When talking about stablecoins, Tether, the stablecoin par excellence, immediately comes to mind, given its enormous diffusion and, above all, its capitalisation, which is now firmly above four billion dollars. However, there are also many other stablecoins pegged to the dollar, the euro, other fiat currencies or some rare assets like precious metals.

StableCoinsWar is a practical tool has been created to monitor the main dollar-anchored stablecoins. It is an online service that allows to easily keep an eye on stablecoin statistics, without having to search for them on CoinMarketCap.

So it’s nothing innovative in itself: it’s simply a version of CoinMarketCap intended exclusively for stablecoins, which is quite useful when selecting a stable currency to move value from one exchange to another.

StableCoinsWar: a tool to monitor the main stablecoins

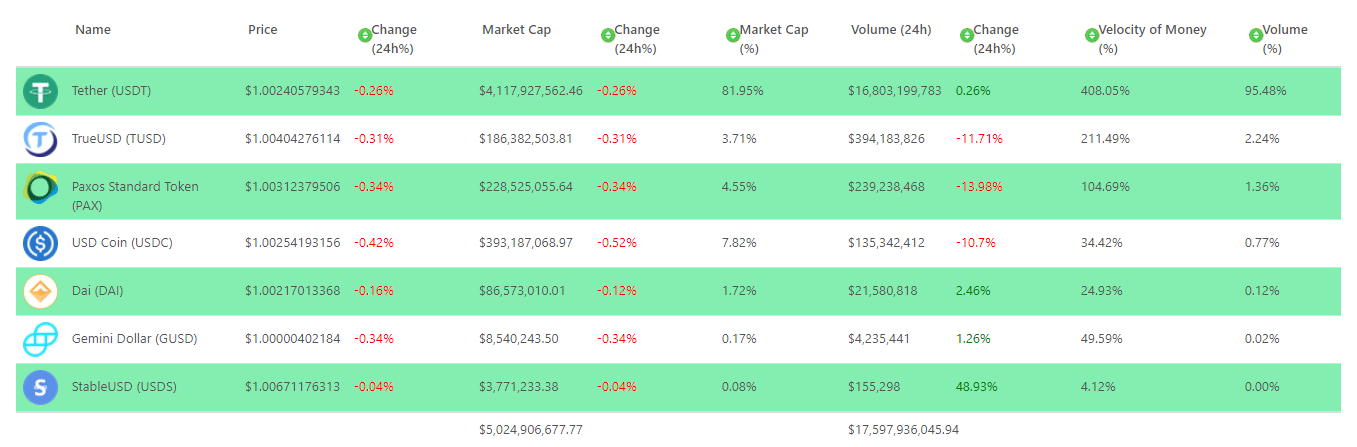

StableCoinsWar is easily accessible from the website and allows to monitor, besides the value of the coins (even if technically they should remain fixed), also the trading volumes in the last 24 hours, which are also expressed in percentages with respect to the rivals.

It is also possible to monitor the total supply of circulating coins, as well as the percentage of the market capitalisation of each currency with respect to its competitors.

It also reports the Velocity of Money, which is the rate at which money is traded between transactions.

At the moment the list includes only the main stablecoins anchored to the dollar, namely Tether, Gemini, USDC, TrueUSD, DAI and others. So there are no coins anchored to other currencies fiat (Euro, YEN and Australian dollar), as well as those that have rare minerals or other cryptocurrencies as a reserve asset.

StableCoinsWar: who will win the stablecoin war?

The name of the website is not accidental. Over the last year, in fact, a lot of new stablecoins have debuted, while those existing and active since 2017/2018 have literally fought to establish themselves on the market.

DAI and USDC, for example, started to establish themselves only after being listed on the well-known Coinbase exchange, considered by many as a gateway to the cryptocurrency world for newbies.

At the moment, the undisputed leader remains Tether, with more than 4.1 billion of capitalisation, a figure that alone holds 82% of the total capitalisation of stablecoins pegged to the dollar.

Second on the podium is USDC, with nearly $393 million of capitalisation, followed by Paxos, with a slightly lower value. At the moment the battle still sees Tether in the lead, but competitors are growing fast.

Of all the existing stablecoins, in fact, Tether is now the only one able to support more blockchains and even the sidechains of Liquid Network. In the future, USDT should also debut on Lightning Network, thus making the stablecoin available on several fast but above all cheap solutions.

To date, in fact, the USDT tokens run on the Ethereum blockchain, on the Omni protocol, therefore the bitcoin blockchain, and recently also on the EOS and TRON blockchains.