DefiLlama is one of the most interesting tools for analysing blockchain and cryptos in the decentralised finance sector.

Let’s take a closer look at how it works and what are the most important data to observe in the platform.

Summary

What is DefiLlama and why is it useful for crypto analysis?

DefiLlama is a cryptocurrency and blockchain analysis tool that is particularly useful for finding data related to the world of decentralised finance, also known as DeFi.

Very often, when analysing a token or a project in general, it is not enough to make assessments on price action or fundamentals to get a clear picture of the situation, while it is increasingly important to go deeper by looking for information related to on-chain metrics.

DefiLlama can be useful in this regard, as it has a huge amount of verified blockchain data, such as DeFI’s TVL (total value locked), liquidations of lending platforms, trading volumes on decentralised markets, fees/revenues of dApps, vesting periods for cryptocurrency unlocks, hacks and exploits of smart contracts and much more.

Initially, DefiLlama was conceived as an aggregator of TVL of decentralised chains and protocols, given the speed at which DeFi has expanded since 2020 and gained a respectable place in the most desirable sectors of the crypto market.

TVL is very important for the analysis of DeFi because it gives us a measure of how much money is flowing within a decentralised platform or layer, and therefore tells us how ‘important’ that infrastructure is.”

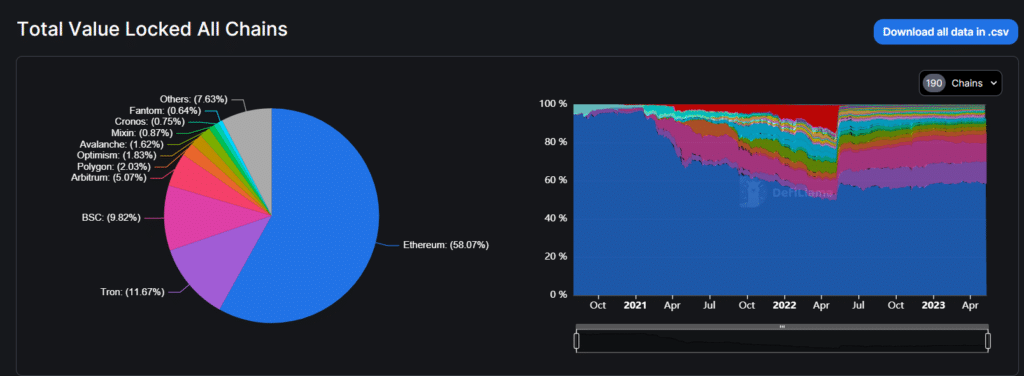

The tool is able to analyse this data from 190 blockchains and around 2500 different protocols.

Currently, Ethereum holds a dominant position in the market, with 58.07% of all crypto assets locked in smart contracts, followed by Tron with 11.67%, BSC with 9.82% and Arbitrum with 5.07%.

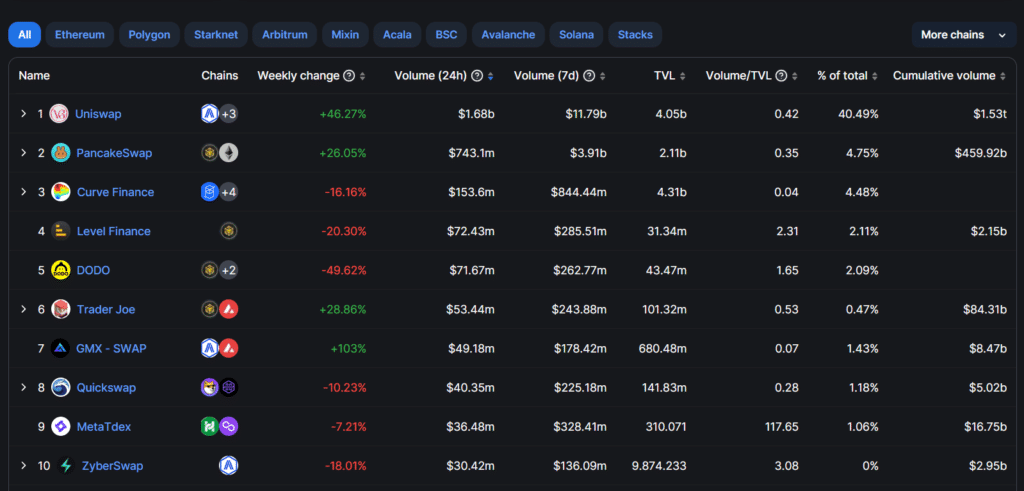

Another very important metric to consider is the volumes recorded within blockchain protocols or infrastructures.

While TVL is a more general figure that shows the amount of money stationed in an on-chain environment, daily and weekly volumes provide more accurate details on the actual usage of these platforms.

It is possible to filter this figure by chains, individual protocols or options platforms.

Currently, Uniswap and Pancakeswap have the highest volumes in the last 24 hours and the last 7 days.

The top crypto protocols on DefiLlama

Let us now try to determine, based on the data observed on DefiLlama, which crypto protocols are the most important in terms of liquidity within smart contracts, volume and fee/revenue ratio.

Firstly, the most prominent project in the DeFI sector is Lido, a liquid staking platform, which is the protocol with the most TVL (USD 12 billion) with a dominance index over all other protocols of 25.51%.

This is followed by platforms such as MakerDAO and Aave, which have $7.11 billion and $5.14 billion of value locked in their infrastructure respectively.

Uniswap is the protocol that earns the most through fees paid by its users, with $2.8 million in fees collected in the last 24 hours and a cumulative value of $3 billion since its inception.

GMX, the flagship DEX of the Arbitrum ecosystem, has a TVL of $678 million, representing more than 24% of all capital flowing through the chain, and a volume in the last 24 hours of $49 million.

Other highly respected platforms that have made history in the DeFi world and set what are now the cornerstones of the industry are: Compound, Curve Finance, PancakeSwap, Convex, Balancer, Frax Finance, Yearn Finance.

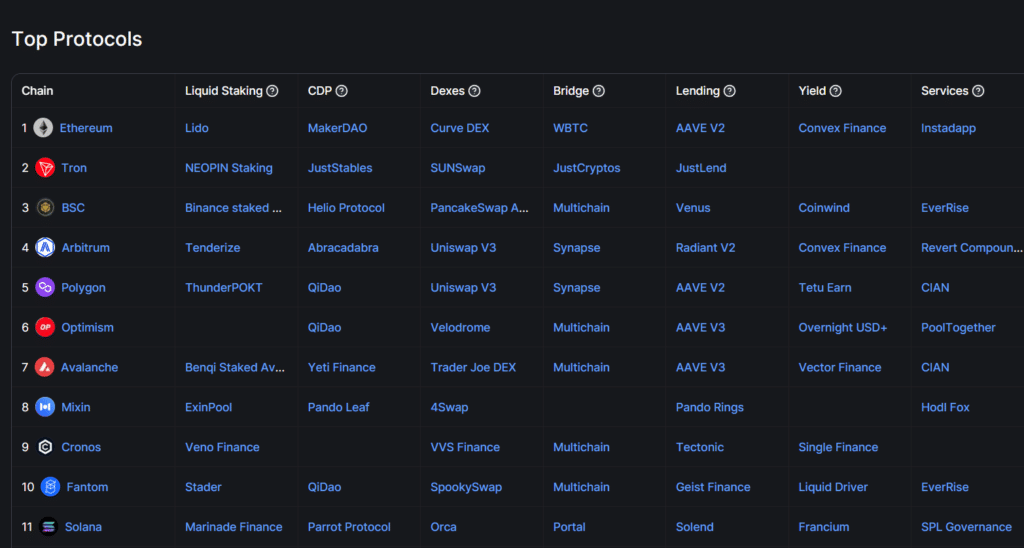

On DefiLlama, it is also possible to classify the protocols according to the blockchain they belong to and the area in which they compete.

In detail, for each chain we can find the best projects for Liquid Staking, stablecoin minting platforms with collateralized loans, decentralised exchanges, bridge, lending, yield and service.

Other blockchain analysis platforms

DefiLlama is not the only tool the web offers for analysing crypto protocols.

Since most blockchains are public by nature, and therefore available to everyone, a large number of websites have emerged over time that allow users in the crypto world to identify data of all kinds, not just specific to the DeFi sector.

Among the most useful tools to get an edge in the daily analysis of projects and to facilitate the reading of on-chain movements are three tools in particular.

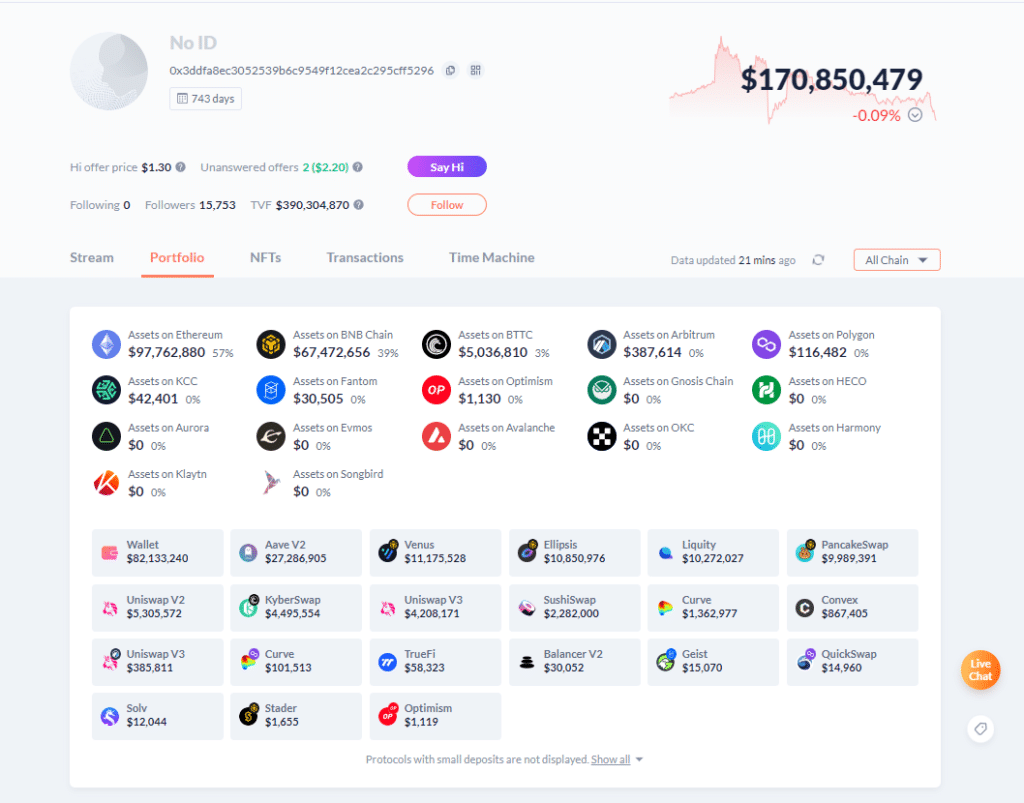

Debank is a tracking platform for Web3 addresses, particularly useful for tracking funds in your own wallet, but also in those of other people whose address you know.

Through a very user-friendly graphical interface, you can check the balance of a wallet, the amount of assets held per blockchain and a history of actions taken since inception.

Dune Analytics, on the other hand, is a platform that enables the instant creation and sharing of analytics related to a specific query.

Smart contract data is collected and converted into a human-readable format that can be queried using the standard SQL language.

Much of the most interesting information can be found and grouped on Dune Analytics. The only thing to watch out for is when the information has been updated, as some dashboards may have been created in the past and abandoned by their creators over time.

Finally, an all-round analysis and insight tool for tokens, blockchain and decentralised protocols is Nansen.

Founded by Alex Svanevik, it is the most comprehensive and convenient data aggregator around, with over 250 metrics available and a variety of tokens and chains to which they are applied.

The likes of a16z, Tiger Global, Coinbase, Google, Pantera Capital and Jane Street have also invested in Nansen.

Nansen is suitable for all segments of the crypto community as it offers solutions for investors, Venture capital, Blockchain and L2, Exchange, DeFi Protocols and Service Providers.

The downside is that, unlike DeBank and Dune, this tool is not free: the basic plan costs $100 per month, while the VIP and Alpha plans, which offer access to professional data and highly researched market metrics, cost $1000 and $2000 respectively.