2019 saw the big explosion of DeFi, but what will be the crypto trend in 2020?

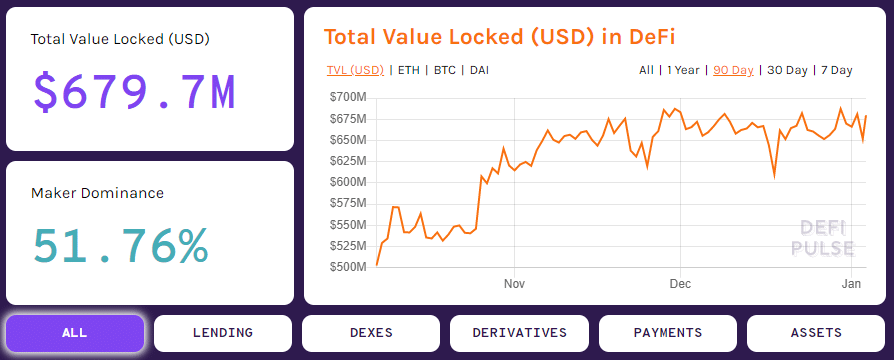

MakerDAO has ignited the industry with the creation of DAI, the stablecoin that represents the most used asset in the DeFi ecosystem with a percentage that, according to DeFi Pulse, exceeds 50% of the total value locked within contracts.

Trends 2020

It should be remembered, however, that a few months ago this share was around 90%. The ecosystem is evolving and new players are gaining market share, causing the sector to grow.

- Synthetix (Derivatives);

- Compound (Loans);

- Instadapp (Loans);

- Uniswap (Decentralised Exchange);

- dYdX (Loans);

- Bancor (Decentralised Exchange).

These are just a few of the names that are accumulating capital in their Smart Contracts, promoting the growth of the DeFi system on Ethereum.

New crypto players grow: pTokens

This wave of enthusiasm and productivity has generated new ideas and launched projects that will soon be making their contribution, some of them have been awarded by TokenInsight as the most interesting in the “DeFi project” landscape. pTokens is Among them.

pTokens is a project created by the Poseidon group to bridge the different blockchains in a safe and sufficiently decentralised way. By using a Trusted Execution Environment, pTokens will allow locking a cryptocurrency “different from Ethereum” (e.g. Bitcoin, Litecoin, EOS, Tron) on their main blockchain and create the equivalent pToken using the ERC20 standard on the Ethereum blockchain. There is already a representation of BTC called wBTC in the ecosystem, but in this case, there is a custodian, BitGo, which centralises the operation.

Let’s imagine the potential generated by the Ethereum ecosystem if other cryptocurrencies could be used on it to receive loans in stablecoins or generate interest on capital locked in loan contracts (Lending)

Maple.finance‘s bonds, also among the projects reported by TokenInsight, are a great innovation. Maple is building a new market by giving DeFi users quick access to low-cost bond financing, as well as allowing investors to provide their capital.

Crypto problems to solve

DeFi projects are not always decentralised: they are considered open, censorship-resistant and disintermediate protocols, but it is not always the case. Compound itself has proven to have special privileges for some system administrators who can censor transactions or modify parameters without the stakers.

Beta versions of these protocols can still be dangerous and the communities in charge often have a lot of power over systems they describe as decentralised. There is much that can be done to mature the industry.

Centralised exchanges seem to be well organised in absorbing these technologies into their ecosystems.

Binance, with the creation of its BNB token and later with IEOs and its own blockchain, has started an autonomous system that uses liquidity and network effect to keep the user on their platforms. It is not impossible to see a future where copies of DeFi systems are replicated in their ecosystems to exploit what happens on Ethereum as a testing platform to re-propose for their large communities.

Great opportunities for wallets

Wallets like Eidoo have a great chance to become a service bridge to connect trading, deposit and interest generation for their customers.

2020 will see the growth of projects like this one, whose capacity to develop the concept of financial sovereignty for the benefit of their own communities will allow them to grow.