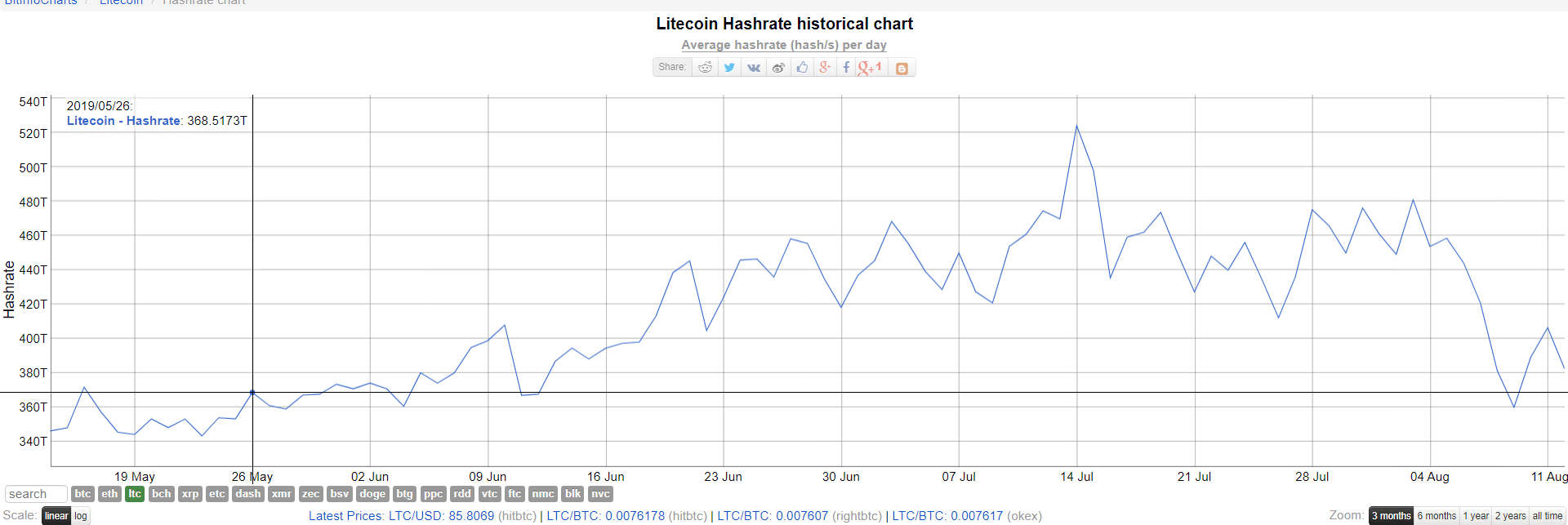

In the days following the halving, there has been an initial substantial drop in the Litecoin hashrate. The litecoin network lost about 20% of the total hashrate in about 72 hours, leading to a rapid decline in the mining difficulty of the currency.

The famous litecoin halving took place successfully on Monday, August 6th, causing the block reward to go from the previous 25 LTC to the current 12.5 LTC, resulting in a considerable reduction in the compensation for miners of the currency.

Although initially, the price of litecoin had risen, touching 107 dollars, in the following hours the value of the currency returned below 100 dollars, and then over the weekend it settled between 85 and 90 dollars.

As many expected, the price, except for the short pump, remained practically in line with the value of the days preceding the litecoin halving, resulting therefore in a clean halving of the reward for each block correctly validated by the miners.

This is why Litecoin’s hashrate would have fallen.

From the initial 460 TH/s recorded on August 6th just before the event, it quickly dropped to 360 TH/s, to then return to the current 380 TH/s.

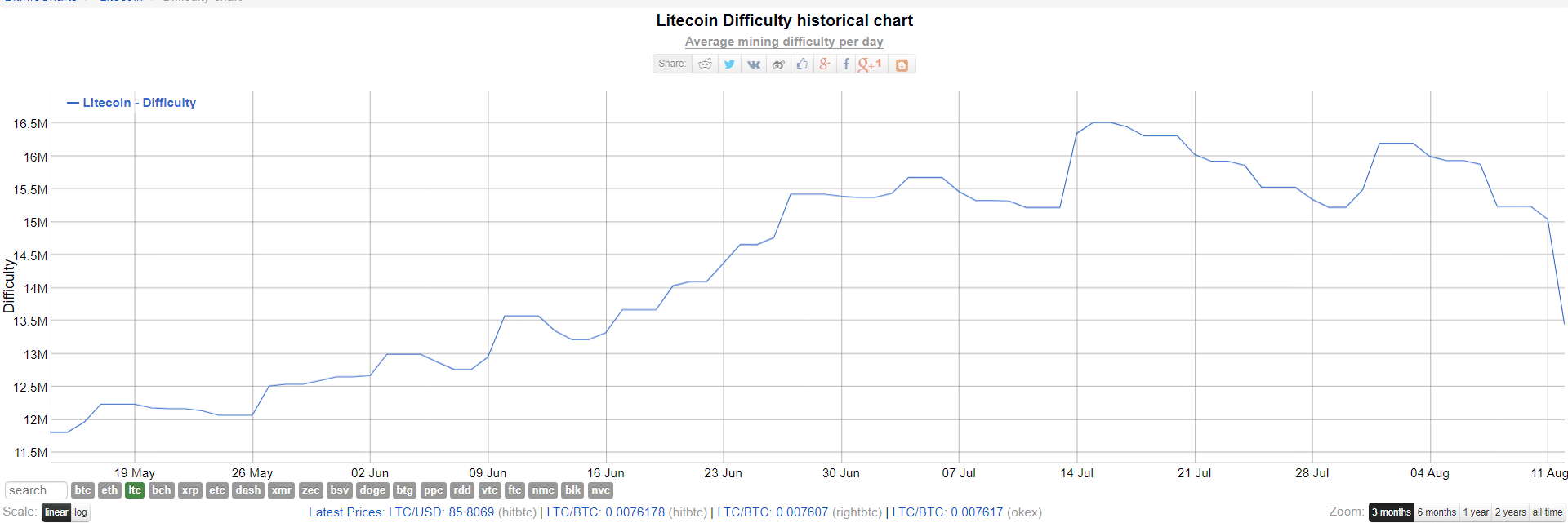

Litecoin’s difficulty and hashrate drop

With a drop in the hashrate of about 20%, even the difficulty fell sharply and underwent a substantial correction. Unlike bitcoin, in fact, the difficulty of litecoin, while maintaining the same constraint of the 2016 blocks, is recalculated in a quarter of the time, or about 3 days, as LTC blocks are four times faster than those of bitcoin (2.5 vs 10 minutes).

In this case, it has gone from the initial 16 million to the current 13.5 million, undergoing a correction close to 17%. However, this value could decrease further in the next days, since the hashrate is in further decline and it takes about 3 days to recalculate the difficulty.

This is a value that has not been reached since last June and that in the next few weeks will probably decrease further together with the hashrate, a trend that could only be reversed with an increase in the price of the currency.

Many are wondering where all the hashrate that has disappeared in these days has gone. It’s hard to give an answer, most of the miners probably moved to other coins with PoW Scrypt (including Dogecoin), some probably temporarily turned off the machines and others, those using FPGAs, probably converted their devices to other mining algorithms designed for other coins.

There are also those who claim that most of the ASICs used by bitmain to mine litecoin – in particular, the new Antminer L5 – have been turned off and are about to be sold to the public. This is a dishonest practise but has already happened several times in the past with other coins.