Larry Fink and BlackRock are looking at climate change; failure to adapt means downgrading. The world is facing difficult times because of the changes that the planet is undergoing and every sector must take responsibility, blockchain and crypto are not exempt from the issue.

BlackRock is a company that offers investment solutions and technologies designed to protect and make sustainable the financial strategies of its clients.

In a recent letter addressed to company directors, the financial giant, represented by its CEO Larry Fink, expressed a strong viewpoint and a strict corporate stance.

“Awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance”.

Climate change could radically change the economic sector. The structural problems that states will face will have a major impact on monetary policies, what will happen to inflation and interest rates? How will we address the paradigm shift in a carbon-based energy sector?

According to BlackRock, the answer to these questions lies in companies taking responsibility and planning.

Those who prefer to close their eyes to the problem may have advantages in the short term, but in the long term, those who are prepared will prevail. For shareholders, this translates into investment security, which is why Fink’s company will take these aspects into account when producing its reports.

The role of blockchain for the climate

The letter reveals several links to the sector:

- An urgent need to use the supply chain to certify the history of a product at various stages of production to ensure its environmental sustainability. In this respect, the blockchain has certainly already begun its journey as a distributed ledger capable of guaranteeing the immutability of the data – although it cannot guarantee its correct recording;

- The crisis of traditional currencies and of the banking sector, affected by the monetary policies of countries in the grip of climate difficulties, could favour the growth of decentralized finance and the adoption of disintermediated digital assets;

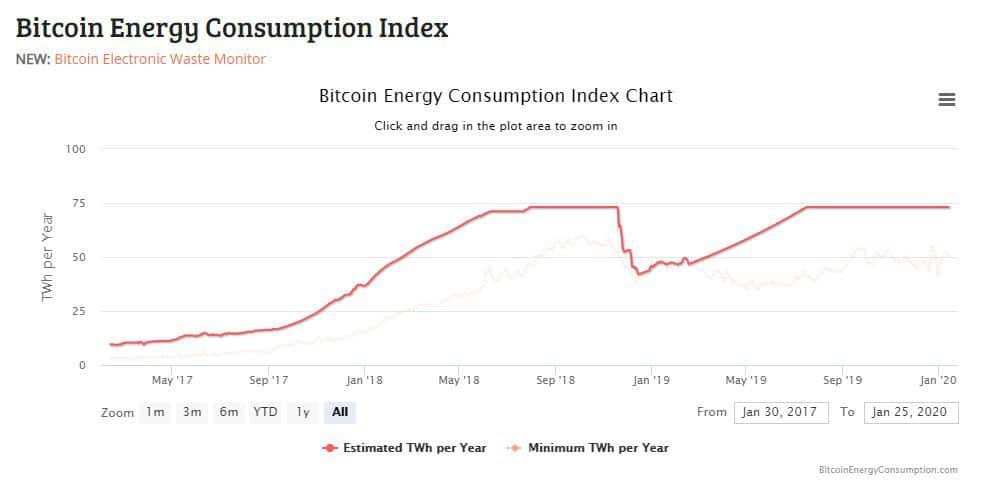

- The energy consumption of the cryptocurrency sector could be at the centre of an important ethical and political debate.

Proof of Work

Not all consensus mechanisms are the same. Blockchains add a block to their chain using different systems of validation. The most famous is certainly the PoW – Proof of Work – born with Bitcoin.

Accused of being energy-intensive, this solution has so far defended itself against environmentalists by emphasizing the ability to exploit excess energy in areas of the planet more suitable for mining.

There is no doubt, however, that the hardware required undergoes rapid deterioration and produces a lot of heat, so much so that it must be cooled or placed in cold areas of the planet to optimize performance.

If mass adoption of this technology were to occur, on-chain scaling solutions could reach dramatic proportions.

Proof of Work versus Proof of Stake

Bitcoin is experimenting with off-chain scaling systems, leaving most of the transaction requests to external validation, reducing the growth of mining equipment.

Other competing players such as Bitcoin SV and Bitcoin Cash, also known as big blockers, are experimenting with solutions that strengthen the mining sector by focusing on it as an engine for growth and scaling.

This part of the ecosystem is expected to consume more energy, proportional to the size of the network.

In particular, BSV will be at the forefront of consumption if it applies the concept of Metanet by bringing data storage on the blockchain, greatly increasing the number of validations and therefore the use of PoW.

But here Ethereum, the second blockchain for market capitalization, challenges the industry by introducing Proof of Stake, a mechanism that promises a reduction in net environmental impact.

No more Proof of Work for ETH? There’s still a long way from version 2.0 of this protocol and there’s no guarantee that the transition will go smoothly.

Certainly, if BlackRock were to use a blockchain or recommend a portfolio diversification into crypto, it would have to choose a PoS-based blockchain.

Worth noting is that Tezos and Cardano are already working and active with PoS and there have been many experiments over the years since the legendary Peercoin.