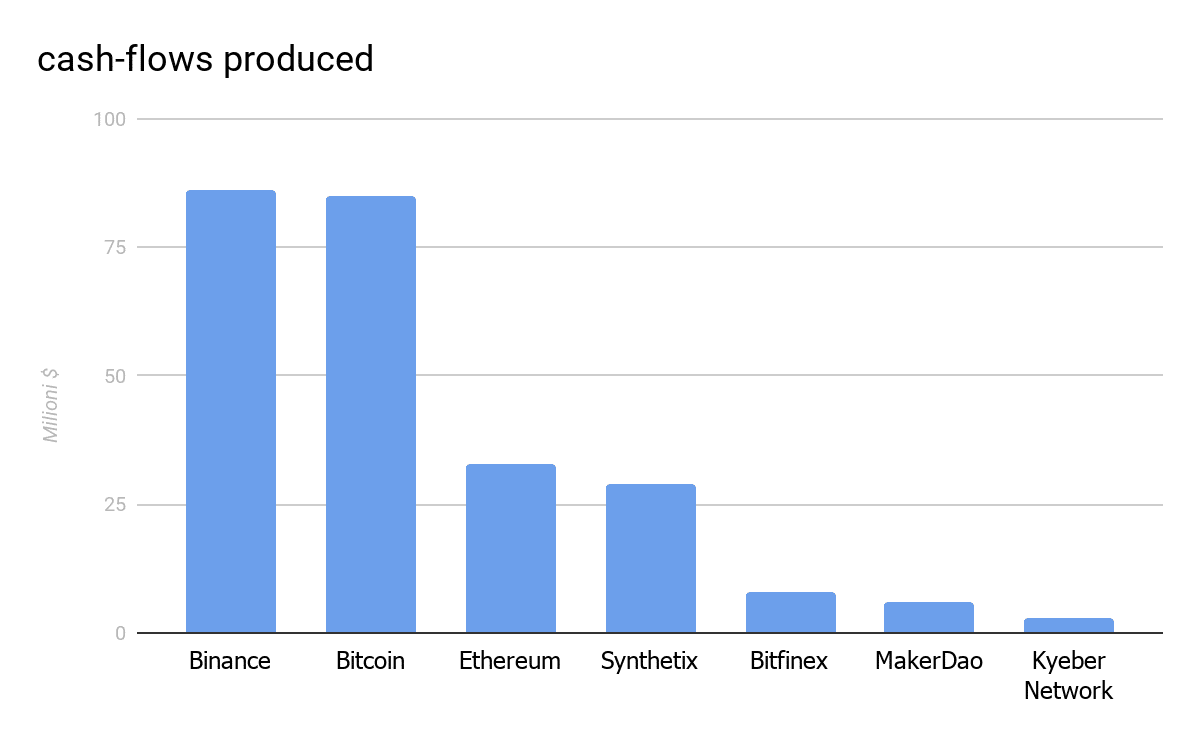

Calculating the total fees (transaction costs) accumulated annually thanks to the volumes moved by the exchange of Changpeng Zhao, Binance collects more fees than Bitcoin miners.

According to the monthly data available so far, more than $86 million in a year is collected by the world’s most profitable exchange from users trading on the platform.

The most surprising data is linked to Bitcoin and other major players in the blockchain ecosystem.

In fact, Binance generates more in fees than all the miners operating the Bitcoin protocol.

BTC follows with $85 million but it is important to note that this figure should be divided by all the players involved in providing computing power to the system.

No wonder that some people in the system related to the mining world are not so happy about the developments in this industry.

Investments and developments on the hardware front are being challenged by a business model based on speculation within exchanges, rather than being focused on the adoption of the ledger itself.

The arrival of DeFi

Centralized exchanges are not the only ones eroding Bitcoin’s mining margin. With fees as a parameter, data shows who is emerging:

Data from Token Terminal

After Binance and Bitcoin in the ranking, there are obviously the miners of Ethereum with the players of the DeFi world.

Following strongly there’s Synthetix, as well as Maker DAO and Kyber. Bitfinex is also mixed among them, which, being a centralized exchange, has a business model identical to that of Binance.

Fees: the distribution of wealth

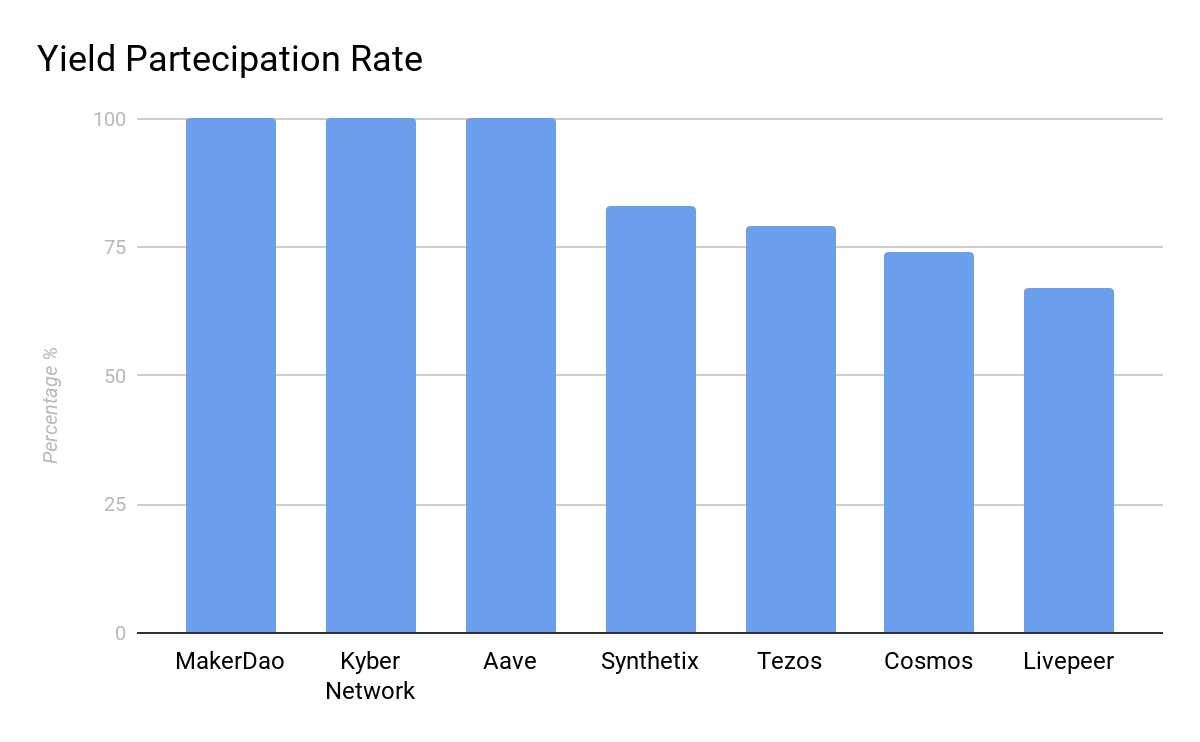

It is important not to overlook the fact that the distribution of revenue takes place with very different models:

- Centralized exchange model: a centralized structure in which earnings are shared between the shareholders and partners of the company;

- Mining PoW model: an open economic system in which anyone involved in securing the network can generate revenue from transaction fees;

- DeFi/Staking PoS model: the capital provided by stakeholders entails rights linked to the fees generated by the protocol in question.

Taking into account the percentages of revenues distributed to platform users, there is now a very different ranking:

Data from Token Terminal

DeFi is leading the way with revenue distribution models that shift from 100% dividend participation to lower shares that depend on more complex business models which we will not explore in this article.

DeFi projects are often managed by DAO models that decentralize government. The smart contracts that these protocols rely on can verify how the code will behave when managing the money circulating on it.

Conclusions

Looking at data such as these, it is spontaneous to note how the adoption of cryptocurrencies might be slowed down by the players who are gaining from the centralized management of exchanges.

Internal debit cards and increasingly simple services are tempting for the user who rarely leaves the exchange.

New models of wealth distribution draw attention to themselves. DeFi is growing as a result of revenue sharing.

The use of decentralized stablecoins could be a model that in the long run will allow to partially detach ourselves from debit cards and avoid leaving the blockchain due to the volatility of the main cryptocurrencies.

Although the risks are still high in this very immature market, the Ethereum ecosystem seems to be the real big competitor of exchanges, the programmable currency at the base of this blockchain is its driving force.

To make this paradigmatic change possible, however, Ethereum must scale and make its network fast and secure. Some steps forward have already been made but the expectations of use are high and the results achieved with version 1.0 will not be enough for much longer.