Instead, the first vesting for private investors will arrive in August 2024.

By the end of 2024, the supply will be 2.6 times greater than it is now, with prospects for the number of tokens in circulation to increase ever more rapidly and violently.

It looks very much like inflation is set to reign over the fortunes of the WLD crypto, whose future prices could be severely disappointing, thereby undermining the future of Worldcoin.