The stock market crash that occurred today will be remembered as a historic event.

There are days that remain indelibly engraved for those who are part of the financial sector and follow the market trend on a daily basis. Days with fluctuations pass similarly for those who do this job. It is rare that the memory is fixed on a certain date that upsets the current moment. Today is likely to be one of those historic days.

A mocking fate, March 9th coincides with the low that the world stock markets recorded as the lowest point in the previous financial crisis: it was March 9th, 2009.

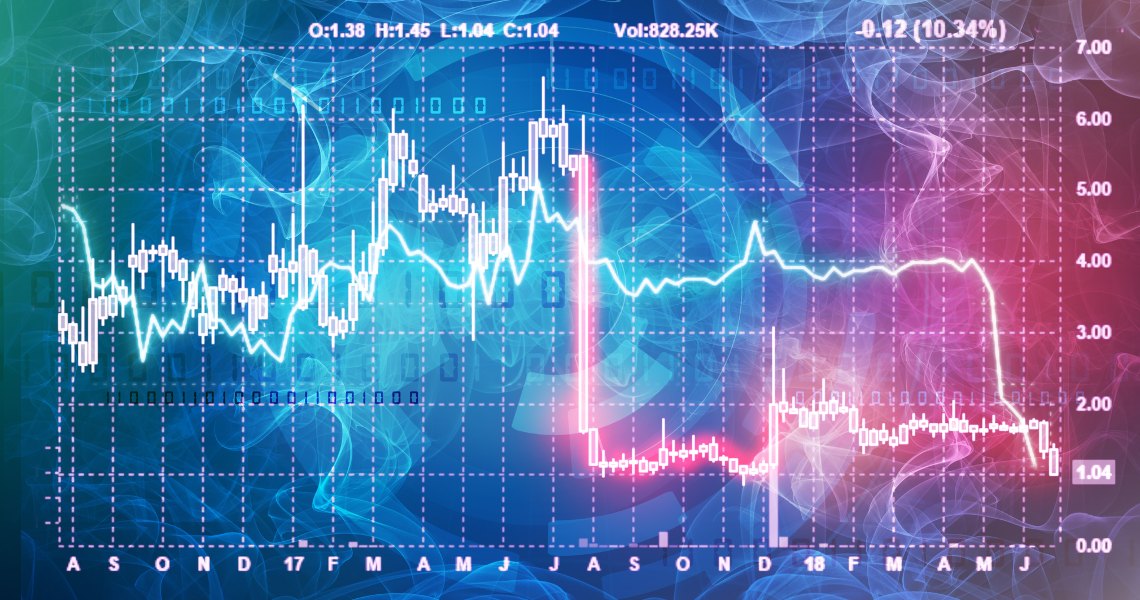

From that moment the world stock markets began a turnaround, having reached the lowest point that began with the crisis of August 2008 and that triggered the biggest financial crisis, the real estate crisis, and then extended for the next six months. From that lowest point, monetary policies unknown to global finance began. This action repeatedly saw central banks take on the role of major players and led to one of the longest-lived rises in the history of finance, which today we can say ended with the highs of two weeks ago, on February 19th, 2020.

A trend that has repeatedly seen a double move between US and European stock indices with the former much more vibrant and well set, to the extent that in recent months they have been characterized by record highs with new absolute historical highs. The European indices have performed differently, with new highs in recent years but not absolute ones.

The German Dax index reached new absolute highs last month, whereas the Italian Ftse Mib was far from the previous highs scored in May 2007 when it exceeded 44,000 points. With the high reached on February 19th, the Italian index reached a maximum of 25,500 points, the highest point recorded since September 2008. With today’s decline it fell below 18,400 points, the lowest level since January 2019.

The context of 2008 was decidedly different and saw, in particular, a crisis that started on the other side of the ocean and then had repercussions in Europe. The old continent suffered the consequences in the following years and the crisis continued until the summer of 2012, while the US began to score new higher lows.

Today’s crisis cannot be compared to the crisis of 2008, even though the intensity with which the markets have been falling in recent weeks at a percentage level is very similar to October 2008 and to what happened in the weeks following September 11th, 2001. This is a structural, social crisis, which sees the entire globe as compact in this respect.

The collapse of oil prices

To this is added another major crisis that today has most likely delivered another severe blow to the world stock exchanges and in particular to the Italian stock exchange, namely the oil crisis. During the night, when the first accounts were already being made of the possible repercussions that the markets would have with today’s openings, came the decisions of Saudi Arabia, which has decided to increase the protection of crude oil and to lower the price, which, in less than 24 hours loses 30% of quotations, going to expand its loss around 50-60% since the beginning of the year.

The WTI has therefore reached a low of under 30 dollars, the lowest point since February 2016 and which is having a heavy impact on the energy sector where Italy has always played its part. Eni, the national standard-bearer company, now loses 20% and returns to 1997 levels.

Markets and coronavirus

The Coronavirus, an event that was already known since January and which saw a crisis contextualized only at the Asian and Chinese level, does not appear so sudden, in fact, the consequences on the stock markets came more than a month later, and after the peak of February 19th, 2020.

There is tension, uncertainty, a lack of confidence in the policy itself, which is causing panic at a social and also at a financial level. Announcements and proclamations since last night are being made by the policy of intervention by the central banks. Even if this were to happen in the next few hours and days, it would only constitute a precautionary measure, since the current economic situation can be recovered after a solution has been found on the healthcare side, that is, after the vaccine that everyone is waiting for and that many people are demanding from the pharmaceutical sector. Pharmaceutical companies, the same companies that are often referred to as speculative and unethical companies, at this time are instead urged to find a vaccine as soon as possible to solve first of all the fear that is affecting our lives in recent days, and which will then again bring a possible return of confidence from the markets.

It is a crisis that if analyzed coldly affects both supply and demand and comes along with another crisis, the oil crisis that broke out in the night, the black swan that is giving the coup de grace to trading today.

Black Monday of the stock exchanges

It is a particular black Monday in terms of date and day, as it was on March 9th, 2009, which was also a Monday, an almost creepy analogy for how it is characterizing itself.

Piazza Affari with today’s sharp decline sees its prices fall from the high of February 19th by more than 25%, officially entering the red market. The S&P 500 holds back better after having been closed during the morning, with today’s strong opening it loses about 17% from the February 19th highs.

Even the Eurostoxx, with the heavy opening this morning recorded a drop of 9% since Friday’s closing, officially enters the bear market losing 25% from the mid-February highs.

The only sector that today is gaining ground and scoring positive performances is gold, which in the last few hours has reached a record of over $1,700 per ounce, a level not recorded since December 2012.

The crisis of 2008 came after a bearish movement, while today’s crisis looks much more like what happened in September 2001, when the markets reflected the sentiment of the crisis triggered by an attack on a single nation. Today there are no military attacks and guerrillas, but the emergency is sanitary. There will certainly be better times and this will be just a bad memory.