Bitfinex vs Kraken: the valuations of the two exchanges are disproportionate and can be explained simply by looking at the numbers of the two crypto trading platforms.

In an email to their most prestigious customers, Kraken recently expressed their desire for a capital increase.

While pointing out the fact of having reserves, Kraken’s email explains that they are considering opening up to new investments with a valuation of $4 billion and a minimum required investment of 100 thousand dollars.

The question that arises is: when there’s a competitor like Square, which has just beaten Coinbase as a bitcoin purchasing app, why is Kraken looking for funds? Maybe to buy companies and take advantage of the low prices of the crypto market?

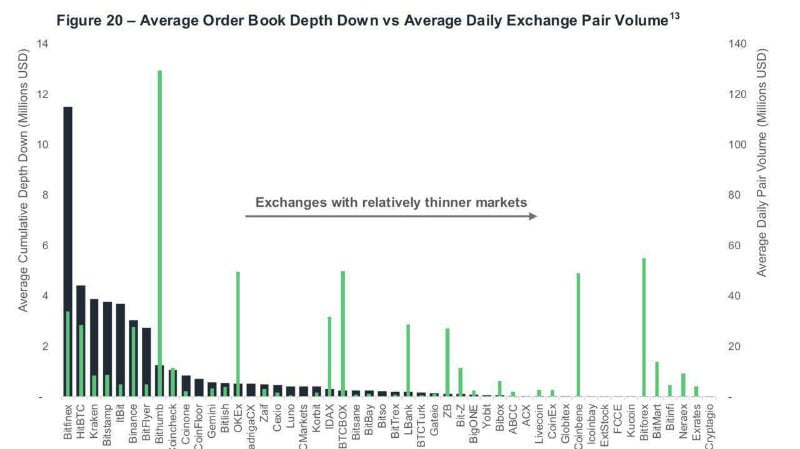

Kraken is in 34th place in the top 100 of the list of exchanges for trading volumes, while – for example – Bitfinex is 19th place, a platform with a valuation of about 1.6 billion.

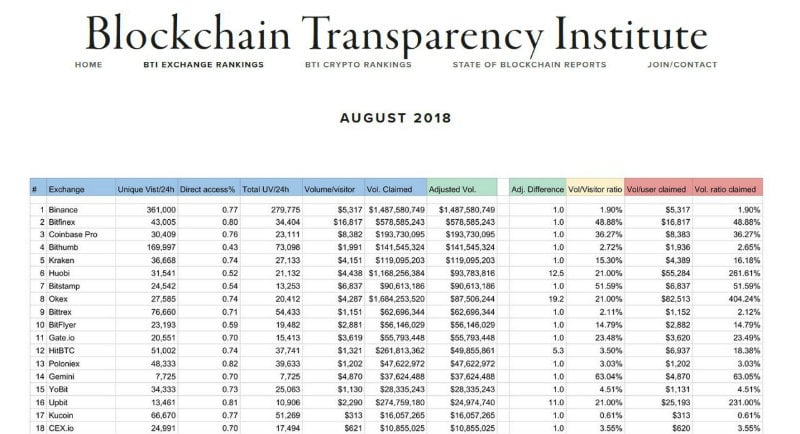

The numbers don’t add up: Bitfinex on Bnk to the Future is on sale with shares at $9 despite having collected in 2018 as many as 385 million in profits, while Kraken has a more than double valuation despite having at least half the profits of the competitor, given the volumes.

Bitfinex, in fact, has a commission similar to Kraken but trades 250% more.

Compared to Bitfinex, Kraken has higher costs also because the Kraken team has almost 1000 employees (if they kept the promise made in a Bloomberg article), while Bitfinex about 90.

So why is Kraken valued more than Bitfinex?

According to data from August 2018, Bitfinex would also have more active users than Kraken, this would mean on average fewer completed KYCs, so even if regulation affected the evaluation (big data are essential), these would still be less for Kraken.

Even according to Similarweb, Bitfinex user accesses have been higher than those of Kraken over time, with a difference of more than 1 million visits.