It’s a very positive day for the crypto sector, with a clear prevalence of the green sign for over 80% of the cryptocurrencies, but what stands out most is the strong bounce that Bitcoin has made during these early hours of the day, with a climb that in some cases has also marked a double-digit rally of about 10%, with prices that have gone close to 8,600 dollars.

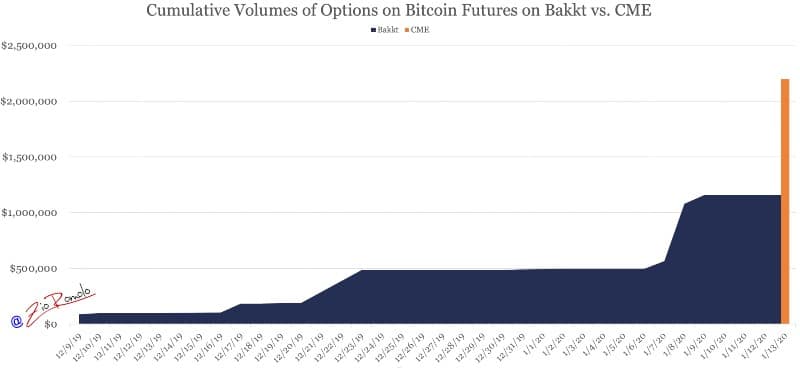

The day celebrates the launch of Bitcoin options on the largest derivatives financial market in the CME, which recorded 2 million trades on the day of its debut. CME doubled Bakkt‘s trades, which yesterday stopped at $1 million.

These are positive news that affect investors and lead to a sharp rise in trading volumes, which in the last 24 hours increased by 20% to a total of $90 billion.

As always Bitcoin is dragging all the rest of the industry, scoring the second-best day for intensity since the beginning of the year.

The last few days, just like today, have seen strong increases both by Bitcoin Satoshi Vision (BSV), which rose more than 30% from yesterday morning’s levels, and by Bitcoin Cash (BCH), the best together with Litecoin, which gains about 8%.

BSV, with today’s further leap, has achieved a 125% increase in 10 days, bringing the prices back over $200, levels it hadn’t seen since last July. The chart shows a vertical rise that highlights the strong buying speculation for over two weeks.

The other fork of Bitcoin, Bitcoin Cash, in these hours is close to 290 dollars, levels of mid-November.

Bitcoin also returns to mid-November levels reaching $8,600 on Bitfinex, putting behind it all the negative trend that had characterized the month of December, which had led to the closure of the last quarter of 2019 in negative, an event that has occurred a few times in the last 10 years.

Among the best of the day, Dash continues to remain stable on the podium, with a further 24% on a daily basis, achieving a rise of over 50% in the last week, a gain that makes it the best among the top 50 altcoins, alongside BSV.

The market cap increases again to 230 billion, levels of last November. The dominance of Bitcoin remains unchanged compared to the last 24 hours with a market share of 68%, the same is true for Ethereum and Ripple, respectively at 7.3% and 4.3%.

The bounce of Bitcoin (BTC)

After having failed to break the dynamic bearish trendline in the first week of January, which combines the decreasing highs since last August, today’s bounce creates an important extension that brings prices from 8,000 to 8,600 dollars.

This is a strong upturn which took place in a handful of hours, giving a second signal of a possible medium-term reversal that will be important to quantify and validate in the coming days for a trend change.

The next level that would give the definitive signal of reversal of the trend will be an extension of the prices in area 9.200-9.500 in the next days.

Ethereum (ETH)

Ethereum, which is among the best of the day, also benefited greatly from this positive trend, with an increase of 4.5%. Ethereum thus regains the $150, providing the second bullish signal after the first occurred on January 6th with the break of the dynamic downward trendline started from last June’s highs.

Ethereum is now one step away from regaining the $155, a level already tested at the end of November and which had given a clear downward trend that continued until mid-December. The recovery of $155 will be the signal that will reverse the trend in the medium to long term. It will bode well in these early months of 2020.