With trades reaching last year’s lowest levels and prices increasingly caged in a narrow range of a couple of percentage points, it seems there’s no significant movement. Bitcoin’s volatility is at the annual lows.

Scrolling the list on Coinmarketcap, among the first 40 coins only two manage to raise their heads above the parity: Iota (MIOTA) and Zcash (ZEC). On the other side, the deepest sinkings are marked by Decred (DCR), Dogecoin (DOGE) and Bytom (BTM) which lose more than 6% from yesterday afternoon’s levels.

Capitalisation sways just over $210 billion, with bitcoin slipping below 53% of market share. Ethereum also loses its appeal, returning below 10% and approaching Ripple that is trying to surpass 9%.

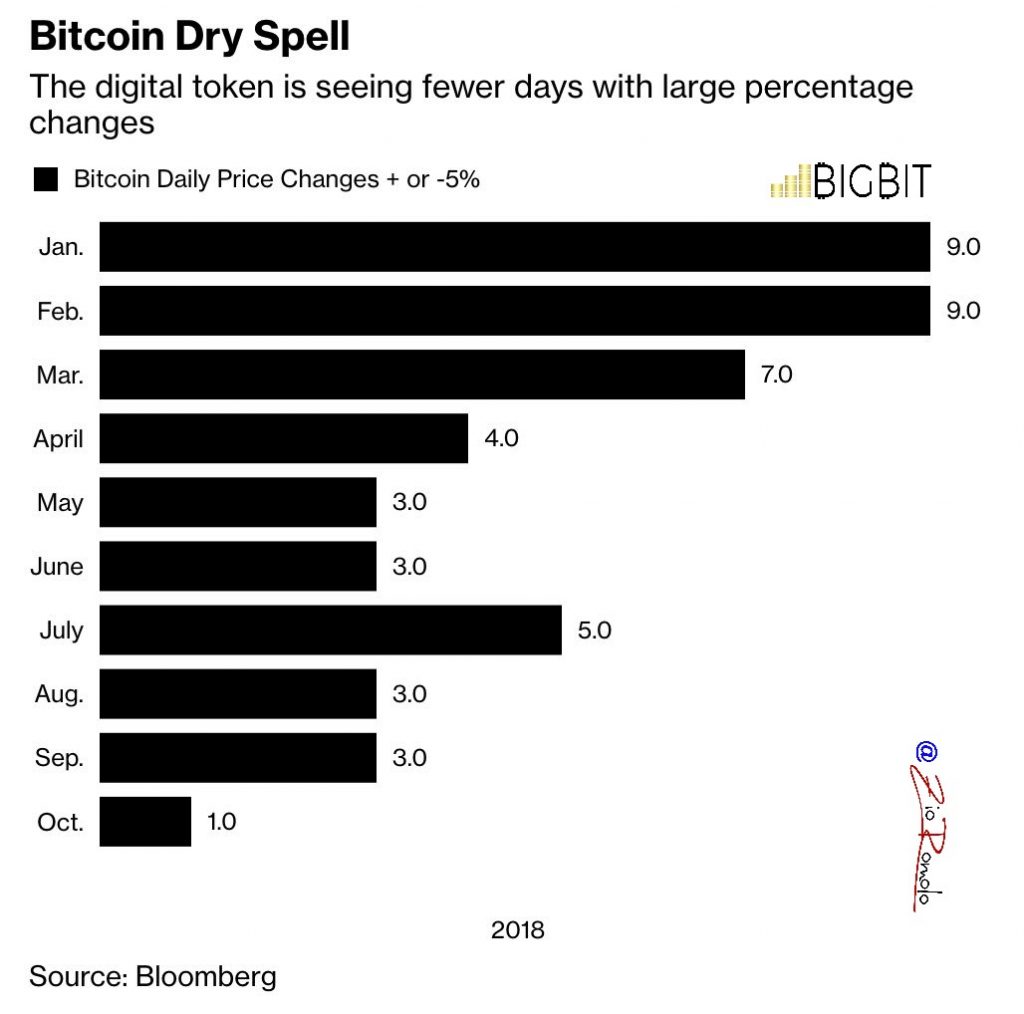

The particular period of prolonged boredom and trading that since early October has pushed the bitcoin index volatility below 2%, the lowest levels of the last 18 months, does not escape Bloomberg.

Yesterday’s article emphasizes the low volatility present in recent weeks for reasons already highlighted on these pages.

It is interesting to note that the month of October had only one day with a fluctuation of more than 5%. So far, the most volatile months have been the first three since the beginning of the year.

In both January and February, there were 9 days with fluctuations of +/- more than 5%, while in March the days were 7.

Both the head of the Atlantic House Fund Management in London, Charlie Morris, and Danial Daychopan CEO of Plutus, an app that allows the exchange of cryptocurrencies, see positively the volatility collapse of bitcoin and other cryptocurrencies. After months of decline, it seems that the Bears have had enough fun. Now, however, we need the decisive return of the Bulls.

Bitcoin (BTC)

When commenting on the current technical situation, it can be said that the situation remains stable, the cryptocurrency shows no signs of improvement.

At the same time, there is a good chance of recovery.

Ethereum (ETH)

If for bitcoin the situation remains stable and unchanged, for Ether the electrocardiogram is almost flat. In the last 24 hours prices have fluctuated between a minimum of 203 and a maximum of 208 dollars.

The risk of falling asleep in front of the monitor is high. It is better to set alarms on the platform and return to follow when prices are above 210, or below 200 dollars.