Bitcoin is one of the best crypto of 2019, with an annual performance that is one of the best among the most popular assets.

The year ends with an increase for Bitcoin of about 90%, doubling the second-best performance in terms of importance, that of the Nasdaq 100 index, which closed the year with an excellent +39%, followed by a short distance by oil, at +33%.

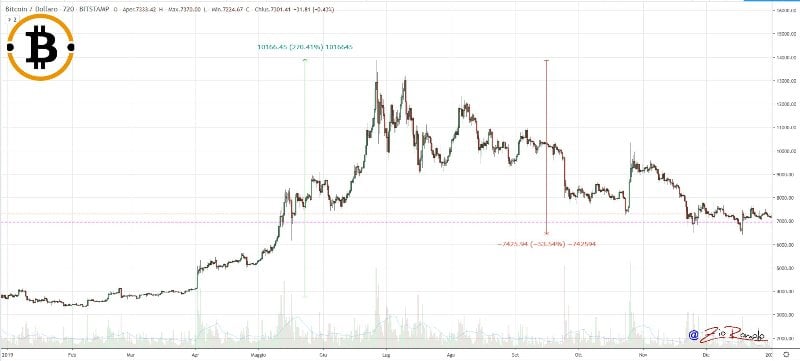

The year that saw the redemption of Bitcoin was actually divided into two parts. The first half, characterised by the second quarter in particular, saw one of the best upward movements in recent years between April and June, with BTC tripling its value. Altcoins such as Litecoin (LTC), Binance Coin (BNB) and TRON (TRX) also saw their value multiply 5-6 times.

After hitting annual highs between late June and early July, the second half, from July to December, was characterised by a bearish trend for most cryptocurrencies.

From mid-December, Bitcoin reached relative lows returning to May levels, burning about 50% of the movement that was triggered between March and June. Ethereum did worse after the highs reached at the end of June it began a slow bearish movement that is still characterising this phase of Ethereum.

Unlike BTC, Ethereum closed in negative territory with an 8% drop from the values at the beginning of the year, on January 1st, 2019.

The situation is worse for Ripple (XRP) which, along with Stellar ( XLM), is among the worst of the first 100 crypto for capitalisation.

Despite the agreements between the Ripple Foundation and the financial institutions, the value of the XRP token has been halved. Stellar is even worse, a project very similar to Ripple that loses more than 60%.

The best crypto of 2019

Bitcoin, despite a good performance in 2019, occupies the 21st position as the best increase of the year. Among the best known, Chainlink (LINK) does best, gaining over 500%, followed by Binance Coin, with another triple-digit rise of 125%. Seele (SEELE) achieved a 4-figure performance of 4,700%. Synthetix (SNX) is also doing very well, benefiting from the decidedly positive momentum in the DeFi sector. Synthetix is among the players that occupy an important place in decentralised finance. This benefits the token, which in one year has seen its value increase by 2,800%.

The worst crypto of 2019

By contrast among the big names, Ripple, as mentioned, is among the worst, together with Stellar. But among the top 100, the worst performance is that of Algorand (ALGO). The token, launched in June 2019, has lost its value from the starting price levels of $2.5 by more than 90%.

Among the worst performances, there is also Zilliqa (ZIL) which has lost 75% of its value since the beginning of the year. Some of the big names include Waves (WAVES), which is also losing 65%. And finally, ZCash (ZEC), which drops 55%.

Cryptocurrencies in 2020

2020 is a highly anticipated year as in May Bitcoin’s third halving will take place. This usually leads to strong bullish movements in the following months. 2020 is also the year in which it is very likely that one of the most clicked search keywords of recent months, decentralised finance, will increasingly emerge.

The last half of 2019 saw the negative sign prevailing in the crypto sector, unlike what happened in the DeFi sector which instead saw an increase in adoption, which will also characterise 2020.

2020 will also be the year of the stablecoin anchored to the Chinese yuan which will be launched within the first half of the year.

Other search keywords that will attract attention are the projects of private stablecoins such as Facebook’s Libra, which had to postpone its plan to launch a centralised global cryptocurrency at a private level.

In all likelihood, there will be a resurgence of US ETFs with the actions of the SEC and other financial authorities that will provide more clarification on regulation. This could facilitate the adoption of STOs (Security Token Offering) which are currently halted.

Many companies, starting with Telegram, which has already closed its fundraising, are considering launching their own cryptocurrency in the coming months. But there are also Google, Amazon and Nike that from rumours seem interested and ready to launch a project involving STOs and stablecoins. However, without a clear regulatory framework, it is very likely that the projects will remain at a standstill.

The cryptocurrency industry is always changing. Even 2020 will see new players and new topics that will support and give more vitality or more headaches to what is an ever-changing sector.