Many analysts and commentators anticipate that Brexit will have a significant impact on crypto in the event of the UK exiting the EU without a deal. In such a post-Brexit context, the crypto sector could play a major role. The positive consequences would be considerable.

“A no-deal Brexit could see Bitcoin and other cryptocurrencies reach record highs,” says EXANTE Vice President of Sales Andrea Michael from London, who points out that the possibility of a no-deal Brexit has already caused a sharp decline in the pound sterling and some other major currencies. Meanwhile, “given the ongoing political uncertainty and likely prospect of a no-deal Brexit“, the price of Bitcoin has risen in recent months.

The forthcoming rise in prices could be unprecedented according to the estimates of analysts in the crypto world. Investments in British assets, Michael recalls, are already declining, with many traders and funds trying to diversify their portfolios as much as possible with the aim of reducing the risks associated with the uncertainty surrounding Brexit.

One way to diversify is to focus on cryptocurrencies. In addition, “Brexit has presented other unforeseen opportunities such as the rethinking of alternatives to the traditional payments systems used with fiat currencies“. A Brexit without formal agreement “will not only create turmoil and volatility across two major fiat currencies but will also likely trigger an identity crisis for the global system“.

A pro-crypto approach is making its way around the world

Despite the plans of British Prime Minister Boris Johnson, one of Brexit’s advocates long before the June 2016 shocking referendum, which proved to be unsuccessful, the chances of a no-deal are very high and Brexit is only a month and a half away from its official date. Furthermore, until October 14th, the parliament will remain closed.

According to self-evident reasoning, the latest innovations have in some way favoured the cryptocurrency markets. In fact, a UK free from the intricate bureaucratic network of the EU is more likely to retain its status as a world financial hub, moving towards a more pro-crypto and pro-blockchain approach.

That shouldn’t come as a surprise. Firstly, thanks to their decentralisation, cryptocurrencies can boast a less complex financial structure than traditional currencies.

Secondly, something has been going on in the private sector for a long time considering that 75 large international banking groups have already adopted blockchain technology. In the public sector as well, it is known that the United Kingdom has been exploring the crypto and blockchain universe for a long time. Outside of the UK, progress has been made in Switzerland, Japan and even China.

The Zurich Stock Exchange, for example, has launched a project to develop a stablecoin anchored to the Swiss franc. After approving several new crypto exchanges, Tokyo announced two months ago that it would launch an international network for cryptocurrency payments as an alternative to the SWIFT system.

The recent cases of China and the United Kingdom

In China, despite the prohibitions against the crypto sector, the wind seems to be changing. In August, the Chinese authorities announced that they would be working on the creation of their own cryptocurrency. Indeed, the central bank of the Asian nation, the PBoC, has been working on it since 2014. And the government – which exercises control over the national banks – is facilitated in this task compared to more liberal countries such as the United States.

The United Kingdom’s central bank, too, has recently announced the possibility of relying on a cryptocurrency capable of overcoming the monetary hegemony of the dollar. Possibly created and supported by a network of central banks. The stability of the currency would be guaranteed by the fact that it would be anchored to a basket of existing canonical currencies. It was Mark Carney, the President of the Bank of England, who put forward the possibility.

The Bank of England intends to break off relations that have always tied it to the traditional big banks, paving the way for non-financial organisations such as Facebook as to offer alternatives to orthodox means of payment and credit.

Brexit, an opportunity to review the regulatory framework

“Recent statistics also indicate“, Michael recalls, “that cryptocurrency investment will continue to benefit when risk appetite is persistently low in the markets and Brexit is a major source of continued market uncertainty“. If volatility rises as the October 31st deadline approaches, “investors could take advantage of these conditions to lock in profits“.

Who knows whether the next G8 member to launch itself into the crypto world is London. In this perspective, the objective would be to strengthen the City’s position in the global financial landscape, while reducing the appeal of traditional currencies that dominate global trade and finance, such as the dollar and the euro.

The exit of the United Kingdom from the EU, in fact, “will provide the opportunity to reshape the regulatory landscape, as the country will no longer be bound to EU rules“. At that point “the UK is expected to take a more proactive approach in implementing blockchain innovation“. This would also result in greater popularity of crypto assets.

Brexit: the global system going haywire

“Not only will a no-deal departure from the EU create turmoil and volatility across two major fiat currencies (pound sterling and euro, Ed.)“, but it would also cause – according to the CEO of CommerceBlock, a blockchain technology group – the pre-established world financial order to go haywire.

The global system would have to deal with a real “identity crisis as the contingency and vulnerability of major global fiat currencies is laid bare“. These are the words pronounced last August 8th by Nicholas Gregory approached by the Independent.

Although cryptocurrencies are known for their volatility and lack of capitalisation in the markets, there are investors who are not buying Bitcoin and the like just for the sake of speculation. More people are beginning to consider cryptocurrencies as a safe haven.

Bitcoin, the digital gold as a refuge asset from Brexit

Just like the precious metal, the ultimate safe haven, Bitcoin has a limited supply and this scarcity makes it more attractive as a store of value. Although it is not a physical and thus tangible asset, there are those who consider Bitcoin the “new digital gold“. Bitcoin, even before its crypto sisters, “is already gaining its status as a safe-haven asset during times of market uncertainty,” notes Michael.

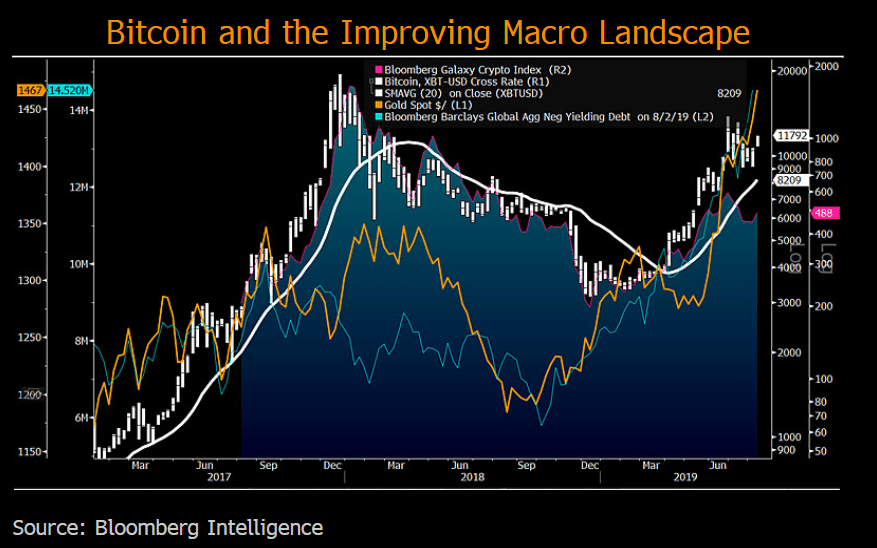

“Bloomberg data has also demonstrated how the bitcoin price correlation to gold has doubled during the last few months“. Last year’s statistics show that the ratio between the two assets was 0.496, while in the past three months that ratio has risen to 0.837.

In a possible scenario of chaos and financial crisis caused by a no-deal Brexit. The decentralised and borderless infrastructure of Bitcoin and its other digital sisters would make them less dependent on interest rates and less prone to the negative effects of fiat currencies, individual markets and individual countries.

“Although some market sceptics continue to debate over whether Bitcoin and cryptocurrencies are unlikely safe havens, both political and economic factors could be favourable for the digital assets. Furthermore, the looming Brexit uncertainty could be a key driver to further strengthen their global status”.