In recent days, QuadrigaCX, Canada’s largest exchange, has been down for several hours and, in recent months, customers have encountered significant problems when withdrawing both crypto and fiat.

Then on January 28th, the exchange published a statement explaining that QuadrigaCX was upgrading.

Meanwhile, the Canadian Imperial Bank of Commerce (CIBC) had frozen about $21.6 million as a result of a conflict over the determination of certain exchange accounts. In addition, the death of CEO Gerald Cotten on December 9th, did not make things any easier.

Subsequently, the upgrade message was replaced by the following message, which explained that QuadrigaCX was down.

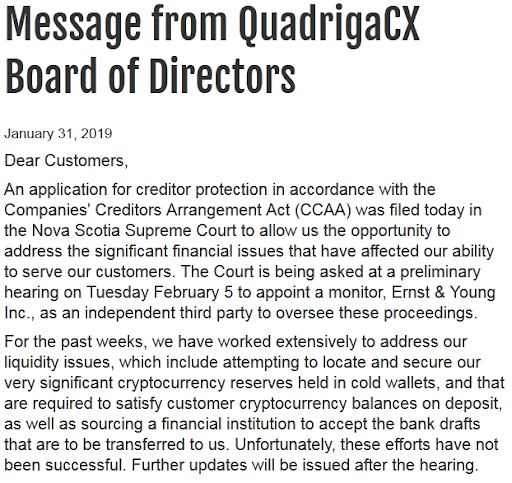

Unfortunately, the surprises did not end there for the exchange and, on January 31st, the platform was blocked by a CCAA issued by the Supreme Court of Nova Scotia in order to allow the exchange to solve the financial problems that plagued QuadrigaCX.

In other words, the QuadrigaCX team can’t find the access data of the cold storage wallets where all the information and the various cryptocurrencies of the customers are stored.

For this reason, the exchange relied on the Supreme Court of Nova Scotia, which, after researching the case, drew up an official document including Jennifer Robertson, the widow of the founder of the exchange.

The document also found about $190 million of assets on the exchange divided as follows: 26,500 units of bitcoin, 11,000 of bitcoin cash, 11,000 of bitcoin cash SV, 35,000 of bitcoin gold, 200,000 of litecoin and about 430,000 Ether.

Everything should be clarified on February 5th, when other external parties will verify the transactions and try to recover access to data. For customers, however, the problems have just begun since, as a last resort, the same platform will be sold to try to refund the largest number of customers.

The latest news on QuadrigaCX

A few hours ago, the analyses of the various wallets of the exchange were concluded in order to determine whether they had actually lost access. After careful analysis, it was found that the exchange was using deposits to pay other users requesting withdraw.

This would mean that the exchange did not lose access to the bitcoin deposits and that the estimate of the total BTCs would be lower than in the previous document. In addition, this means that the delays in withdrawals were caused by the lack of funds from the exchange, which used other users’ deposits instead.

Some of the addresses linked to the exchange have been recovered:

36aenge8ZXwjRxHvtbt3HkvJRzxPNnMfeY

3Hz4NRi2fMZkUrfJXUbYygi5zoo86QXGg6

3FtVrDgvnhfAiGNHKazmjNwC7kBbT9fktX

3L4QYoGJfocATAHQz5SXB+FHWbNbMhQjEdA

358ugsYE2hKDr8Bcyob5TUXgc5n5FHxtjj

3HVkrkZjj7YNscV6KrtaSpWPSGVqVum6RAR

3FYCpaMxvZ5dX8VCyUwcTkuCvteAUgys3c

3Bei6hrKrsbE2NTg9gNXwRP6EVPmYcZ7Zx

3LZfJoPiZGUt5cDAsFwibVFLyjMbq1H2Us

33x4GqFGJi4fu3WEKNk7qQ6bF3uzyATqS8

39b59sQb4azPuUdoEXtUL7K2QQLQzC9knT

3Q8KJEBP58wVK4RDgeuPAKgi5vZQHcUAYu

3HyNBSg8HjbxUuycfiJ8cU4dfNTYeSrGpA

3J1ywusNW48i9qAWGeXwh4CURii7ieoZUv

3NAWo2VV2XSmxckfG8xinrtJ46queEp1w7

35gtPDp3nvACjLPFg2PC1mXsgfaoYYjFSX

35r88wsFESp4CXmwKRnXPykTARwWnVH1sq

3JEasHVpmkn9Vivf1KEhJEXJjrGF1KejpJ

3MNaurs8trMJmJwZewSB1gY7dmDgCziris

335hbW2xXygr7rrmoddchYjchzykiYtELw

3LGgMA2uw6VWyCQ8U2dM6GAaNAKzRr9Wrr

34hoZWYmv4WnoUDzV4BQvvFAcwUbL54G5X

36qBVXUpZB8ByHo1cqEyTSRa9V3bSrLdXa

3PssBQxdXoq2HLrD8W56QZNi7eH2vko4mB

3KYEyqY2av6PzbAKwJvLsT4wKRPrnsV8Mu

35pnEcngU5SnRViZNHiAFRqUuXAWJtVBhD

3FWxEN9ebgnbCvZqLK6mbmZ5f8PAtT4nEJ

35k2kwnn1Uhk55ZCVUzRpWKrdGeNobYsHm

3MVfvS31Si4oiK8sTn5TuHt59bQyZUoebM

34jprabSiFXPiFuDBmzzVwf2B19MiUU6Ld

3L5t5tzjsgqRbdWVdgBNTQJM48LhhSMf7o

From these data, it was discovered that the exchange has transferred about 3 BTCs, a movement that contradicts the claim of loss of access to funds.

The next step for exchange users and QuadrigaCX itself is to wait for tomorrow’s (February 5th) Court’s ruling.